Client Affairs

COVID-19 And ESG Data: Spotting Cracks Before The Quake

How far can country ESG data help identify potential fissures and predict a country's capacity to cope with pandemics and its social and economic ramifications? A senior country analyst looks at the current landscape.

Robeco's senior country analyst Max Schiele has written a timely piece about how the pandemic has put countries in the spotlight, arguing that ESG data is becoming a powerful tool for understanding and mitigating geopolitical and country risks within an investment portfolio. He looks at where countries are ranking on global security and health indexes during these times and how swift and efficient governments have been to act so far using their institutional strengths. All of these data points, some plotted below, are highly variable as countries change tack and learn from one another. But this pandemic, as Schiele points out, is making investors see the world in a new light. The editors are pleased to share these comments and invite responses. To reply, email tom.burroughes@wealthbreifing.com and jackie.bennion@clearviewpublishing.com

The Coronavirus has shaken the foundations of many countries with devastating effect. But many of the structural weaknesses that have exacerbated the crisis, were already visibly evident in country ESG performance data. A closer look reveals striking parallels between ESG scores and effective crisis management. Surprisingly, high scores on health system metrics proved insufficient in predicting a country’s coping capacity - proving that there are no magic indicators with full predictive power. Data must be analyzed collectively and comprehensively for patterns to surface and true root causes to be identified.

Reflective of this, strong governance and institutional indicators were strongly correlated with a country’s coping capacity, helping explain the surprising success and failure of many countries in dealing with the crisis. But strong governance should not be confused with absolute governance; authoritarian regimes have fared no better than Western democracies in combating and controlling the coronavirus’ spread and impact.

For investors the implications are clear - if ESG data can provide insights on a global pandemic, it can also be a powerful tool for understanding and mitigating geopolitical and country risks within an investment portfolio. And, as recent events this year (and last) have emphatically underscored, societal and geopolitical risks can be sweeping and destructive for countries, companies, and portfolios alike.

While the Corona crisis appears to be ebbing in some early hotspots, its spread continues with vengeance in other parts of the world with equally devastating economic impacts. Moreover, the threat of a second pandemic wave has not been averted and the situation remains fluid and far from stable. It is still too early to estimate final death tolls, economic damage, and their potential effects on global financial stability, let alone draw clear and instructive conclusions. And yet, it is obvious that some countries have been more successful in their fight against COVID-19 than others. Indeed, there are early indications that a country’s ESG assessment can provide useful insights into effective crisis management as well as potential pathways to economic recovery.

The COVID-19 pandemic is exposing gaping fissures in the economic, social and political structures of many countries, particularly those most affected by the crisis. A closer look at country ESG profiles reveals those fissures were already evident within ESG data and that striking correlations appear between country ESG performance and their capacity to contain the virus, reduce economic fallout and mitigate socio-political ramifications.

And while the current pandemic began as a public health risk seemingly limited to health and welfare variables (social dimensions within ESG data), it has quickly and aggressively contaminated and crippled the broader macroeconomy. Given the resulting contagion of the macroeconomy, financial markets, the geopolitical landscape and society, it should now be compellingly clear that a country’s ESG profile should be an essential part of investment considerations and decision making.

ESG country data not only gives a read on a country’s social dimension but also on its governance (the “G” in ESG). And as the coronavirus crisis indicates, a country’s “G-force” provides valuable insights when trying to evaluate its capacity to deal with the pandemic and its potential to overcome this crisis.

Pandemic causes and solutions are far from one

dimensional

Though health and health systems are at the epicenter, the crisis

reveals deeper fractures across other ESG dimensions. The

COVID-19 pandemic is a stark reminder of the crucial importance

of a widely accessible and strong public health system. But good

physical health is only one pre-requisite for a thriving

individual, a thriving population and a thriving economy. Other

factors within the social dimension such as demographics, living

conditions, education and opportunity - in short, human

capital - are also essential. A prospering and stable economy

requires human beings to live under reasonable and healthy

circumstances in order to rely on a productive and adequately

skilled workforce. It is therefore imperative that these kinds of

social indicators are meaningfully reflected in a country’s

sustainability profile.

