Investment Strategies

Caution Is Investment Watchword For UK-Based Welrex

Although taking a broadly "conservative investment" position, the wealth management firm is also unafraid, it says, to state that the US remains "uniquely positioned" in macroeconomic terms.

Welrex, a digital wealth management platform, will have reasons to feel cheerful after stating in its 2026 outlook that about half its portfolio is allocated to Swiss-hedged assets and gold. And it has turned more upbeat about the US market than was the case in 2025.

The firm (see more about it here and here) said it is keeping to a “conservative investment” position this year – holding a broadly equal weighting between stocks and bonds and implemented by a thematic strategy across different assets. It also has limited exposure to speculative assets such as bitcoin and Etherium. Welrex is less negative on US assets and the dollar than was the case in 2025; it is negative about the oil price and has turned negative about the outlook for industrial metals. In currency terms, it prefers the Swiss franc over the dollar, the dollar over the euro, and prefers the euro to sterling.

Explaining the past year and future approach, the group’s chief investment officer Kirill Pyshkin (pictured below) said Welrex’s multi-asset strategy portfolio delivered a total return of 26.5 per cent in 2025 when measured in dollars – a result he said which beat all comparable benchmarks. (See its views from more than a year ago here and here.

Kirill Pyshkin

“Our primary investment thesis in 2025 was a preference for European assets – including equities, bonds, and the euro – combined with a conservative, balanced allocation between equities and fixed income. We also advocated exposure to gold and the Swiss franc as defensive hedges. These core views proved correct,” Pyshkin said.

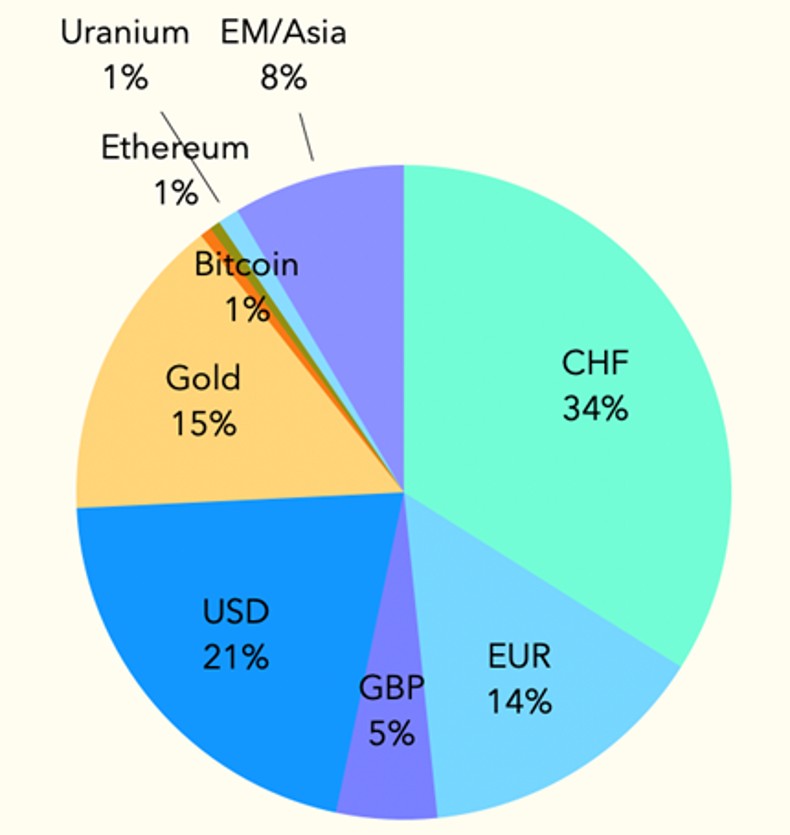

“For 2026, we maintain a broadly similar positioning, with an approximately equal allocation between equities and bonds. Roughly half of the strategy portfolio remains invested in gold and Swiss-franc-denominated assets, including short-duration corporate bonds and defensive equities. This results in a materially more conservative profile than that of a typical multi-asset portfolio,” he said.

The first weeks of 2026 have seen investors grapple with whether the high valuations of US stocks – and the Big Techs in particular – can sustain gains. Worries about US central bank independence, geopolitical volatility and slippage in the dollar last year have encouraged, among other trends, further gains to gold. The yellow metal pushed above $5,000 per ounce a few days ago.

WELREX multi-asset strategy portfolio (look through)

Source: Welrex

Debate still open

Pyshkin said that certain debates about “elevated asset

valuations and rising public debt levels highlighted last year

remain unresolved.”

