Surveys

Hong Kongers' Retirement Withdrawal Goals Aren't Realistic - Schroders

Another study identifies the gap between what investors think they can do with their money and what in reality is achievable. It is a sobering reminder that wealth advisors have work to do in helping frame how people set their goals.

Hong Kong investors think that they can pull out more money from retirement savings than they can really afford; it is another case where wealth expectations don’t fit objective evidence.

A study by Schroders, the UK-listed firm that operates in Asia, covered 500 investors in Hong Kong out of a total investor sample base of 25,000.

Hong Kong investors think that they can take, on average 8.9 per cent a year from their retirement savings without running out of money. This is lower than the Asian (10.8 per cent) and the global (10.3 per cent) average, but it is still far higher than long established guidance on how much to take each year to pay an income. In the US, for example, the “4 per cent rule” has been the basis for financial planning in recent decades, although some experts now deem a 4 per cent withdrawal rate to be too high, Schroders said.

“The withdrawal rates look very high around the globe, especially when you consider the lowest rate of withdrawal was a little over 7 per cent. That should really set the alarm bells ringing, particularly when real interest rates are negative in developed markets. And while real rates have been higher in some emerging economies, these rates have been falling as well,” Sangita Chawla, head of retirement savings at Schroders, said.

“So why are investors being so bullish? It could be that too many people are underestimating how long they might live. Consider that global average life expectancy for 65-year-olds has risen from 80 to 82 in the past decade, according to United Nations data. Although this differs from men to women, and is likely to increase further in the future, it’s the less developed countries that are ageing most rapidly,” Chawla continued. “It’s also possible that people are being more bullish about the amounts they plan to withdraw because they have other sources of income or wealth to rely on."

While the Schroders’ survey touches on a far wider demographic than high net worth individuals, the data may also jolt wealth management clients into taking a more realistic view of what withdrawals are realistic. The study also suggests that there is a persistent gap between what people think they can retire on, and what is actually possible. Earlier this week, a Standard Chartered report in Asia and the Middle East found that almost six out of 10 people face a “wealth expectancy gap” of 50 per cent or more.

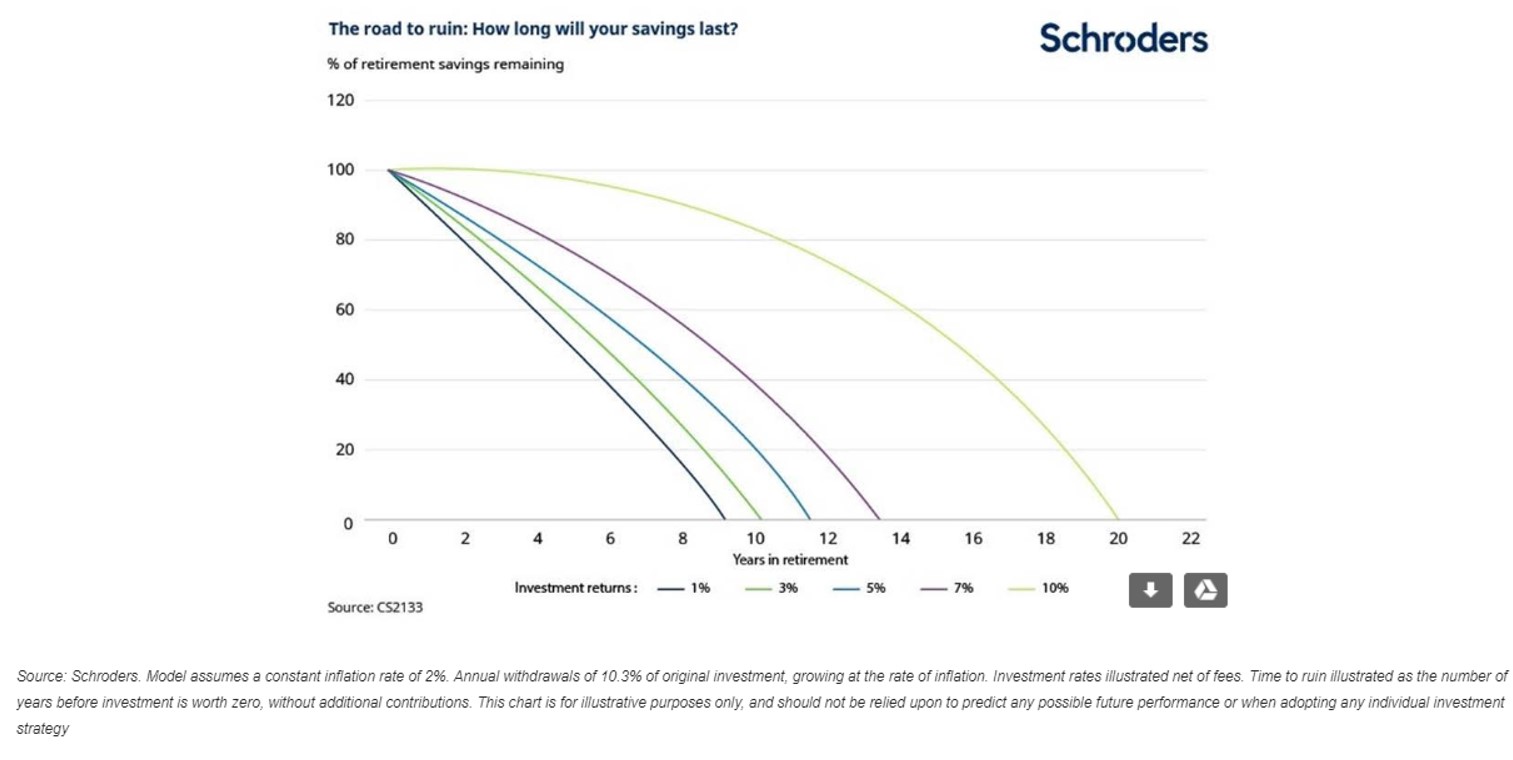

As far as withdrawals are concerned, Schroders’ report noted that the “4 per cent rule” emerged in the early 1990s. From retirement savings of $100,000, an investor would draw $4,000 a year, with the withdrawal rate rising with inflation each year. Taking more than this runs the risk of the money running dry within 30 years, according to the rule.

The chart below, based on Schroders analysis, shows the effects of a withdrawal rate of 10.3 per cent on a portfolio.