WM Market Reports

Asia Remains World's Biggest Wealth Story - Knight Frank Study

While the world may be in the middle of a global pandemic, understanding where wealth is accumulating and at what pace are important metrics for the industry. This year’s survey is about consolidation and a degree of retreat.

The global population of ultra-high net worth individuals is expected to grow by 27 per cent over the next five years. Asia is the main recipient. Knight Frank’s 2021 Wealth Report indicates that the pool of ultra-high net worth individuals, those worth $30 million or more, will reach 663,483 by 2025. That is up from around half a million today. The number of newly-minted millionaires globally is due to rise by 41 per cent over the same period.

Knight Frank’s latest barometer of wealth trends has Asia firmly in the driving seat of wealth generation, and it is expected to grow its UHNWI population by 39 per cent, well above the global average of 27 per cent. Within the region, Indonesia is expected to record the strongest growth, tripling its ranks of the ultra-wealthy, closely followed by India rising by 63 per cent, in the continuing Asia growth story.

“Asia is the key wealth story,” Liam Bailey, global head of research at Knight Frank said. “The US is, and will remain, the world’s dominant wealth hub over our forecast period, but Asia will see the fastest growth in UHNWIs over the next five years.”

Bailey says the firm’s latest analysis has Asia hosting a quarter of the world’s ultra wealthy by 2025, up from 17 per cent a decade ago.

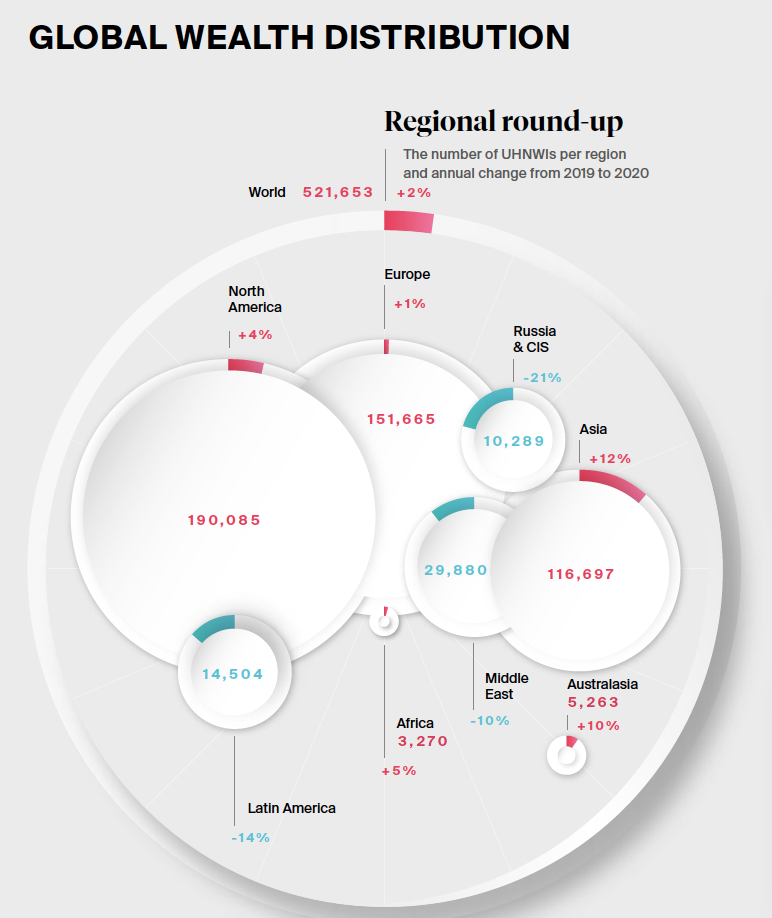

In 2020, the number of ultra-wealthy people globally increased by 2.4 per cent, a two-thirds drop in the gains recorded in the pre-pandemic days of 2019. China saw the largest increase in its wealth pool, adding a further 9,600 ultra-wealthy this year, followed by the US adding 6,000, and Japan, back in investor favour after years of sclerotic growth, adding 1,200. Expansion wasn't universal. Numbers of UHNWIs in Latin America, Russia and the Middle East all fell for the year as currency shifts and the pandemic took a toll on local economies. See the chart below for where gains and losses were made.

