Tax

Australia Wealth Management - Latest Developments Â

Here is an outline of important recent legal, tax and regulatory developments affecting wealth managers conducting business with or in Australia.Â

Here are further guides to legal, regulatory and tax developments across Asia as they affect wealth managers, private client lawyers and their clients. The overviews come from Baker McKenzie. The authors of this guidance are John Walker, partner and Joanna Kuok, associate. The editors are grateful to the authors for sharing this content. The usual editorial disclaimers apply. We welcome feedback and commentary. Email tom.burroughes@wealthbriefing.com and jackie.bennion@clearviewpublishing.com. See the previous overviews on Singapore and Malaysia and Japan here.

Tax residency rules for individuals

Proposed changes to the individual tax residency

rules

In the 2021-22 Federal Budget, the Government announced changes

intended to simplify the tax residency rules for individuals.

The primary test under the new rules will be a so-called "simple bright line" test under which a person who is physically present in Australia for 183 days or more in any income year (i.e., the Australian tax year ending 30 June) will be an Australian tax resident. This represents a simplified version of the 183-day test used by some of our major trading partners such as the US. Even if an individual is not physically present in Australia for 183 days or more, they may still be a tax resident under secondary tests that depend on a combination of physical presence and what are proposed to be "measurable, objective criteria."

The government has yet to release draft legislation; however, the new individual tax residency rules are intended to apply from 1 July following Royal Assent. The proposed changes will be based on the Board of Taxation's March 2019 report entitled "Reforming Individual Tax Residency Rules - A Model for Modernisation". The report sets out a number of tests:

-- the primary test is the 183 day test - if an individual spends 183 days or more in Australia, then they are a tax resident;

-- the secondary rules (a "commencing residency test" and a "ceasing residency test") apply to individuals who are in Australia for less than 183 days in an income year.

-- Commencing residency test: If an individual is in Australia for more than 45 days but less than 183 days, the secondary test would adopt a day-count together with a focus on four factors, two of which must be satisfied in order for that person to be deemed to be resident in Australia:

-- the right to reside permanently in Australia (e.g.,

citizenship or permanent residency),

-- the ability to access accommodation in Australia (e.g.,

rights of ownership, leasehold interests, licences),

-- whether the individual's family (spouse or any of their

children under the age of 18) are generally located in Australia,

and

-- the individual's Australian economic connections

(employment, business, interests in Australian assets).

Ceasing residency test: If an individual was a resident in the previous income year, and is in Australia for less than 45 days in the current income year, they would only cease to be a resident in the following circumstances:

-- for "short-term" residents (that is, those who have been

a resident of Australia for less than three consecutive income

years immediately preceding the current income year), they

satisfy less than two of the four factors set out above; or

-- for "long-term" residents (that is, those who have been a

resident for three or more consecutive income years), they have

spent less than 45 days in Australia in each of the two preceding

income years.

The report also included certain other proposals, such as an overseas employment rule, under which Australian tax residency would be lost where an individual is employed for a period of over two years overseas and certain other requirements are met.

A key issue to remember is that, even if an individual is a tax resident of Australia under Australian law, a tie-breaker provision of a double tax agreement may give the result that the individual is instead treated as a tax resident of another country during a particular income year.

The ATO's data matching program with the Department of

Home Affairs

The ATO has access to data from the Department of Home Affairs on

passenger movements from the 2016-17 to 2022-23 financial years

(being 1 July 2016 to 30 June 2023).

The ATO estimates that the details of approximately 670,000 individuals will be obtained each financial year.

The passenger movement data-matching program will be used as part of the ATO's risk detection models in determining and assessing the residency status of individuals for Australian tax and superannuation, and to address, identity any residency compliance risks including registration, lodgment, reporting and payment obligations.

The data items include the full name, personal identifier, date of birth, gender, arrival and departure dates, passport information, and status types (visa status, residency, lawful, and Australian citizen).

