Wealth Strategies

EDITORIAL COMMENT: India's Stock Market Stuck In Neutral; Reform Hope Promise Fails To Fully Convince Investors

One of the BRICS that at long last appeared to be surging ahead has hit a soft patch and its government needs to live up to expectations.

A barometer of India’s stock market returns shows that since January this year, they have delivered – wait for it – barely 3 per cent. That is capital growth plus reinvested dividends. Considering the sizzling double-digit performance last year, the country isn’t convincing investors that the pro-reform promise of its new government is coming through fast enough.

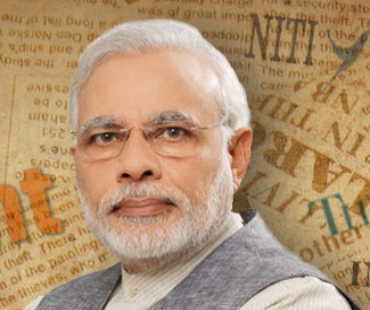

In 2014, the MSCI India Index delivered returns of almost 24 per cent (in dollars), handily beating the MSCI World Index of developed countries’ stocks of 4.94 per cent. A year ago, the newly-elected BJP Party of Narendra Modi, which took office pledging to shake up India’s notoriously bureaucratic and protectionist economy, excited investors. But as markets are forward-looking, some disappointment after a period is, perhaps, understandable.

At the investment house Alquity, its head of Asian investments, Mike Sell, gives the India government a “B+” report grade – some progress but could do better.

“The economy has significantly strengthened and is very well positioned for any global macroeconomic instability (Grexit, US rate rises). Inflation has declined and foreign exchanges have increased dramatically. However, our interactions with local companies indicate that we are only now seeing the first signs of improving consumer confidence and economic growth - which has taken longer than many commentators expected,” Sell said in a note.

“In terms of infrastructure, which is inherently long-term, there has been a dramatic increase in project approvals, and the backlog of delays has shrunk rapidly. Modi has been successful at ensuring the notorious Indian bureaucracy has become a) more efficient and b) more decisive,” Sell continued.

From a political point of view, Sell said the focus has moved to what hasn’t been done by the government rather than the successes, with the stock market retracing all of its 2015 gains. “Game-changing, landmark bills in the areas of land acquisition and tax simplification have not been passed,” he said.

Sell argued that the recent India parliamentary sessions were some of the “most productive for several years”, with long-delayed legislation, such as on the insurance industry, being passed.

“All things considered, we believe the government has made creditable progress. In our view, they need to continue and actually accelerate their reform drive whilst the economic weather is fair, and before unforeseen political events potentially blow them off course,” he argued.

Last year, an India-focused hedge fund, called the Passage To India Opportunity Fund (Cayman), run by Arcstone Capital, blew the lights out in performance terms with a net return figure of 225.1 per cent (source: Preqin). This fund was the best performer last year. Such a gain, as experienced investors know, tends to be hard to repeat. In the main, however, investors will hope that the Modi administration delivers on its promises. India, with its young demographics and relative political stability, has been often touted as one of the BRICS that may yet outperform its emerging market rivals. The jury is still not quite fully decided on that score.