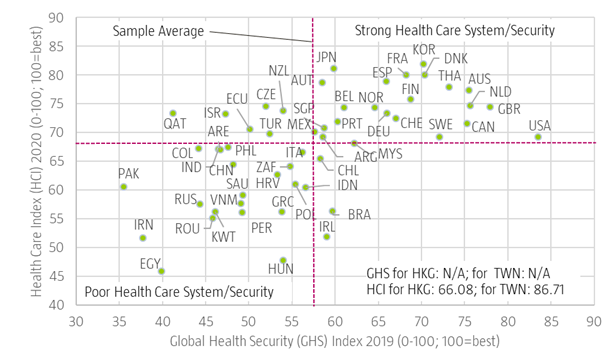

Moreover, solely focusing on singular ESG data indicators can be

dangerously misleading as recent events have proven. For example,

trusting in health system variables alone were insufficient in

judging a country’s preparedness for this pandemic threat.

Examining current numbers of confirmed COVID-19 cases and

comparing them with Figure 1 shows that top-ranking countries,

based on major healthcare system indicators, are among the

hotspots of this pandemic—most notably the United States, Spain,

Italy and France.

Figure 1 | Health Security & Health

Care Quality of selected countries

The Global Health Security (GHS) Index lists the countries

best prepared for a pandemic.

The Health Care Index (GHI) is an estimation of the overall

quality of the healthcare system.

Sources: Nuclear Threat Initiative, John Hopkins Center for

Health Security, EIU; Numbeo - The Health Care Index by

Country

It has become obvious that when a contagious disease strikes with such a punch, even the most advanced health systems can be overwhelmed if other conditions (measured by other ESG dimensions) have not been met.

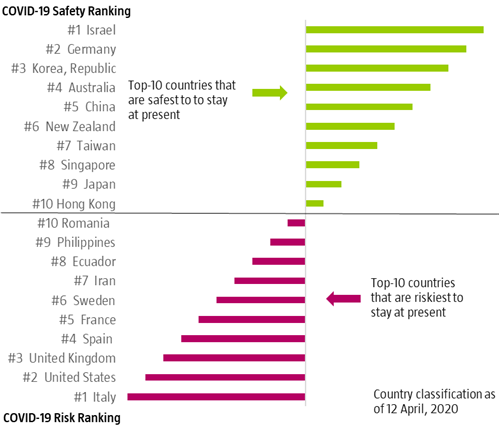

In countries most severely hit, the disease’s spread may have

been more effectively contained if swift and decisive action had

been taken early on. Figure 2 provides an early indication of

which countries have managed the coronavirus crisis more

successfully than others so far.

Figure 2: COVID-19 Country Ranking by Safety &

Risk

The ranking is based on DKG's framework utilizing raw data from a number of publicly available sources for 72 parameters and aims at assessing the countries in terms of safety and risk in dealing with COVID-19 as well as the economic, political and societal impacts. Source: Deep Knowledge Group

The country classification may change quite frequently as the ranking is updated continuously. What is surprising is that a country’s governance and institutional scores (see Figure 3), rather than its health system/security scores (Figure 1) are better predictors of its ability to successfully manage the coronavirus crisis so far.

Figure 3: Pandemic preparedness across selected countries

The Institutions score is based on input data from the Worldwide Governance Indicators & the Fragile States Index; the Health score is based on the Health Pillar score of the Prosperity Index; both are part of the RobecoSAM Country ESG Framework. Sources: Fund of Peace, World Bank, RobecoSAM

Returning to the epicenter, the success of the health-policy response with respect to containing the spread of the virus, treating the ill, and enhancing immunity will also be decisive in controlling the severity and duration of the imminent economic recession to follow.

Strong formal and informal institutional networks are

key

The COVID-19 crisis has clearly demonstrated that an effective

pandemic response relies on a strong and well-functioning

institutional framework. Robust state institutions, a sound

system of checks and balances, a capable public administration,

strong advocacy groups and a vibrant civil society are essential

in ensuring representation and fairness among its citizens and

accountability from its leaders. In addition, these societal

institutions also serve to support and stabilize society when

government authorities are overstrained. It is no coincidence

that most of the more severely affected countries display

weakness in various institutional or overall governance aspects,

visible in lower scores for their institutional framework (see

Figure 3 above).