According to the ATO, the objectives of this data-matching programme are to:

-- promote voluntary compliance and increase community

confidence in the integrity of the tax and superannuation

systems;

-- improve knowledge of the overall level of identity and

residency compliance risks including registration, lodgment,

reporting and payment obligations;

-- gain insights from the data to help develop and implement

administrative strategies to improve voluntary compliance, which

may include educational or compliance activities;

-- identify ineligible claims for tax and superannuation

entitlements;

-- refine existing risk detection models and treatment

systems to identify and educate individuals and businesses who

may be failing to meet their registration, lodgment and payment

obligations and help them comply; and

-- identify potentially new or emerging non-compliance and

entities controlling or exploiting those methodologies.

If the ATO detects a discrepancy that requires verification, they will contact the taxpayer usually by phone, letter or email. Taxpayers will be given at least 28 days to respond and verify the accuracy of the information before the ATO takes any administrative action.

Records received from the Department of Home Affairs will be retained by the ATO for five years.

Capital gains tax on trustees distributing capital gains

to non-residents

The Federal Court decision in N & M Martin Holdings Pty Ltd v

Commissioner of Taxation supports the imposition of capital

gains tax (CGT) on trustees distributing capital gains to

non-residents, even where the gains related to assets that were

not taxable Australia property (TAP) and therefore not subjected

to CGT. The decision follows the earlier Federal Court decision

of Peter Greensill Family Co Pty Ltd (trustee) v Commissioner of

Taxation. It also affirms the views of the Australian Taxation

Office (ATO) in draft Taxation Determination TD 2019/D6.

Similarly to Greensill, the decision in Martin has major

implications for non-resident beneficiaries of Australian

discretionary trusts.

Both Martin and Greensill were heard concurrently by the Full Federal Court in February 2021. On 10 June 2021, the Full Federal Court unanimously dismissed the taxpayers' appeals in both cases.

Facts

The trustee of an Australian discretionary family trust (Martin

Family Trust) made capital gains on the sale of shares which were

not TAP over two income years. The Martin Family Trust

distributed a significant percentage of the capital gains to Mr.

Martin, who was a foreign resident and beneficiary under the

discretionary trust. Mr. Martin argued that he was not liable for

CGT as he was a foreign resident at the relevant times and the

shares were not TAP.

Findings

Mr. Martin's arguments were considered and rejected by the

Federal Court in Greensill. Accordingly, the Federal Court in

Martin would follow the decision in Greensill unless it was

satisfied that Greensill was "plainly wrong".

It may be recalled that, under section 855-10, foreign residents are to disregard capital gains or losses from a CGT event if the CGT event happens in relation to a CGT asset that is not TAP. The court in Greensill had found that this did not apply to disregard the capital gain made in this case as the word "from" required a direct connection between the capital gain and the CGT event. A capital gain which is received by a beneficiary because of a CGT event in relation to a CGT asset that is owned by a trust does not have the requisite nexus and is not a capital gain "from a CGT event" (instead, it was "from" a construct of the trust capital gain provisions). As a result, the beneficiary was liable for CGT on the capital gain on the sale of shares.

The court in Martin found that the Greensill judgment should be followed "as a matter of precedent, comity and good sense."

As a consequence, had the capital gains been made by the beneficiary directly (i.e., if Mr. Martin had held the shares that were disposed of and made a gain), or through a fixed trust, Mr. Martin would have been exempt from taxation.

The key takeaways

-- CGT can be imposed on capital gains distributed to

non-resident beneficiaries of Australian discretionary trusts

even where the gains relate to assets that are not taxable

Australian property.

-- The case dispels the notion that a beneficiary's tax

position is to be determined as if they had been the one to make

the capital gain. Had a non-resident beneficiary made the capital

gain in their own right, no CGT would be applicable.

-- Individuals should carefully consider the use of

discretionary trusts with non-resident beneficiaries in the

context of asset management and estate planning due to the

uncertainty raised by this case, TD 2019/D6, and Greensill.

The ATO may use its access powers to challenge claims of

privilege

The recent Federal Court decision in CUB Australia Holding Pty

Ltd v Commissioner of Taxation confirmed that the ATO may use its

access powers under section 353-10 of Schedule 1 to the Taxation

Administration Act 1953 in considering claims of legal

professional privilege (LPP).

