Surveys

How APAC Nations Rank For Women Hunting Fintech Careers

Fintech is growing rapidly, but are roles for women expanding within it? A new study of 12 Asia-Pacific countries ranks progress.

Asia is often seen as lagging behind the West when it comes to equal opportunities for women, and no matter how technology is progressively couched, it is a male dominated sector. Recent research from EY showed that 86 per cent of fintechs among the 10 nations making up the Association of Southeast Asian Nations (ASEAN) have all-male founding teams.

With that in mind, a new study from Singapore-based research group Value Champion has looked at how the turbo-charged Asian nations, on which so much economic expectation is riding, are supporting women in the equally super-charged fintech space.

1. Australia

Perhaps no surprise, Australia has topped the ranking. It scored

high marks on economic participation, salaries, and career

advancement. The World Economic Forum (WEF) ranks it third

globally for gender policies; and more than half of Australia’s

tech workforce (54 per cent) are women. Its closest neighbour,

New Zealand, also scored exceptionally well on gender policies

and creating a business-friendly environment for fintechs to

flourish.

The 12 countries ranked in the study were scored on three weighted categories: Women's Chances of Success, which counted most towards the final ranking (45 per cent); Strength of the Fintech sector (35 per cent); and Lifestyle & Expense (20 per cent). The group pulled data from a raft of public sources, including the WEF, the World Bank, The Economist Intelligence Unit, and from regional studies. It noted that information specific to women was sometimes hard to come by and one reason why Hong Kong was excluded from the rankings.

2. Singapore

Second ranked overall, Singapore logged the highest number of

fintech startups per capita among the 12 nations. The study found

that it has received US$453 million in fintech investments in the

first half of 2019, and suggested a “rather positive environment

for women.” Singapore has "been identified as the safest country

for women in Asia-Pacific. Additionally, the gender gap has

decreased in the past few years, reflected in the unopposed

election of the nation's first female president Halimah Yacob in

2017," the authors said.

On the downside, it found that Singapore's gender pay gap had increased notably in 2018, with the widest gap surfacing among the insurance and financial sectors, and compounded by Singapore’s high cost of living. These factors make the country “slightly less attractive for females seeking lucrative roles in fintech” than Australia, it said.

Other factors though, such as strong government support through Singapore’s Financial Sector Technology & Innovation (FSTI) scheme helping seed fintech startups, coupled with tax breaks and regulation encouraging innovation, put Singapore behind only New Zealand in the region for ease of doing business.

3. New Zealand

While home to a small fintech market, New Zealand excelled in

gender equality and opportunities for female advancement. The

nation scored highest for gender equality across the 12 nations,

and ranked 7th globally. From WEF data, the study reported that

New Zealand has closed more than 80 per cent of its overall

gender gap since 2006. Women benefit from non-discriminating

employment laws, and currently make up 55.5 per cent of

professional and technical workers. The country also has the

world’s youngest female premiere Jacinda Ardern as a positive

role model. She received wide praise earlier this year for the

remarks she made and her handling of the Christchurch mosque

shootings.

4. Malaysia

Malaysia stands out for the number of women on boards, which is

higher than average for the region, but far from knocking it out

of the park. It stands at just 13.5 per cent, but the study found

the Malaysian tech environment still more conducive for women

than that of most of its neighbours.

It also pointed to a shake up in the country’s business culture which has helped stimulate fintech growth. In 2017, Malaysia launched the Digital Free Trade Zone (DFTZ) initiative to increase cross-border eCommerce and meet aggressive GDP sector growth targets. It also specifically cited DuitNow, launched by fintech firm PayNet, owned by a consortium of banks, for shaking up the sector and allowing banking customers to transfer money via mobile phones.

5. Japan

Deloitte recently designated Tokyo as a new global hub for

fintech growth. While Japan has a strong fintech market, it is

also home to one of the largest gender gaps in the region, the

study showed. It said private banks' tight grip on the financial

system has hampered mobile banking adoption compared with uptake

elsewhere in the region. It also said that Japanese fintech deal

flow was healthy, up by a third for the year, with established

accelerators such as Fujitsu, Softbank, and MUFG Fintech driving

growth.

Direct support for women, however, was less evident. The study ranked Japan 11th of the 12 nations for gender equality; while the WEF placed it 110th globally, a rather dismal ranking for the world's third largest advanced economy.

“Tellingly, women make up only 3.5 per cent of boards of Japanese firms (compared to 13.5 per cent in Malaysia). Nonetheless, there has been movement towards improvement. Prime Minister Shinzo Abe launched an initiative in 2014 to increase gender diversity in the workplace and boost the percentage of women in leadership positions to 30 per cent by 2020. There are non-discriminatory hiring practices in place, which also opens doors to a degree.”

