Alt Investments

Coller Capital Closes Another Secondaries Fund, Says Sector Important Diversifier

Whether held in an evergreen structure or some other form, UK-headquartered Coller Capital is a prominent player in the secondaries market and argues – perhaps unsurprisingly – that this segment of the alternatives space is a useful way to spread risk and enter the wider private market.

Amidst all the noise around why high net worth individuals, family offices and others should jump into the private market investment story, one way into the game is the secondary market, a firm says.

“Secondaries” are pre-existing investments in private equity, credit, venture capital, real estate, infrastructure and related areas. Investors may sell their stakes earlier than they had planned – for example, to raise money they need – or to switch into a different investment. Either way, secondaries also give investors in what are otherwise relatively illiquid assets a channel for moving money around. They’re part of the lubricant of the market.

This week, London-headquartered Coller Capital, which says it is the world’s largest dedicated private market secondaries manager, announced the final closing of Coller Credit Opportunities II, aka CCO II, bringing a total of $6.8 billion raised for Coller’s credit platform in its latest fundraising cycle.

“Secondaries give broad diversification as a risk mitigator,” Jon McEvoy, managing director and co-head of private wealth secondaries at Coller Capital, told this publication in a recent interview. McEvoy, who joined Coller in 2022, has worked for much of his career in the private wealth sector at firms including Skybridge Capital and Morgan Stanley.

There is a great deal of headroom for growth. In the primary market, for example, there is an estimated $11 trillion of unrealised net asset value inside private equity firms globally; in secondaries he said, last year’s transaction volume was $160 billion, according to Evercore data. By 2030, it could reach $500 billion.

“It [secondaries] is a liquidity solution for those who need liquidity,” McEvoy continued. “They are an obvious place to be [for clients] looking for private market exposure.”

One diversification source includes holding multiple vintages of investments, he said. Secondaries tend to show lower volatility of return and are therefore more predictable.

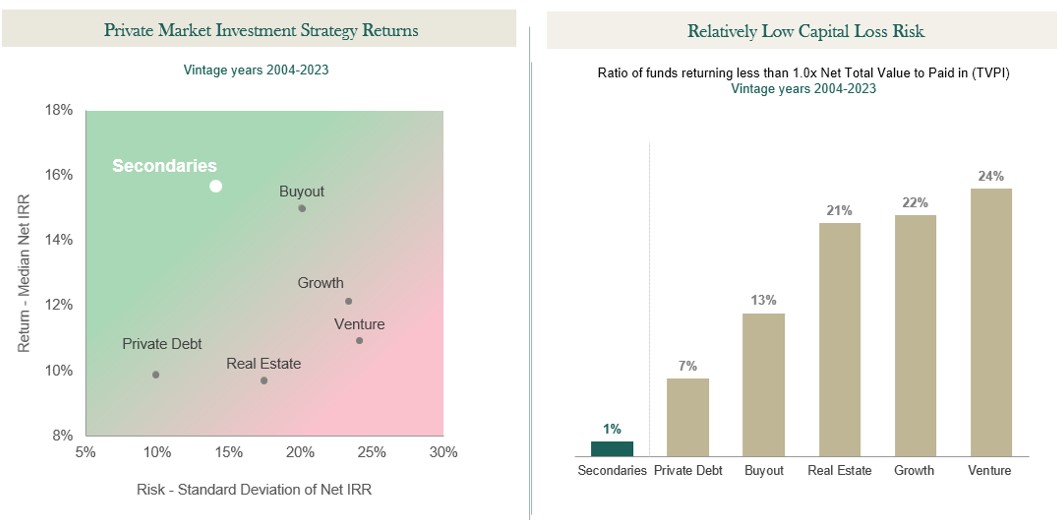

Based on private market investments with vintage years (when a fund was initiated) from 2004 to 2023, Coller Capital, citing data from research firm Preqin said secondaries' returns came highest of any private market type, at almost 16 per cent for median net internal rate of return, and at a standard deviation of net IRR at 15 per cent, with only private debt at a lower standard deviation, at around 10 per cent. The firm also said that secondaries have a relatively low risk of capital loss, at 1 per cent, versus venture capital at the highest, at 24 per cent.

Source: Coller Capital – "The Case For Equity Secondaries." (Uses data from Preqin, others.)

McEvoy spoke at a time when major firms such as Blackstone, Carlyle and Hamilton Lane have been busy rolling out “evergreen,” or perpetual, structures that operate on an open-ended basis, without the capital calls and pre-set exit points for a traditional private market fund. Seen as a way for investors to get their toes into the water, they play to increased demand for wider access to what had been an asset class dominated by large institutions and the super-wealthy. In parallel, policymakers in the UK, Europe and US are, in varying ways, seeking to spread access. The US, to give one example, has loosened its Accredited Investor regime

Not everyone is relaxed about this trend. This publication’s US correspondent has encountered signs of caution and scepticism about whether the hunger for returns will cause problems down the line.

Secondaries into perps

For McEvoy, crafting new fund structures is valuable, and the

secondaries market offers a convenient, and increasingly

attainable, route into the market.

With secondaries, a person can buy investments at a discount and there is no blind pool risk, he said. (This refers to the idea that in conventional private investments, the investor puts money into a pool which has yet to be invested in a particular set of firms. With secondaries, those companies are invested in already.)

McEvoy said there is more appetite in the wealth sector for more user-friendly entities. “It makes sense to put secondaries into a perp,” he said.

Perceptions

A challenge is convincing investors that when buying a secondary

investment from someone, they are holding a valuable investment

rather than something that is unloved. A buyer can realise that

the seller needs liquidity, and this create a chance to buy value

at a discount, he said.

“We focus, through our due diligence, on those [sellers] who need the liquidity and help them solve a problem,” McEvoy said.

Coller Capital has been building momentum. In 2024, it launched its first offering for accredited investors: Coller Secondaries Private Equity Opportunities Fund (CFEF). This was built specifically for investors seeking access to private equity returns without locking up capital for a decade.

In its latest offering, CCO II targets senior direct lending and high-quality performing credit investments across LP-led and GP-led opportunities. Coller Capital said it has seen $53 billion of secondary credit investment opportunities since January 2024, with substantial growth anticipated as more private credit funds mature.

Secondaries tend to show lower volatility of return and are therefore more predictable.

The sector is scalable, he said asked about capacity of the sector and potential issues for performance. McEvoy added that the rise of this market comes amid a wider rise of private markets. “The secondary market is a wider part of the ecosystem.”

McEvoy said Coller has a very selective approach to the

secondaries it invests in, leveraging its large investment team

to screen the market but only doing about 2 per cent of those

deals.