“As a result, we continue to favour a defensive positioning. To offset the risk of excessive conservatism and to preserve portfolio balance, we maintain selective exposure to higher-risk assets capable of generating outsized returns, notably bitcoin and Ethereum,” he said.

The CIO noted that a year earlier, Welrex argued that European assets, including the euro, bonds, and equities, would outperform, and that was the result.

“For 2026, we are less confident that this trend will persist and have therefore increased our allocation to US assets across all asset classes,” Pyshkin continued.

Brightening US

Pyshkin said that this year, it thinks the US is “uniquely

positioned from a macroeconomic perspective.”

Fiscal policy is supportive, helped by the tax cuts and measures of last year’s One Big Beautiful Bill Act and continued foreign direct investment following earlier tariff negotiations. In addition, significant tariff revenues are contributing to the reduction of the budget deficit, although there i still a small risk that these measures could be overturned by the courts, he said.

The US Federal Reserve is also, Pyshkin wrote, likely to adopt a more accommodative stance as economic growth moderates, pushing interest rates lower. The combination of fiscal stimulus and monetary easing is inherently inflationary.

“In 2025, our multi-asset 'Inflation Buster’ theme delivered a +43.1 per cent absolute return in dollars and was the best-performing portfolio. We believe this theme may again generate outsized returns in 2026,” he said.

“From a traditional asset allocation perspective, this macro environment would favour equities over bonds. However, US equities are expensive, and certain segments – most notably artificial intelligence – exhibit characteristics of a potential bubble. While US equities were already expensive last year, valuation concerns have shifted from expectation-driven multiples toward a requirement for tangible earnings and cash-flow delivery from AI-related investments,” he continued.

“Accordingly, while we prefer equities over bonds in the US, we maintain exposure to both for risk management purposes. Within fixed income, we favour long-duration US Treasuries, where yields remain unusually high. In equities, we focus on thematic and selective opportunities, favouring active management over broad market exposure, with an emphasis on strong balance sheets and clear monetisation pathways,” he said.

Preference for Swiss safety

Pyshkin said the firm thinks that Switzerland is the safest

region within Europe, and Swiss franc-denominated and hedged, or

Swiss-headquartered assets” represent “our largest regional

allocation”.

“Exposure to the euro area is more limited and focused on long-duration euro-denominated government bonds, which serve as a higher-risk hedge relative to our ultra-defensive Swiss holdings,” he said.

European equity valuations are lower than those in the US. However, Pyshkin said weaker growth momentum, thinner margins, and limited visibility into AI-driven earnings constrain the upside for European equities in general.

In the UK, Welrex mainly has exposure focused on corporate bonds, with equity exposure focused on the energy and industrial sectors.

Emerging markets

Pyshkin said the underlying conditions for emerging markets are

stronger than they have been for years, but the market is

“increasingly fragmented.” After the benefits of falling

inflation, early rate cuts and stabilisation to currencies, some

of the broad gains (“beta”) to the asset class have already been

achieved.

“Going forward, returns are likely to be driven by country-specific factors, balance-sheet strength, and policy credibility. Our exposure to emerging markets therefore remains measured and selective, implemented through our thematic multi-asset 'Rising BRICs’ portfolio, which is structured at approximately 60 per cent equities and 40 per cent bonds.

“Within emerging markets, we see attractive risk-adjusted opportunities in fixed income over the near to medium term. Hard-currency and high-quality local-currency bonds benefit from improving fundamentals, attractive carry, and declining inflation. Consequently, our exposure to India is currently expressed exclusively through bonds.

“On the equity side, our largest exposure is to Brazil, where valuations remain reasonable and earnings are supported by domestic reform momentum. Exposure to China remains limited and highly selective, Pyshkin said.

Oil and other commodities

Turning to areas such as crude oil, Pyshkin said he expects that

any peace deal between Russia and Ukraine would involve

easing/removal of sanctions on Russia, which would weigh on oil

and gas prices.

