WM Market Reports

Global Wealth Not Buckling Under Pandemic Strain: Credit Suisse 2020 Report

Global household wealth has proven remarkably resilient in the wake of the pandemic, showing a small increase in total wealth to the end of June. However, there are plenty of regional winners and losers in the details of Credit Suisse's annual report.

Covering the wealth of roughly 5.2 billion adults across 200 countries, the takeaway of the Credit Suisse Global Wealth Report 2020 released today is that in spite of everything the pandemic has thrown at humanity, global wealth has remained remarkably steady.

After plunging by $17.5 trillion in the three months to March, global household wealth recovered reaching $400 trillion by the end of June, $1 trillion more than the March total, showing little evidence by mid-year that global wealth distribution had changed very much.

Impact

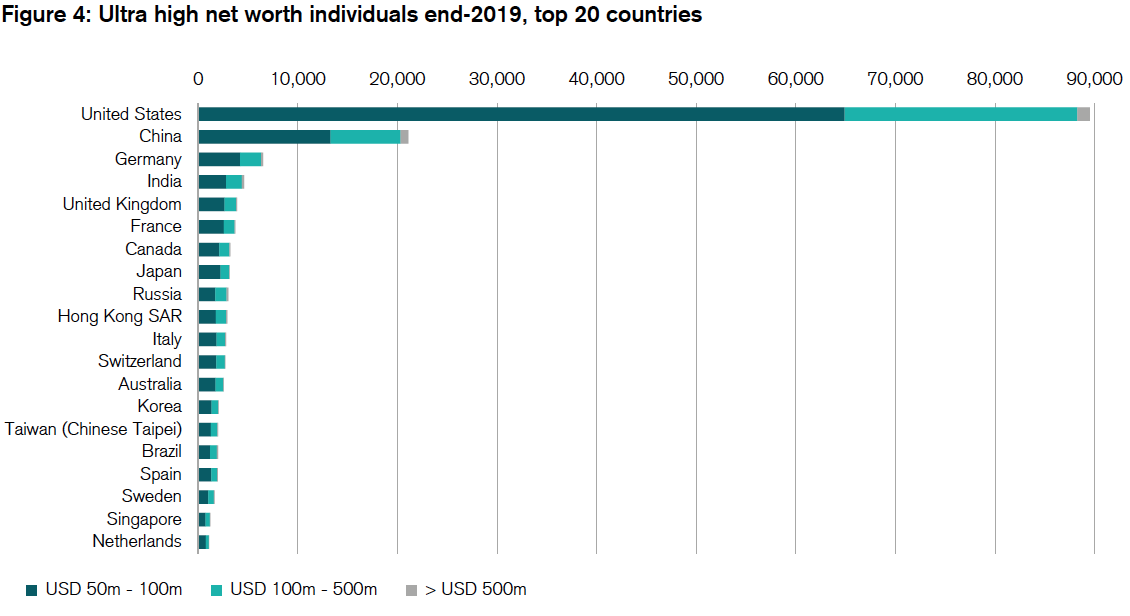

After 2019 saw millionaire numbers up by 11 per cent worldwide

reaching 52 million, this figure barely moved in the first half

of 2020. At the start of the year, the report estimates that

there were 175,690 UHNW adults globally with a net worth of over

$50 million.The cohort shed just 120 members in the first half of

2020, leaving a net gain of 16,640 UHNWs globally since the start

of 2019.

“Given the damage inflicted by COVID-19 on the global economy, it seems remarkable that household wealth has emerged relatively unscathed,” co-author Anthony Shorrocks said.

The question of why the pandemic has not had a bigger impact on global wealth rests on several factors, the Manchester University economist said in a call on Thursday to discuss the 56 page report.

The first factor is that consumption is down but incomes have held steady or gone up through government support. This, in turn, has fuelled a big rise in savings. And that trend has created "big numbers,” Shorrocks said. “Ten per cent of total global wealth has ended up in financial assets or gone into reducing debt” during the pandemic period.