Despite geopolitical tensions between the West and China, and countries moving out of the pandemic at different speeds, this year’s wealth trends further vindicate wealth managers’ doubling down in Asian markets.

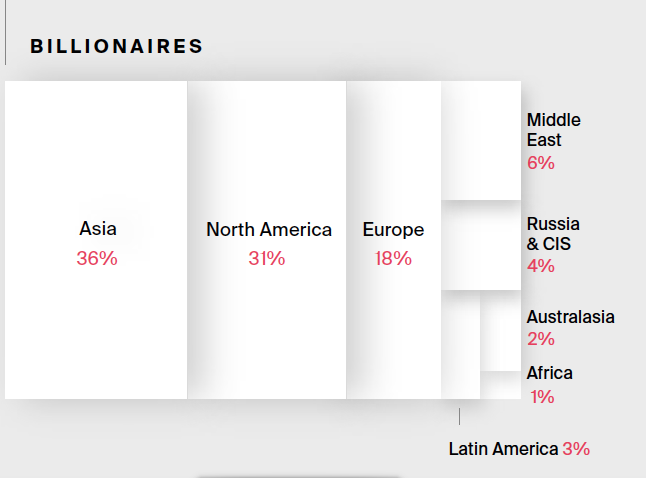

The region is already home to more billionaires than any other, taking over a third of the global total, and China is the main protagonist, on track to grow its wealthiest pool by 246 per cent in the decade up to 2025.

Europe remains second after the US as the largest wealth hub, and is expected to boost its ultra-wealthy population by 23 per cent to 185,860. The biggest rises in Western Europe are predicted for Poland (61 per cent) and Sweden (59 per cent). For the year, however, some European countries saw their ultra-wealthy populations fall. The largest declines were seen in Italy, France and Spain, with falls of 3 per cent, 9 per cent and 14 per cent respectively.

After Asia’s phenomenal rise in the past decade, Africa is the other big growth story and where wealth managers will be seeking to strengthen ties. The continent is forecast to grow its ultra-wealthy cohort a third by the middle of this decade, led by Zambia and South Africa. Africa is also an important market for the steep rise in the mass affluent population.

In recognition that not everyone is rapt by the fortunes of a global elite as the pandemic has rained heavy blows on the less fortunate, Bailey says it is nevertheless important to understand these trends in relation to the market and asset performance.

“The objective of The Wealth Report is to assess how the fortunes of UHNWIs are changing, where they spend time, what they invest in and what they are likely to do next. From policy makers to investors, a lack of insight into the behaviour and attitudes of the “one-percent” risks a serious misreading of economic trends,” he said.

Private wealth rising as are tax concerns

In the Attitudes Survey, half of private bankers

reported that their clients’ wealth had increased in 2020. While

COVID-19 was seen as the biggest single risk to future wealth

creation, nearly half in this group are expecting growing wealth

inequality to fuel demand for policies to address the imbalances

– specifically wealth taxes – which the report said are already

being floated in Argentina, Canada and South Korea, and likely to

be replicated elsewhere.

