Strategy

How Can Wealth Managers Impress “Early Adopters”?

The author of this article contends that to impress Early Adopters, wealth managers have a range of options, such as quick "wins" such as improving timeliness of data; others are more complex like advancing customization and access to specialists.

Here is a sponsored article from FactSet on an important theme within the global wealth management industry.

By Greg King, CFA

A growing number of tech savvy investors, dubbed Early Adopters (1), are using online tools and insight to complete their end-to-end investment management activities virtually.

A common misconception about Early Adopters is that they tend to be digital natives or “difficult-to-please” Millennials (under-35s). However, since our 2018 study, Winning Clients in the Era of Hybrid Advice, the average age of an Early Adopter has increased from 37 to 45. Although they are comfortable with conducting approximately two thirds of their wealth management activities online, 78 per cent say they do so while navigating a range of digital pain points.

Technology offers investors a degree of control and transparency, particularly in a volatile environment, enabling clients to make more informed decisions. The steep post-pandemic rate of technology adoption, however, has revealed a growing digital divide between what Early Adopters need and what wealth management firms are able to deliver. To continue to offer a superior digital experience to its clients, wealth managers must urgently review and reconcile gaps in their offerings.

Advent of a digital investor

Our latest study, in collaboration with Aon, finds that Early

Adopters tend to be more “sophisticated” investors who, in

constructing portfolios, weigh up a broad range of investment

considerations.

Since the start of the pandemic, the majority of Early Adopters have altered their investment approach to adjust to the volatile economic environment. For example, 46 per cent of Early Adopters are adopting a longer-term investment horizon and over half have shifted the focus of their portfolio to growth (52 per cent vs 10 per cent of Digital Phobics).

As a result, the composition of their portfolio is also changing. Although liquid assets remain the dominant preference for portfolio construction, there is a tendency among Early Adopters to prefer illiquid assets (30 per cent vs 4 per cent for Digital Phobics) due to an extended investment horizon.

Technology offers Early Adopters greater access to information and therefore may be the reason why a greater proportion of high net worth individuals say they feel very confident about their financial futures (44 per cent vs 30 per cent). It may also explain why they are more likely to say they have adventurous attitudes to growth of capital strategies than their less digitally savvy counterparts.