The second factor is that persistent low interest rates have largely propped up global house prices and other assets such as pension rights, which are holding their value. The third factor is the huge rise in government expenditure and the trillions transferred from government to household purses during the crisis.

The big question for wealth watchers is how temporary this is and how governments will try to recover some or all of their spending from taxes in the future.

But for now, dealing with the pandemic has had minimal impact on global household wealth.

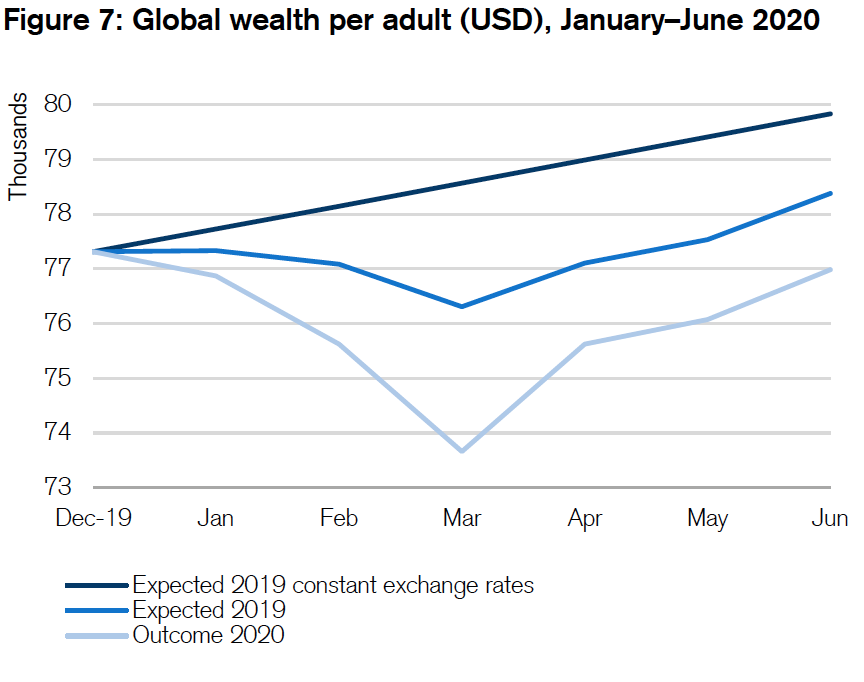

In the finer details of the report, issued annually by Credit Suisse and closely watched for trends in/and the trajectory of global prosperity, the average wealth per adult dropped slightly for the year to $76,984, largely attributed to a small rise in the average total population for the period.