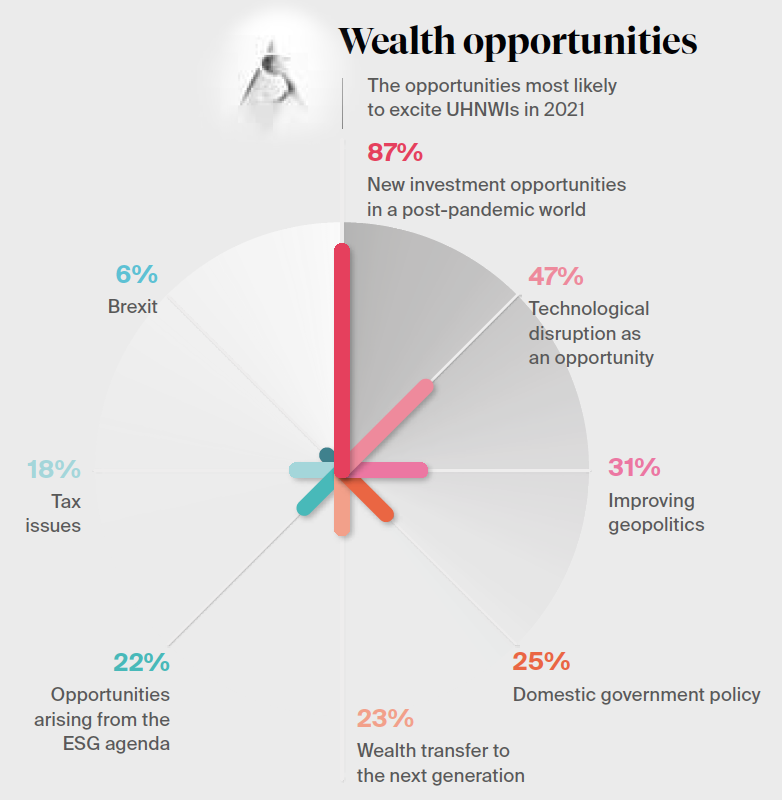

Capital markets researcher for the firm Victoria Ormond said a number of forces will steer activity in 2021, including an asset retreat, and in other respects a physical retreat to safe havens. On the back of this movement, “large, relatively liquid, transparent markets should continue to attract global investment. Global travel disruptions also provide opportunity for private investors to leverage understanding and ties to more local markets,” which might usually face stiffer competition for assets from institutional investors, she said. ESG is also something private investors can’t afford to ignore or the rise of data centres. Both trends offer “huge potential for investment opportunities,” Ormond said. The chart below shows how sentiment divides.

The report dubbed 2020 the year that passports lost their power as many borders closed. But the Attitudes Survey revealed that while disruption has sent global mobility into reverse, it has sharpened a need to secure second boltholds. The report found that nearly a quarter of UHNWIs are planning to apply for a second passport or citizenship. Katie Good from immigration law firm Fragomen, told the report: “We have seen a significant increase in enquiries in the latter stage of 2020 and [they have] reached pre-COVID levels already.” Another trend noted is that many nations are wooing wealthy digital nomads, particularly Caribbean countries such as Antigua and Barbuda, Dominica, Grenada, Saint Lucia, and St Kitts and Nevis.

Where is optimism?

The bankers and wealth managers responding to this year’s survey

said that their North American clients were the most optimistic.

Those in Australasia were the second most optimistic, flush from

a strong property market and currency performance. South Korea

completed the trifecta. Where bankers reported that their UHNWI

clients’ wealth had increased, diversification, equities, and

property were named as the main drivers. Private capital globally

into real estate reached $232 billion, 9 per cent above the

10-year average, but down on 2019 levels, the report said.

The US, Germany, and the UK topped the real estate investment list for 2020, with the majority of countries in the top 10 relying on domestic over cross-border investment. The debate on the future of global cities fell on the side of don't write them off. They will remain mothers of innovation and reinvention.

That said, Bailey said strongest current demand for property was in rural and coastal areas. “The pandemic is super-charging demand for locations that offer a surfeit of wellness - think mountains, lakes, and coastal hot-spots. Demand will help fuel price rises of up to 7 per cent for our key markets this year,” he said.

Auckland led this year's property index with price rises of 18 per cent. New Zealand’s handling of COVID-19, rapid economic recovery, ultra-low mortgage rates and limited stock fuelled the surge, the report said.

What has become of luxury in 2020?

Handbags as a store of value and passion have held up the

strongest among global tastemaker demands. Hermès handbags topped

Knight Frank’s Luxury Investment Index for the second year

running, with prices rising by 17 per cent in 2020. Fine wines

also had a good year coming in second. The art market meanwhile

saw some of the heaviest declines, falling by 11 per cent in

2020. “At the top end of the art market, no painting sold for

over $100 million for the first time in number of years,” the

report noted. Classic cars fared better, with Ferraris

outperforming, and sales in that asset class up by 6 per cent for

the year.

“For obvious reasons, one of the biggest changes was a shift towards private sales at the major auction houses last year,” said Sebastian Duthy from AMR, which tracks the luxury market. “The volume of all sales that were publicly auctioned at Sotheby’s and Christie’s were down 26 per cent and 46 per cent on 2019, respectively.”

The problem was compounded by a slowdown in supply of quality works as consigners who could afford to to sit it out at home, did just that, Duthy said; but suggests there was still plenty of buyer enthusiasm. “With a new emphasis on home working, there was a surge in demand from collectors sprucing up their homes,” he said.