Family Business Insights

Family Businesses Must Plan For NextGen

This article, which covers different aspects of family business transfer and succession, comes from HSBC's global private bank.

The moment of handing over the family business has always been a critical one for entrepreneurs, and with attitudes and assumptions changing – and varying widely by region – succession planning has never been more vital. The author of this article addresses this issue. The writer is Caroline Kitidis, global head of UHNW, HSBC Global Private Banking. The usual editorial disclaimers apply to views of guest writers. Thanks to Kitidis for sharing these valuable insights. To respond, email tom.burroughes@wealthbriefing.com and amanda.cheesley@clearviewpublishing.com

Family businesses are rarely uncomplicated. For entrepreneurs who have inherited their family business, the matter of succession is fraught with crosscurrents of expectation and emotion.

Pride in achievements is mixed with layers of uncertainty over how best – and, indeed, whether – to pass control of a family business to a further generation. What is best for the business may not be what is best for the family member tasked with the responsibility of running it – or the family at large.

With pride comes pressure

One of the key findings from our recent Global

Entrepreneurial Wealth Report, which surveyed 1,800 business

owners around the world, is that business is very, very personal

for entrepreneurs. They’re truly passionate about their

companies. And for inheritors, the responsibility of assuming

control is significant and emotionally charged. It’s not like

getting a job; the psychological impact is deeper. Many

inheritors feel a strong sense of pride in upholding the family

name, but alongside this comes pressure to conform to

expectations and duplicate successes, and difficulties in making

a personal mark on the business. It’s about pressure and

pride.

The next-generation challenge

Given those pressures, it is not surprising that business owners

are asking themselves whether the next generation is ready, or

even willing, to take on the responsibilities of ownership.

Having themselves experienced the responsibility of meeting

parental expectations and the financial pressures of managing the

business, the prospect of automatic succession gives many owners

pause for thought. As our research shows, these reservations are

more common among those who’ve inherited than among

first-generation business founders.

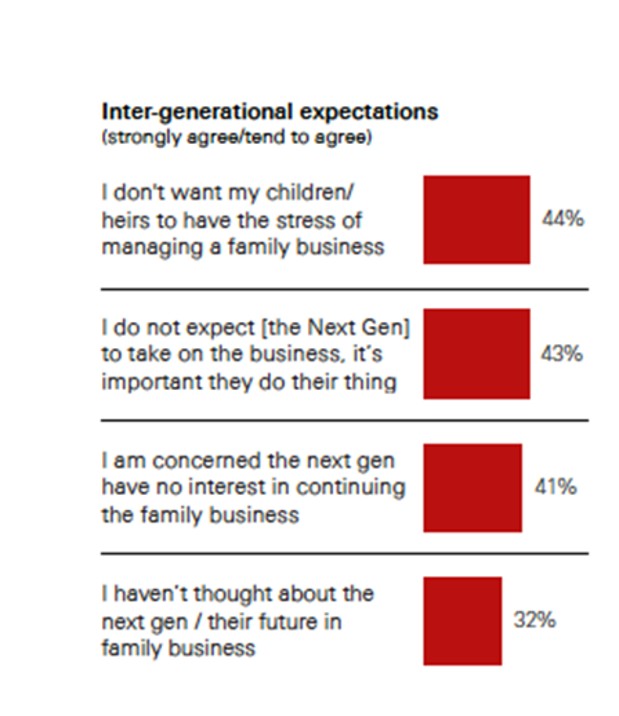

GRAPIC 1: Intergenerational expectations

Source: HSBC Global Entrepreneurial Wealth Report 2024

Even though more than 80 per cent of surveyed entrepreneurs say they felt trusted and supported in taking on the family business, attitudes to succession remain complex. Many say that feeling trusted to take on a business is not the same as wanting to do so, and today it’s common to hear reservations about forcing responsibility onto the next generation.

For example, half of these entrepreneurs say they felt they had no option about taking on the business, and that the experience has held them back in their careers. So, it should be no surprise that 44 per cent now say that they don’t want the next generation to shoulder the same responsibility and stress, and a similar proportion say the main priority is for the next generation to do what they want, not what the family business dictates.

The planning deficit

We’ve found that there is no single, dominant attitude and there

are significant regional differences. For example, nearly nine

out of 10 Indian entrepreneurs say it’s important that a business

is kept within the family – the highest regional proportion in

our survey.

Amid the differences, there is one common factor: succession planning is often neglected.

More than half of the business owners surveyed have no exit plan – and the reasons cited for this are typically highly personal. The majority say that even contemplating a business exit is too difficult because the business is their identity. Almost as many say that they fear loss of control and influence, and loss of professional purpose.

Yet evidence shows that business owners eventually come to regret the failure to address succession planning. More than one-third of those who’ve completed an exit think planning for their next steps should have been better.

Success is within grasp

For all these reservations, it is our experience that family

business successions work well when they’re properly planned and

supported. They’re best secured through transparent communication

within the family or stakeholder group about expectations and

ambitions, often with objective professional support.

Succession does not have to be a revolving door. If an individual doesn’t want to go into the family business they may, instead, take a role in the family office. This might involve steering the private investment portfolio or managing art portfolios and coordinating with large auction houses and museums. These are the sorts of roles that the next generation often wants to carve out for themselves.

But it’s worth noting that some entrepreneurs tell us that the crossroads moment for their children comes after the completion of school and university. Too many rely on their children’s education to set them up for life – when in truth the big decisions are made after they have gained some hands-on, real-world experience.

Communication is key

For such generational shifts to be successful, the most important

ingredient is communication. We find that the older generation

often puts off the conversation – and this may be due to no more

than a reluctance to talk about money – but the reality is that

the next generation wants to talk, because they want to

understand what the obligation or opportunity might be.

In fact, we are encouraged by how engaged many young people are in the future of their families. Recently, we held a forum in Switzerland, for people under the age of 35 who will one day inherit their families’ fortunes and businesses. The event was an incredible opportunity to inspire and educate these young people so that they can gain the necessary experience to be future family leaders themselves. It also provided crucial networking opportunities so that they can build the vital connections that will support them going forward.

From our experience of advising family businesses, conversations like these should start early and should be informed by professional advice where needed. Business owners need to explore the different roles that inheritors might take on in the business, as well as planning their own next steps with care. Whatever the shape of the transition, the golden rule is the more communication, the better the family dynamics and the long-term outcome.