Real Estate

Global Luxury House Prices Gain Ground; American Cities (Mostly) Fall

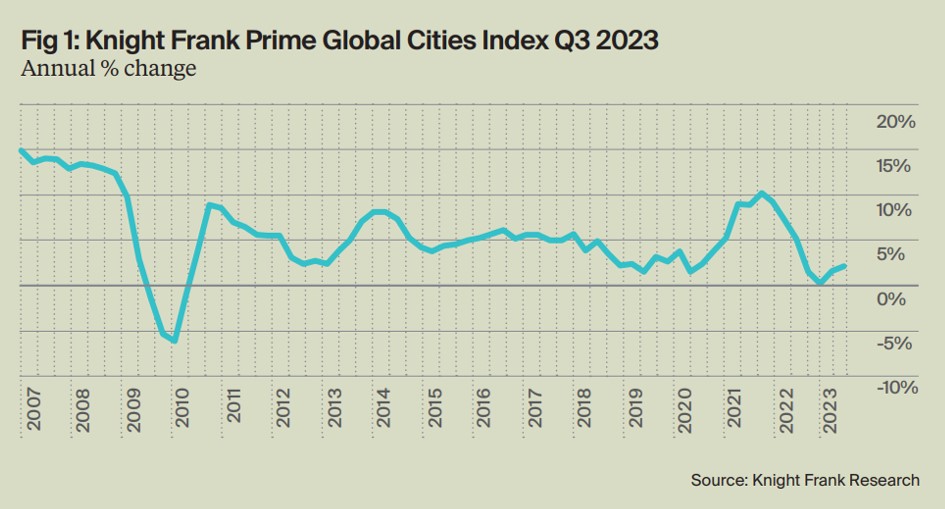

The global market for prime residential property has picked up although there are still uncertainties that act as a headwind.

An index of prime residential real estate around the world from Knight Frank shows that house prices rose an average of 2.1 per cent in the 12 months to September. Manila, in the Philippines, took top spot with a 21.2 per cent price rise, and Dubai (15.9 per cent) came second. Shanghai came in third place, at 10.4 per cent. On the flipside, the data – with one exception – makes for less cheerful reading in North America.

The real estate consultancy said the price rise was up from the 1.6 per cent gain in the second quarter of this year and the recent low of 0.2 per cent recorded in the first quarter of this year.

The recovery in annual pricing confirms that global housing markets are displaying signs of stablizing, despite higher mortgage rates, Knight Frank said. However, although two-thirds (67 per cent) of markets saw prices rise over the year, only 63 per cent saw a rise over the quarter, indicating that uncertainties linger.

“Ongoing uncertainty over inflation and interest rate risks continues to weigh on all levels of the global housing market, including the luxury segment, and is likely to limit price growth in the medium term,” the report said.

The only North American city that has posted a rise in the Knight Frank data is Miami (0.9 per cent). Los Angeles has fallen by 1.9 per cent; New York has fallen 4 per cent, Vancouver has fallen 5 per cent and San Francisco (a city beset by worries about rising crime and social problems) has slumped by 9.7 per cent.

The Knight Frank report said that with inflation heading lower, and central banks holding rates steady, demand for residential property has “improved in several markets.”

Among the markets reporting a small dip in prices were Singapore

and Monaco.