Offshore

After Brexit, How Attractive Is UK Investor Visa?

The pandemic has shaken up "golden"/investment visa programmes. Legal practitioners look at the current market, what has changed for HNWs in the EU, and where it leaves UK attractiveness.

At a time when residency has taken on new importance and the UK is establishing its identity post-Brexit, partner Chetal Patel and associate Matthew James from law firm Bates Wells look at what UK investment visas offer, where new applicants are coming from and how Brexit will change residency options for EU HNWs. The editors are pleased to share this contribution, where the usual editorial disclaimers apply. Email tom.burroughes@wealthbriefing.com and jackie.bennion@clearviewpublishing.com

What the figures show

The number of Tier 1 investor visas issued in the UK has fallen

by 44 per cent to 219 in the last year, down from 394 the year

before. Undoubtedly the COVID-19 pandemic and travel restrictions

have affected this fall in figures.

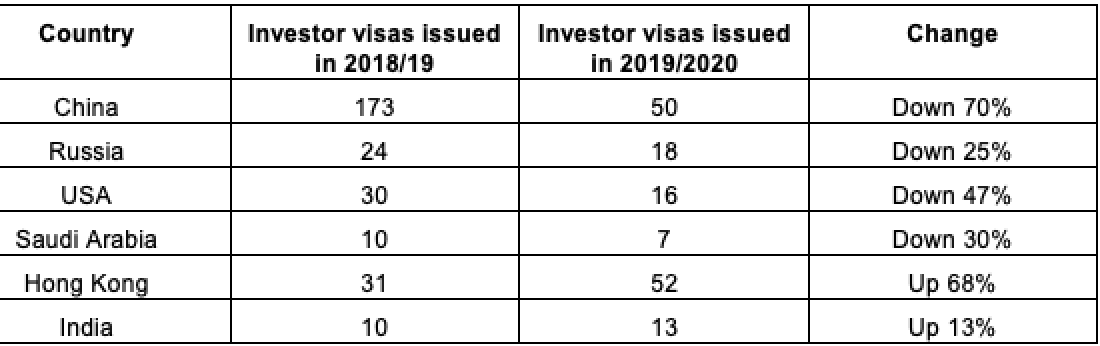

For the majority of countries (except Hong Kong and India), there has been an overall decline in the number of investor visas issued in 2019/20 in comparison with the previous year, these include:

The surge in applications for investor visas from Hong Kong nationals is likely to be due to the political situation. It will be interesting to see whether this drops off following the launch of the British National (Overseas) visa or whether the majority of those seeking to use the investor route are Hong Kong nationals who do not qualify under that scheme.

So what are the benefits of an investor

visa?

-- It offers a fast track to settlement. If an individual invests

£10 million they may be eligible for settlement after two years,

or three years if they invest £5 million. This compares with five

years for most routes, including under the EU Settlement Scheme.

However, this only benefits the main applicant as dependants

still need to reside in the UK for five years

-- Applicants do not need to meet the English language requirement until the settlement stage. If the English language requirement is problematic, then applicants can continue to extend their visa indefinitely under this option.

-- It is an attractive option for families who want to relocate to the UK and educate their children here.

-- It’s a flexible option. Applicants are not tied to particular jobs/relationships. Businesspeople do not need to give up any ‘control’ of their business. It is also possible to ‘retire’ to the UK via this route.

-- It affords international businesspeople the freedom to visit the UK.

How will Brexit affect residency options for EU

HNWs?

Due to the flexibility of the investor visa, it is likely to

become a popular option for EU and Swiss HNWs in the future.

Whilst those residing in the UK prior to 31 December 2020 will be

eligible to apply for status under the free EU Settlement Scheme,

new entrants to the UK will need to apply for a visa following

the UK’s immigration rules.

In addition, those EU/Swiss nationals who are required to or wish to travel significantly may find that the residency requirements of the pre-settled status under the EU Settlement Scheme do not work for them. Although the residency requirements for settlement under both routes are similar, the pre-settled status cannot be renewed, unlike the investor visa. The investor route would offer that flexibility either for applications when the applicant establishes that they are not eligible for settlement as a result of their absences from the UK.

Another potential increase in the use of the UK investor visa will be from non-EU HNWs who would previously have considered obtaining a similar investor visa from Cyprus or Malta in order to benefit from EU citizenship and the freedom of movement. Those HNWs who primarily wished to move to the UK, would now need to consider the UK investor visa rather than the cheaper alternatives.

What are the grounds for refusing an investor

visa?

As with any UK immigration application, general grounds for

refusal apply and these include, but are not limited to, adverse

immigration history, criminality and conduct and associations.

In addition, applications can be refused where the Home Office believes that the applicant is not freely in control of the funds or that the funds have been acquired by unlawful conduct. This brings in an element of ‘genuineness’ to the application which may impact applications for so-called ‘high risk’ countries. Although the underlying rules have not changed significantly over the years, there has been a ‘tightening’ of these requirements via the need to provide further specified documents. Applicants now must either have held the funds for two years or they will need to provide evidence as to the source of the funds. Certain overseas documents (such as deeds of gift) need to be provided with a confirmatory letter from a qualified legal practitioner in that country.

Finally, all applicants need to have set up a UK bank account prior to their application, with the bank explicitly confirming that it has undertaken its new client due diligence checks (so that the Home Office does not have to).

In conclusion

The investor visa has always been an attractive, flexible option

for those who can afford it. As other visa routes close or are

revamped, it has remained, albeit with a few tweaks here and

there. It will be interesting to see not only what the long-term

impact of the pandemic on international travel has on the route

but also the end of free movement and whether we start seeing EU

nationals becoming the most frequent users of the this visa.

Ultimately, however, it will be the attractiveness of the UK for investment and education over the next few years that will determine whether the use of the visa increases of decreases.