Background and facts

Under section 353-10, the ATO has broad information-gathering

powers to obtain information and evidence for the purpose of the

administration or operation of a taxation law. Section 353-10

provides that the ATO may, by notice in writing, require any

person to give any information that the Commissioner requires or

produce any documents in the person's custody or control that may

assist the Commissioner in administering a taxation law.

However, it is possible to refuse to produce documents covered by the section 353-10 notice on the ground of LPP.

In this case, the ATO issued a section 353-10 notice to the taxpayer. The taxpayer claimed LPP in respect of some of the communications, and provided some details of the documents but not certain additional details which would have allowed the ATO to assess whether LPP had been properly claimed (in particular, the titles of the documents or the names of the authors or recipients of the documents).

Issue

The issue before the court was whether the ATO may use section

353-10 to seek further details in relation to documents over

which a taxpayer has claimed LPP.

Findings

The court accepted that the ATO may use section 353-10 to seek

further details to confirm whether to accept or reject a

taxpayer's claim of LPP, reaffirming the broad nature of ATO's

powers under section 353-10.

Key takeaways

The decision in CUB Australia confirms the ATO's ability to

contest the legitimacy of a taxpayer's LPP claim. The decision

also illustrates that LPP claims will not be automatically

accepted by the ATO, as well as the lengths that the ATO may go

to in challenging the validity of such claims.

In recent years, the ATO has been increasingly vocal in challenging LPP claims that it considers inappropriately made, particularly against taxpayers who withhold evidence during the course of tax audits. In that context, the decision in CUB Australia can be seen as a victory for the ATO.

It is likely that a taxpayer's claims to withhold documents under LPP will not be as effective in circumstances where insufficient detail is provided to the ATO to enable it to assess the claim.

The case has been appealed to the Full Federal Court.

Updates on property taxes in NSW and Victoria

Annual property tax proposed in NSW

The NSW Government is considering levying a new annual property

tax, which would consist of a fixed amount plus a rate applied to

the unimproved land value of an individual property. Under the

proposed reforms, buyers can choose at the time of purchase to

pay the property tax instead of stamp duty and the current land

tax. Once a property is subject to the property tax, subsequent

owners must pay the property tax.

It is proposed that residential owner-occupied and primary production properties would pay lower rates than residential investment properties, which in turn would pay lower rates than commercial properties.

For the time being, the proposed reform envisages a two-tier tax system whereby some properties will be subject to stamp duty and potentially the current land tax, and other properties will be subject to the new property tax. Much more detail, however, is needed to evaluate the workings of the proposed new property tax. It is also unclear how, in the long term, "the reform would generate the same amount of revenue as stamp duty and land tax," particularly where a quantifiable amount of stamp duty is replaced with an annualised tax of indefinite duration. It would be expected that, over time, the amount of property tax paid will exceed the amount of stamp duty payable upfront.

Submissions for this proposed reform closed in March 2021. A more detailed proposal, as well as draft legislation, is not yet available for review and comment.

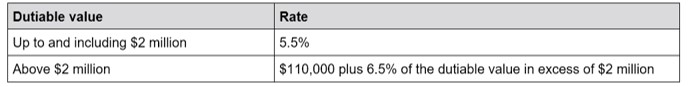

Significant increases to stamp duty and land tax in Victoria

Stamp duty increases

For contracts entered into from 1 July 2021, there will be a

premium duty rate on land transfers for high-value properties and

a new land transfer duty threshold. (Note, the rates in the table

below are exclusive of the foreign purchaser additional duty

rates. For contracts, transactions, agreements and arrangements

entered into on or after 1 July 2019, the additional duty rate is

8 per cent.)

Transitional relief will be extended to options granted and agreements made before 1 July 2021.

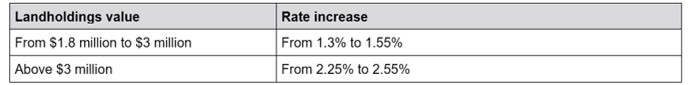

Land tax increases

From 1 January 2022, the land tax rate for taxpayers with larger

property holdings will increase:

This change will apply to both the general and trust surcharge rates.

Footnotes:

1, [2020] FCA 1186.

2, [2020] FCA 559.

3, [2021] FCA 43.