in its latest strategy note.

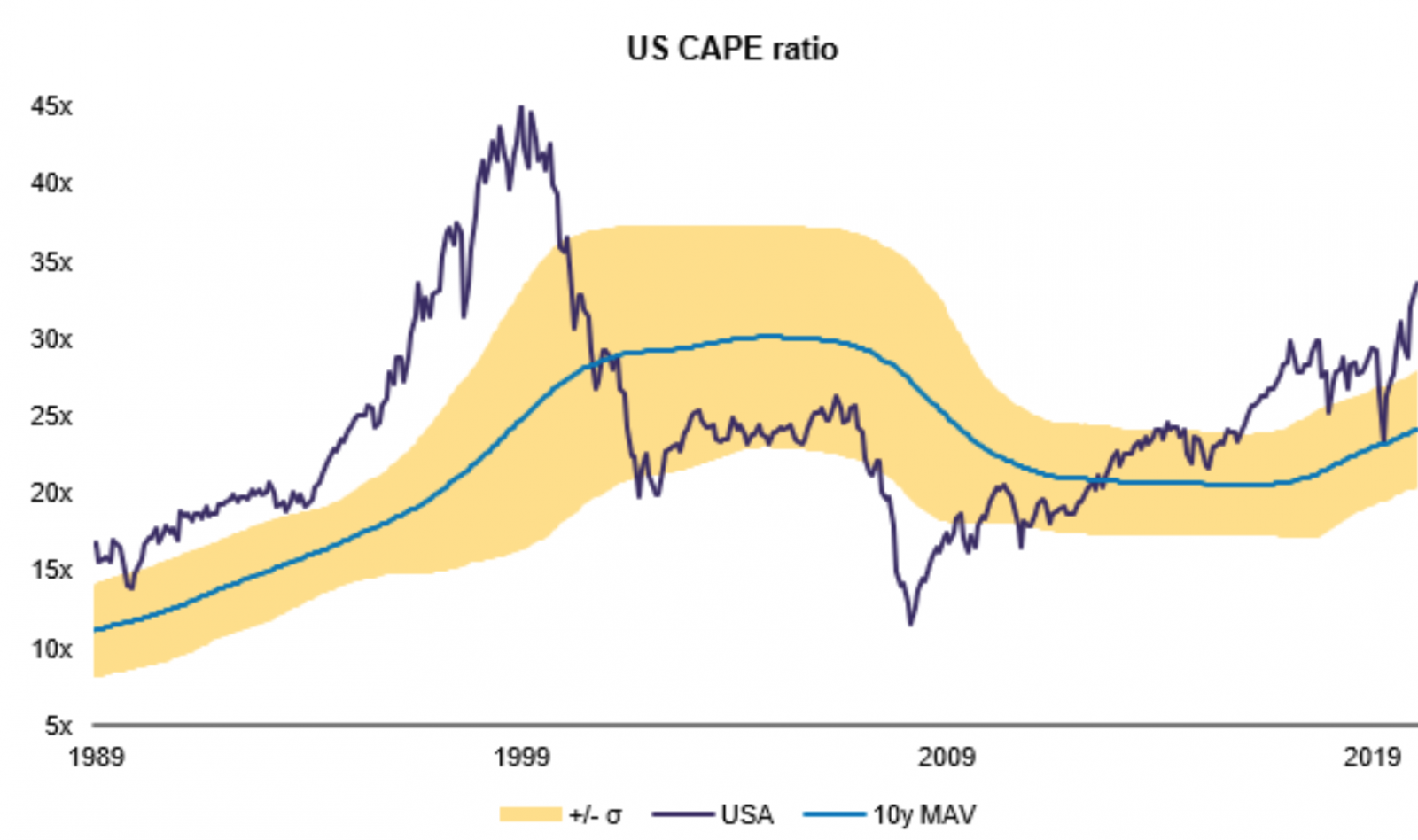

"If we were to view the asset class from a ‘top-down’ approach to investment: we would see them as high, but not outlandishly or prohibitively so. Our preferred metric, a “cyclically adjusted” PE (CAPE) which smooths out short-term fluctuations in earnings by using a ten-year moving average, is shown in the chart (below):

"Looking ahead, the scope for some profit taking in the short-term must be a near-term risk: a lot of good (or improved) news is priced-in and cash positions are reportedly at their lowest level since 2016 (according to the latest Bank of America Fund Manager Survey – another renowned contrary indicator).

"We are trying to stay open-minded: the last decade has not been kind to more dogmatic pundits. Headroom has likely fallen, but this does not look like a bubble to us (and other markets are of course less expensive than the US). Those prospective long-term ‘top-down’ returns for equities have fallen, but still exceed both likely inflation and the likely returns on bonds and cash."

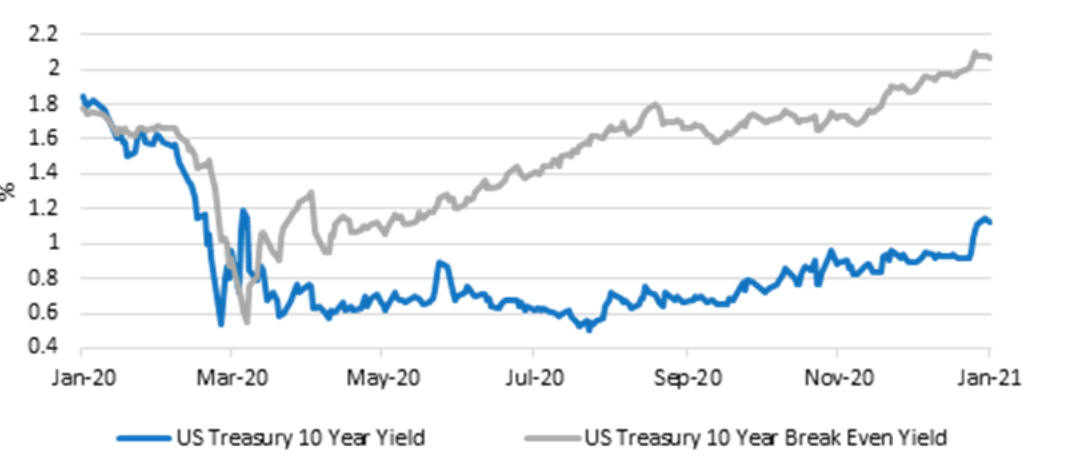

. The chart below shows the US Treasury 10-year yield breaking through the psychologically important 1 per cent mark (blue line below), and equally important perhaps, the US Treasury 10-year break even yield, which measure the market’s expectation of inflation, moved to a two-year high (grey line).

"Inflation expectations have indeed increased swiftly but it would be wrong to say that they have moved to excessive levels," Raynor said. Either way, currently, markets are taking a very positive view of things.

"The market consensus is very positive, with risk-on the dominant narrative. With that, there does seem to be a sense that we have moved on from an “everything” rally. We include ourselves in that group that think bonds might struggle this year, particularly developed government bonds, while other safe havens such as gold might do less well if real yields rise. There is then a healthy side to this, in that diversification could increase in markets, allowing portfolios to be more balanced. Nevertheless, at some point, the debate will likely move on to whether looser fiscal policy leads to tighter monetary policy."