Unsurprisingly, the COVID-19 outbreak in the US has exploded. Unlike other countries, the Trump administration not only failed to take early action but also hampered efforts by maintaining a stance of denial and disregard for scientific evidence and dismissing the early warnings of health officials and other experts. President Trump’s recurrent attacks on both domestic and international institutions since his takeover of power is already reflected in declining US scores across several governance indicators. Trump’s erratic leadership, marked by initial indifference and later belligerence and impatience, has also affected his administration’s working relationship with state governors and other public-private actors during this crisis.

Elsewhere, political leaders have taken similarly complacent positions. Even now, the populist Brazilian and Mexican presidents, Jair Bolsonaro and Andres Manuél Lopez Obrador, are downplaying the coronavirus threat, putting their countries at risk for a devastating hit as well.

Combating COVID-19: Do authoritarian regimes have an

advantage?

With several major democracies reeling, a debate has emerged

about the alleged supremacy of authoritarian regimes in dealing

with this crisis. However, a preliminary glance at the picture to

date shows that both authoritarian and democratic governments

have mixed responses and mixed results with regard to the

COVID-19 pandemic; there is little evidence that shows a specific

type of political regime has done systematically better.

China’s response, though initially disastrous, was eventually targeted and persuasive, while Iran, another authoritarian state, has done very poorly. Irrespective of the veracity of officially reported case numbers and deaths, the two countries’ methods of dealing with the crisis have been controversial from a human rights point of view.

On the other hand, strong democracies such as South Korea, Taiwan, and Japan have done well in comparison, showing visible successes in containing and mitigating outbreaks. In contrast, the US and many European countries were late in recognizing the sheer scale and threat of the COVID-19 crisis and so failed to respond timely and/or strongly enough (see Figure 2). As a result, they have witnessed a pronounced surge in cases and have been forced to adopt more extreme lockdown measures.

This initial assessment of the performance of different political regimes does not yet encompass poorer autocracies and democracies in developing countries (e.g. Brazil, India, Russia). Most of these nations appear to be still in the early stages of the crisis and have not yet felt the virus' full vigor and force.

Is the coronavirus crisis also attacking

democracy?

The current COVID-19 crisis has clearly revealed that an

effective pandemic response relies on a strong and

well-functioning institutional framework, flourishing human

capital, high levels of social cohesion and, in particular, an

effective network of public and private institutions, alliances

and partnerships. Not only are these highly correlated with

success at containing the pandemic, they are also factors

captured in ESG country data. Moreover, the strength of these

same variables will be equally important in overcoming the

inevitable economic fallout, in engineering a sustainable

recovery, and in retaining socio-political stability.

True, the coronavirus crisis has also brought changes on a massive scale, impacting virtually every aspect of daily life as many nations were forced to use draconian measures to slow the rate of contagion, illness and death within the population. Indeed, when determining their pandemic response, democratic governments often followed a narrow and perilous path between enforcing drastic and effective measures on the one hand and respecting civil liberties and personal freedom on the other. In this regard, governments in many Western democracies will have found it more challenging to strike the right balance than countries with more authoritative versions of democracy like South Korea, Singapore and Taiwan.

On the other hand, it has also become obvious that authoritarian regimes are taking advantage of the coronavirus crisis to tighten their grips at home and to promote their political model abroad. Prime examples include (but are not limited to) China and Russia. In Hungary too, Prime Minister Victor Orban was only recently granted extraordinary power allowing him to rule by personal decree and to suspend parliamentary democracy for indefinite periods. And this is just one example of how authoritarian leaders might use the coronavirus crisis as a convenient opportunity to further undermine democracy and consolidate power. These and other developments only serve to reinforce an already concerning rise in authoritarianism globally—a trend that has already been observed and reflected in the respective indicators of our country ESG framework.

Conclusion

Functioning institutions that allow a government to act swiftly

and efficiently are key and will also determine how successful a

country can deal with the economic and social impacts of a

crisis. Moreover, an assessment of a country’s ESG profile is

also a valuable tool for insights on a country’s resilience and

capacity to cope with pandemics and the resulting fallout.

It has taken a crisis of epic proportions to expose to the world to what was already partially visible in country ESG data; we must hope that the magnitude and sharpness of the initial shock and subsequent aftershocks will leave us deeply wounded but acutely sensitised to early warnings that can help avert future risks - worthy advice for citizens, countries, and investors.