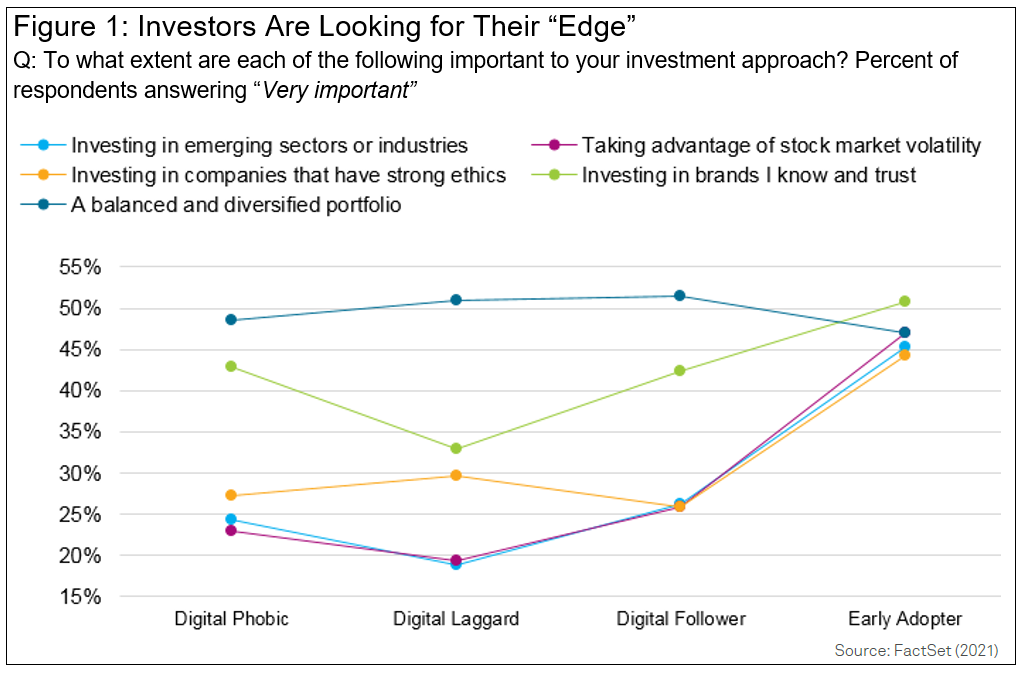

Due to Early Adopters’ unique perspectives, their outlook differs from other investors. For example, they are much more likely to see international stimulus (51 per cent vs. 33 per cent) and changes in political leadership (40 per cent vs. 17 per cent) as opportunities rather than threats to wealth creation. They are also approximately twice as likely as Digital Phobics to say it is very important to continue investing in emerging industries and companies that have strong ethics, while simultaneously taking advantage of any market volatility [Figure 1].

On the other hand, low or negative interest rates are perceived as a risk, which is perhaps why over two in five Early Adopters say they are avoiding companies with high levels of corporate debt (46 per cent vs 44 per cent).

Growing pains

Reliable technology is critical to Early Adopters - if they are

to continue making the most of opportunities in a rapidly

changing investment landscape.

However, they are least likely to be impressed by the digital experience from their wealth providers, with data showing that just 22 per cent say there are no pain points to managing their wealth online. Indeed, only 34 per cent of Early Adopters give their wealth manager’s digital capabilities top scores.

Some issues are easier to solve than others. One of the common challenges is that insights delivered by their wealth managers are not sufficiently tailored to their interests. Another is that investment information is not timely, easy to understand or analyze.

For example, frequently cited pain points by Early Adopters include challenges around understanding portfolio performance (20 per cent vs 7 per cent for Digital Phobics), knowing what are the next steps for their portfolio (22 per cent vs 4 per cent), difficulties with reaching their advisor (17 per cent vs 4 per cent), and the inability to see real-time data (19 per cent vs 7 per cent) [Figure 2]

It will therefore be up to each wealth manager to decide how best to prioritize investment in improving access to real-time insight, portal functionality, and the overall user experience.

Figure 2:

Digital Investor Profiles for a Post-Pandemic World

(Click on the link to view.)

The new dawn

Today, clients’ expectations around the digital experience are

vastly different from only a few years ago - and continue to

advance at an incredible speed.

Because Early Adopters are the first to trial new technology and are, to an extent, self-servicing (as they intend to conduct the majority of their interactions digitally in future) - it’s important for wealth managers to meet their discerning standards and uphold their trust.

A range of innovation opportunities therefore exist to wealth managers wanting to impress their Early Adopter clients. For example, when thinking about missing elements in their wealth relationship, they are six times more likely to value ease of customization (36 per cent vs 6 per cent), and nine times more likely to seek interactive insights (36 per cent vs 4 per cent) and access to specialists (34 per cent vs 4 per cent), than other clients.

A key benefit of completing more wealth management activities online also includes clearer visibility of the products and countries in which they are invested (26 per cent vs 14 [er cent). Such tools are an important value add for investors, as they provide much needed regional oversight and enable Early Adopters to closely monitor the changing landscape.

These sets of priorities differ to other segments, who are less digitally and financially confident, and more defensive in their investment approach. Wealth managers should therefore seek to address these gaps.

Conclusion

Today, most wealth managers have digital propositions that help

clients better engage with their wealth. However, the digital

divide precipitated by the pandemic between firms that have

embarked on a journey of digital transformation and those who

have been slow off the mark is growing - and is a particular

issue for Early Adopters.

While Early Adopters are open to using technology to manage their wealth, they are unlikely to continue if their digital experience remains riddled with issues.

To impress Early Adopters, wealth managers have a range of options open to them. Some are quick wins like improving timeliness of data; others are more complex like advancing customization and access to specialists. Both are worth the investment as innovative tools make firms more attractive not only to Early Adopters, but also to other client segments.

Footnote

1, Early Adopters self-identify as being the first to trial and

use new technology in wealth management.

.png)