Winners and losers

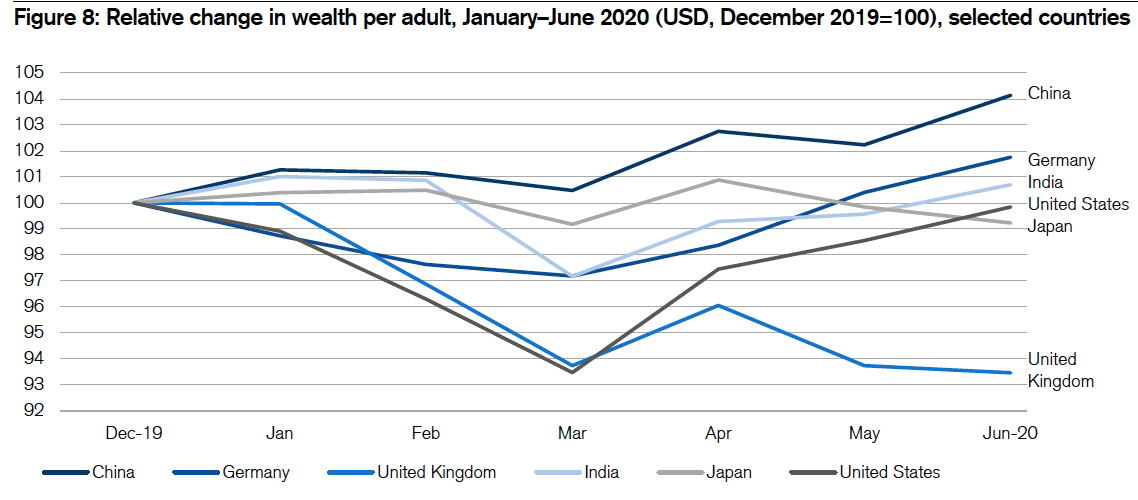

The pandemic has all but wiped out any expected gains in North

America, seen as poorly managing the pandemic, but not alone. The

health crisis has caused losses in every region, except China and

India, the report found. It has hit the UK particularly hard.

Among the major global economies, the UK saw the biggest relative

erosion of wealth for the period to June, with a 6.5 per cent

drop in wealth per adult. A faltering recovery that saw no

rebound in UK equities and exchange rates, dragged down by a

Brexit still in the balance, has created the “perfect storm” for

the UK, the report said. The chart below shows the relative

winners and losers during the first six months.

Reporting on the US wealth situtation, the Swiss bank said that its figures could be "overly pessimistic" as small and medium size business performance features more in US household wealth data than in other countries' data collected, and SMEs have been hit hard by the pandemic. While the US experienced the greatest reduction by the end of March, it recovered the fastest after that time.

Tallying China's performance, Shorrocks suggested that the powerhouse had "absorbed the pandemic without even blinking," recording 4 per cent growth since the start of the year. Germany and India were the only other countries back in positive territory for the year. Across all regions, Hong Kong, Taiwan, Switzerland, and the Netherlands were singled out for strong per-household wealth gains. The home Swiss market scored high for safe-haven currency gains and the high proportion of Swiss HNWs holding foreign assets. The chart below shows how selected large economies stacked up for the six months to June.

Long haul for Latin America

Hardest hit regionally was Latin America, where currency

devaluations were the main factor dragging down GDP figures,

leaving the region 12.8 per cent worse off in total wealth.

It is difficult to roll out any assessment of 2020 without acknowledging what an exceptional year 2019 was for delivering household wealth growth, when total global wealth rose by $36.3 trillion. It also saw financial assets grow at a 50 per cent higher rate than non-financial assets, a trend that has been especially good for the US market, which accounts for more than half of the total financial assets globally.

Just as well 2019 gave 2020 a vital cushion.

Nannette Hechler-Fayd’herbe, head of research and chief investment officer in international wealth management at Credit Suisse, said that even though the impact of the pandemic on household wealth has been minimal, there is worse pain to come. Short-term lower economic growth coupled with shifts in corporate and consumer behaviour are likely to lead to "lost output, redundant facilities, and sectoral changes that could hamper household wealth accumulation for some time,” she said, adding that “China is likely to be the clear winner.”

Notable this year is the overall decline in wealth inequality in one key territory - the US. With the growing wealth divide being a thorny issue for those defending modern capitalism, the slight decline this year nevertheless comes with caveats. Shorrocks warned that the US figures are new metrics released at a time when technology billionaires have come under intense fire for boosting their pandemic fortunes, while others have struggled.

On those who are losing out, more granular analysis showed that certain population groups have suffered disproportionately through the upheavals: the low-skilled, women, minorities, the young, and small businesses being chief among them.

The older members of the millennial generation have probably not fared any worse than the population as a whole, the report suggested, but the younger in this group – especially women and the less educated – have "likely fared quite poorly". Bluntly, what these groups and the next post-COVID generation are facing is reduced economic activity, globalisation heading into reverse, and discouragement from travelling, the report said.

Some optimism

“Unlike the financial crisis of 2007-08, there is reason for

optimism this time around," Hechler-Fayd’herbe said. "The global

financial sector is much healthier than it was then. Governments

and central banks have also learned the importance of credit

arrangements and quantitative easing during a severe crisis."