Alt Investments

GUEST ARTICLE: ETPs - The Twilight Zone Is Ending For Investors

This guest article examines how exchanged traded funds and commodities sit in investors' portfolios.

The following article is by ETF Securities, and the editors of this publication are grateful to be able to share these insights with readers. The article talks about exchange traded products, part of a trend of passive investing that has generated considerable commentary in recent months and years. (See an example here.) ETP is a term that can apply to all kinds of exchange-based vehicles; the term also has a more specific meaning: ETPs are similar to exchange traded funds in the way they trade and settle but do not use an open-end fund structure, as an exchange traded fund does. The use of other structures including unsecured debt, grantor trusts, partnerships, and commodity pools by ETPs can, in addition to a significantly different risk profile, create different tax and regulatory implications for investors when compared to ETFs, which are funds. (See some recent data on the sector here.)

Appetite for exchange traded funds is booming worldwide. Assets under management in the exchange traded products industry, meanwhile, (which includes both ETFs and exchange traded commodities) are predicted to pass $6 trillion by the end of 2020 (Source:EY) as investors increasingly scrutinise the performance and costs of many active products.

But adoption in the UK wealth management space has been slower, with managers continuing to prefer mutual funds in favour of other investment vehicles.

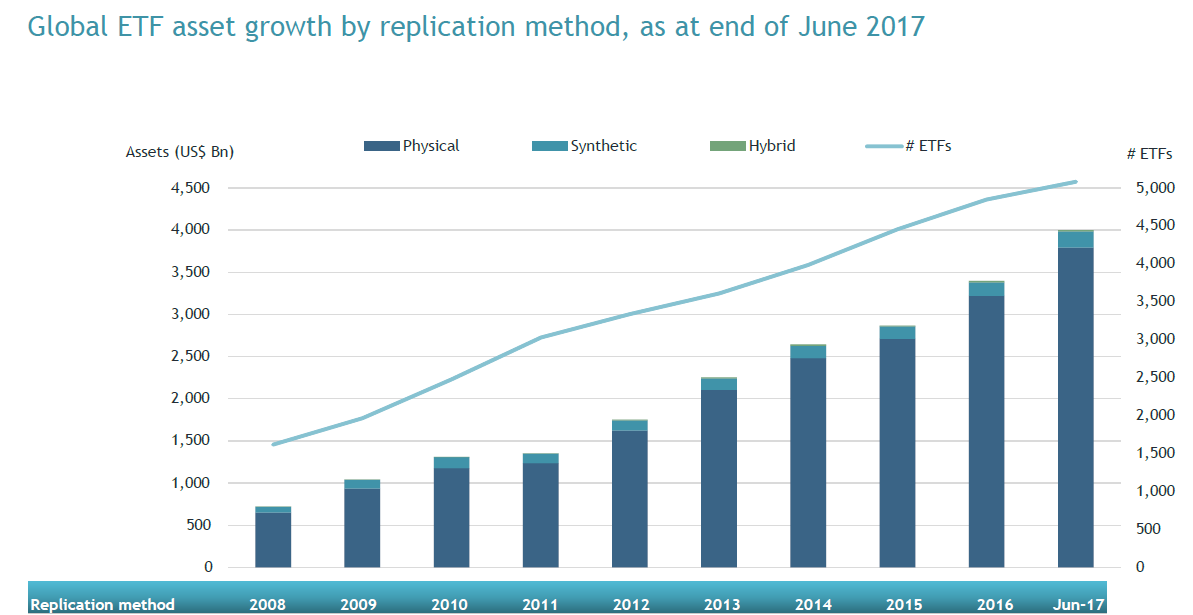

Some barriers to ETP use, such as trading cost-parity and fractional share dealing, are being tackled by platforms, intermediaries and institutions. As a result, investors are beginning to use ETPs more frequently as building blocks for their portfolios. In fact, the number of ETPs globally grew to 6,965 at the end of June 2017, representing over US$4.1tn of assets, according to data from consultancy ETFGI.

Source: ETFGI, June 2017

So, how do ETPs actually fit within a portfolio?

The concept of asset allocation - investing across a wide variety of asset classes to achieve your objectives – is nothing new. It is widely accepted that when negatively-correlated investments are combined, it can result in substantially less volatility within an investment portfolio.

Moreover, when compared against active stock picking, portfolios following a pre-defined, diverse asset allocation strategy tend to come out on top as highlighted in S&P’s SPIVA report in 2016.

Most European ETP assets are exposed to equities and fixed income, in line with the traditional strategic ‘core’ model, so advisors can use ETPs as building blocks to implement strategic asset allocation. This approach is most suited to long-term, buy and hold investors.

On the other hand, ETPs also provide access to other asset classes, such as commodities and currencies that were not readily accessible to investors in the past. This level of access is changing the way in which people approach portfolio construction. Those advisors looking to implement a tactical overlay can make use of the transparency and intra-day tradability of ETPs in order to position portfolios quickly and efficiently.

Whether advisors are implementing strategic or tactical asset allocation, the characteristics of ETPs fit very well into the process of monitoring and rebalancing portfolios.

Although the industry has made progress in improving investors’ ability to trade ETPs efficiently, lack of understanding regarding the structure of ETPs is still a barrier. In order for this to change, wealth management firms must employ a comprehensive, structured due diligence process when assessing both ETPs and ETP issuers. Without robust internal policies in place, end-consumer confidence in the vehicle itself could falter and investors will struggle to fully reap the benefits of the ETP vehicle.

In addition, suitability reporting requirements place the onus on advisors to justify the investments they choose for their clients. Investment strategies are chosen according to risk profiles, so it makes sense that product’s risk profile should match up to an investor’s risk appetite. Historically, many ETPs have not been profiled. Even those that were, were often arbitrarily bucketed as ‘high risk’, stemming from a lack of understanding among professional indemnity (PI) insurers. ETPs were sometimes compared directly to un-collaterised swap-based structured products (where the investor is fully exposed to the credit risk of the issuing institution/bank), in spite of the fact that the vast majority of synthetic ETPs are fully collateralised on a daily basis, with eligible collateral deposited in a separate custody account with a third-party custodian. In fact, most ETPs are physically replicated as opposed to being swap-backed or synthetic, meaning that they actually hold the underlying stocks or assets they are designed to track.

Source: ETFGI, June 2017

In an effort to prevent further muddying of the water, ETP issuers have begun to focus increasingly more on education and due diligence. For example, ETF Securities has developed a five-step due diligence guide aimed at providing a framework for wealth managers to use when comparing ETPs. The guide highlights the following key considerations:

1) Underlying exposure – understanding exactly which index or

asset the ETP is designed to track.

2) Structure – the structure will determine the costs and

performance of the ETP, and how closely it tracks its underlying

benchmark.

3) Liquidity - there are two sources of ETP liquidity – primary

market and secondary market liquidity. This will determine the

tradability of an ETP and can impact the total cost of

ownership.

4) Total cost of ownership - looking beyond the ongoing

charges.

5) Regulation & Tax – important factors to consider, given that

most ETPs are domiciled abroad.

By taking these five points into consideration, advisors will be

able to answer the most important question of all: is this the

right solution to meet my client’s objectives?

Ultimately, it is the responsibility of the ETP industry as a

whole to educate and provide clarity where confusion and

uncertainty remains. Only then will advisors feel comfortable

enough to fully embrace ETPs and pass on the benefits to

individual investors.