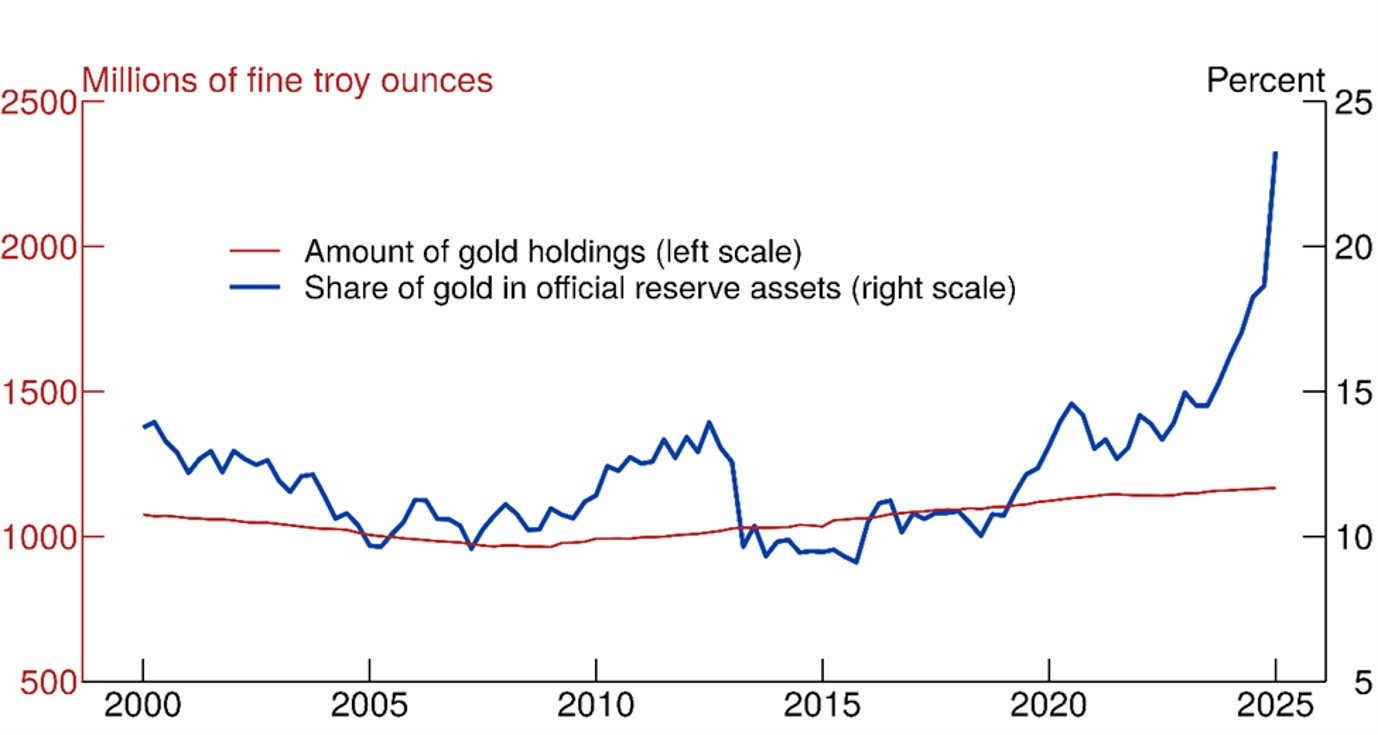

“While reconstruction efforts in Ukraine may generate additional demand for industrial metals, we do not believe this will be sufficient to offset the impact of increased supply. As a result, we maintain a negative view on most commodities, with the exception of gold, where demand – particularly from China’s central bank – remains strong and largely unaffected by sanctions,” he said.

Central banks’ gold holdings

Figure: Share of gold in official reserves (market value as a percent of total reserves)

Source: IMF International Financial Statistics and FRB

Gold and currencies

Turning to gold and cryptocurrencies, Pyshkin said they sit at

opposite ends of the risk spectrum.

“We consider gold to be low risk, while cryptocurrencies are extremely high risk. Nonetheless, both serve as hedges against fiat currencies at a time when confidence in paper money has weakened,” he said.

“In our 2025 outlook, we discussed the 'weaponisation’ of the US dollar, referring to the increasing willingness of the US to restrict dollar usage by regimes it deems hostile. This has contributed to a gradual erosion of the dollar’s share in central bank reserves, a key driver behind the sharp rise in gold prices.

“Similarly, the European Union has demonstrated a willingness to consider the expropriation of Russian central bank reserves held in euros. Although recent attempts were blocked, the precedent has been established, and we expect the euro’s share of global reserves to decline over time,” he said.

Pyshkin said that for central banks, gold remains the primary alternative. Silver is less attractive due to storage constraints, leading some institutions to consider cryptocurrencies as a supplementary reserve asset.

“The long-term outlook for crypto is further supported by increasing institutional adoption, facilitated by improved access through ETFs. While we remain long-term positive on cryptocurrencies, their volatility makes them unsuitable for risk-averse investors.

“Among fiat currencies, the Swiss franc remains our top choice, reflecting Switzerland’s ability to avoid populist policy shifts. In contrast, we hold a negative view on the British pound,” he added.