The other seven nations surveyed and ranked in order were South Korea, Thailand, Indonesia, Vietnam, China, and the Philippines, with India ranked bottom.

With fintech a hot growth market, Hong Kong would be expected to feature highly in the region. The Asian hub rivals Singapore for the number of fintech startups per capita. Its flexible regulation supports innovation; it recently launched an open Application Programming Interface (API) framework; and approved some of the first virtual bank licences, the study noted. “Unfortunately, not enough data is available on women's marketplace potential and the gender gap to accurately rank Hong Kong" against the other nations. According to 2019 census data, HK's female workforce is stable at 55 per cent but still low compared with most of its regional rivals (including Japan), which have female workforce rates of 60-75 per cent. Despite the lack of data on female participation in Hong Kong's fintech scene, the study suggested its environment was “complementary” for women to advance.

“The 2019 Hays Asia Salary Guide found that women make up 33 per cent of management positions, higher than in Singapore (29 per cent) and Japan (19 per cent). These factors all promote Hong Kong as a favourable place for women in fintech, though high living expenses and some quality of life issues (crowding, pollution and more) would impact the region's final standing if ranked.”

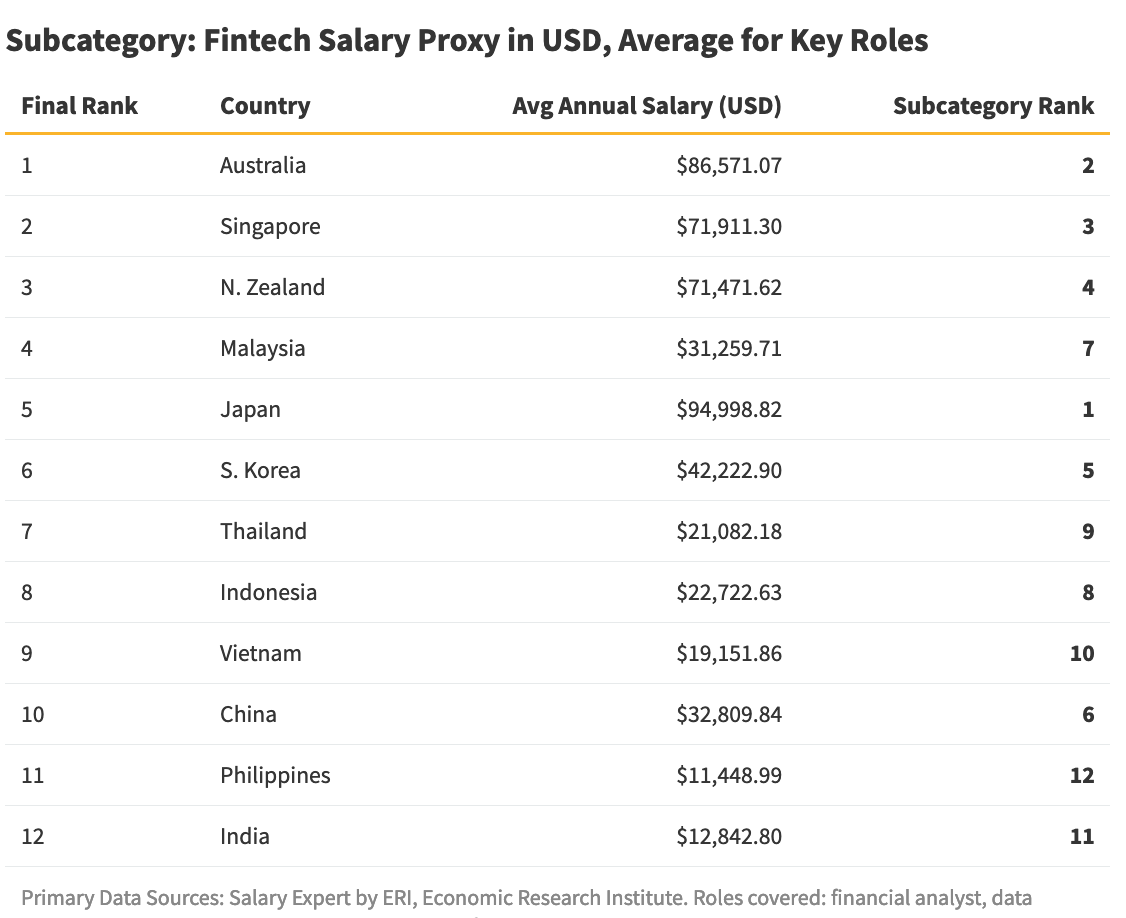

More broadly, the study found the stronger the fintech sector, the worse the gender equality. Salaries among the 12 nations showed a wide disparity between countries and their economic and lifestyle standings (as this chart shows.)