Uncategorised

FMA publishes annual report

New Zealand's Financial Markets Authority has issued a report which explains why it has deferred the opening of its new financial advice regime, undertaken several enforcement actions and cut pay for its executives while nevertheless planning to increase its total funding through levies.

A new regime for financial advice

The start of the new financial advice regime has been delayed, but it is still a huge priority for the regulator. It has made great progress towards a design for the licensing regime and a strategy for monitoring and supervising the sector, which it expects to "have varying levels of conduct and compliance maturity."

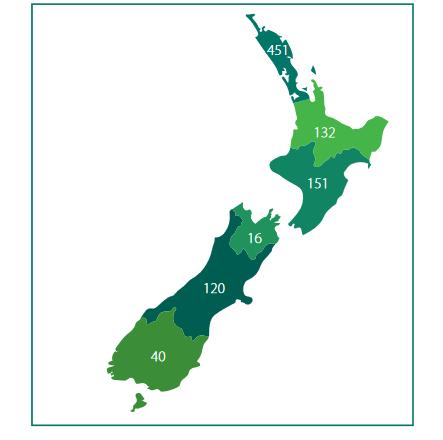

The Financial Services Legislation Amendment Act will change the way in which people can provide financial advice in New Zealand significantly. The FMA is keen to ensure that all advice is given by or on behalf of licensed advisors and to subject those advisors to a new code of conduct, new rules and new regulations (all of which are to be appended to the Act). Applications for transitional licences began last month and their quantities are shown on the map above. As of June this year, the FMA had either granted to begun to evaluate 910 transitional licence applications. Because of the Coronavirus, it deferred the start of the new regime from June until 15 March next year.

Enforcement

A selection of enforcement activity from the past year includes the following.

July 2019 - Syndicated Trusts Ltd. The FMA

issued a Stop Order against this firm, ordering it to stop

advertising or accepting money for fnancial products. This was in

response to contraventions of several aspects of the FMC

Act relating to advertising and disclosure.

August 2019 - Westpac. Westpac New Zealand

signed an enforceable undertaking with the FMA and Commerce

Commission, outlining steps to refund fees to some 93,000

customers whom it overcharged a total of NZ$7 million.

August 2019 - AxiCorp Financial Services. The

FMA suspended the derivatives issuer licence of this firm for

breaking parts of the FMC Act that relate to disclosure,

fnancial statements and auditing. It also contravened its licence

conditions.

August 2019 - ANZ related-party transaction. The

FMA published the results of its inquiry into disclosure by ANZ

New Zealand Group of the sale of a property by its subsidiary

Arawata Assets Limited to Deborah Veronica Walsh (the wife of

former ANZ CEO David Hisco), which determined that ANZ New

Zealand Group should have disclosed this as a related-party

transaction in its fnancial statements for 2017.

August 2019 - Eoin Johnson/Promisia Integrative

Ltd. Eoin Malcolm Miller Johnson admitted to

insider-trading conduct and breaching his director's disclosure

obligations. He was obliged to pay NZ$75,000, in lieu of a

penalty, to the FMA, and was barred for five years from acting as

a director, senior manager or consultant for a listed company or

any FMA-regulated firm.

September 2019 - Barry Kloogh. The FMA cancelled

the authorisation of Dunedin-based Barry Edward Kloogh to act as

a financial advisor, having expressed concerns about his

compliance with his obligations as a broker under the

Financial Advisors Act 2008. The Serious Fraud Office is

investigating his activities; two companies of which he was the

sole director had already been placed into liquidation by the

Dunedin High Court at the behest of the FMA.

October 2019 - Steven Robertson. This man was

sentenced to six years and eight months in prison, having been

found to have misappropriated funds deposited by clients who

believed that those funds were to be traded or invested on their

behalf. He was also found to have withdrawn funds from credit

card accounts of some clients without their authority and

knowledge. The Court of Appeal later dismissed his appeal against

his sentence.

October 2019 - Circle Markets Ltd. The FMA

issued a formal warning to an unlicensed derivatives issuer and

forex provider, Circle Markets Ltd, for compliance failures under

the Anti-Money Laundering and Countering Financing of

Terrorism Act 2009.

November 2019 - FXBTG Financial. The High Court

ruled to uphold a direction by the FMA to de-register this

foreign exchange firm because it was not providing financial

services to customers in New Zealand.

December 2019 - CBL. The FMA issued two sets of

civil proceedings in the Auckland High Court against CBL

Corporation Ltd (in liquidation), its six directors and the chief

financial officer, alleging multiple breaches of the FMC

Act.

December 2019 - AFA non-compliance. The FMA

visited the offices of an unnamed authorised financial advisor,

found it wanting in a minor way and forced it to remedy

matters.

April 2020 - AML warnings. The FMA issued a

formal warning to Tiger Brokers (NZ) Ltd for failing to have

several adequate anti-money-laundering (AML) measures in place.

It also issued similar warnings to six other businesses privately

for their AML practices, mainly because they were too slow to

audit their systems and controls. The Coronavirus may or may not

be to blame here.

May 2020 - Warning to AFA. The FMA issued a

formal warning to a financial advisor who urged clients to move

their investments to ‘low-risk’ funds in the wake of the

Coronavirus without telling them that the advice might not have

been suitable for all of them.

June 2020 - CLSA Premium New Zealand Ltd

(formerly KVB Kunlun). The FMA commenced civil proceedings in the

High Court against this firm, alleging that it broke the

Anti-Money Laundering and Countering Financing of Terrorism

Act 2009.

June 2020 - Rodney McCall/Morgan Cooper Ltd.

Rodney McCall pled guilty to deceptively obtaining funds that he

pretended to be investing. He was neither authorised nor licensed

to make investments on behalf of others. The FMA pressed the

charges.

June 2020 - ANZ credit card repayment insurance.

In this month the FMA opened proceedings in the High Court

against Australia New Zealand Bank, alleging that it had charged

some customers for credit card repayment insurance policies that

ofered those customers no cover.

Funding

The regulator's modest funding is about to sky-rocket, as announced in this year's national budget. The Government (perhaps convinced by a recent report from PwC that claimed that the FMA was underfunded and having to "punch above its weight") has decided to increase its operational funding, which was NZ$36m in 2019/20. The FMA’s appropriation from the Crown will increase to NZ$48.5 million in 2020/21, NZ$53.5m in the following year and NZ$60.8m in the third year. The majority of the increase will come from levy payers.

Scams and alerts

There were 75 suspected scams in 2020, as opposed to 56 in 2019, suggesting that the time of the virus has been a prosperous one for fraudsters in New Zealand, as elsewhere. Total warnings and alerts came to 83, up significantly from 2019's 68. Only 19 unregistered businesses popped up, however, as opposed to 29 the previous year.

Pay cuts

In line with other public sector agencies, the FMA’s chief executive took a voluntary 20% reduction in salary for the six months after 1 June as well as a further voluntary reduction in performance pay for the 2019/20 financial year. In accordance with the Remuneration Authority (COVID-19 Measures) Amendment Act 2020, for the period of 9 July 2020-6 January 2021 the FMA board chairman’s remuneration rate will be reduced by 20%, the board members’ remuneration rate will be reduced by 10% and the Disciplinary Committee chairman’s remuneration rate will be reduced by 10%.