Company Profiles

How Micro Connect Fills Financing Gap For Chinese Firms, Builds Growth Story

We talk to a business in China which says that with with modern technology, it is changing how small firms – often outside the conventional banking orbit – are financed and encouraged to grow.

China’s economy has been buffeted by geopolitical strains and zero-Covid measures. But as restrictions are eased, a business tapping into the growth of micro and small businesses reckons it can surf a rising wave.

Restaurants, auto-repair shops, and hairdressers aren’t usually sectors seen on the front of glossy magazines, but collectively they pack a big economic punch although they are not well served by established financial channels.

A business that focuses on filling this gap, in return for a slice of revenue, is Micro Connect, an investment platform launched in August 2021. Micro Connect wants to make it easier for small businesses in China to obtain capital and create a new, untapped market for global investors.

Micro Connect gets an agreed percentage of a small business’s future revenue that is digitally collected at pre-determined intervals. Potential for this sector is vast, with a potential market opportunity of more than 15,000 stores in 2023. As of going to press, Micro Connect has invested in more than 2,600 stores from 169 brands, across all 31 provinces and 167 cities.

Such a business can be seen as part of a wider global phenomenon of new forms of capital provider, tapping into the limitations of conventional bank, debt and equity finance. These platforms are also drawing on technologies such as blockchain and artificial intelligence to improve scalability and handle smaller financial sums without sacrificing profit margins.

Micro Connect was founded by Charles Li and Gary Zhang. Li, a former CEO of Hong Kong Exchanges and Clearing, also orchestrated the launch of the Shanghai-Hong Kong Stock Connect, Shenzhen-Hong Kong Stock Connect and Bond Connect cross-border trading schemes. Zhang is founding partner and CEO of Oriental Patron Financial Group, a financial services group in Hong Kong.

How it works

Micro Connect’s contracts with firms typically run for an average

length of 42 to 44 months, taking a fixed percentage share of

daily revenues.

Micro Connect has been able to scale its investments in a lower-risk way by focusing on working with brands with strong track records.

Given the ups and downs of the Chinese economy, the sheer diversity of Micro Connect’s portfolio is one of the most important risk-control measures it has in place. Contract length is typically based on the duration of a firm’s property leasehold, which tends to be between three to four years.

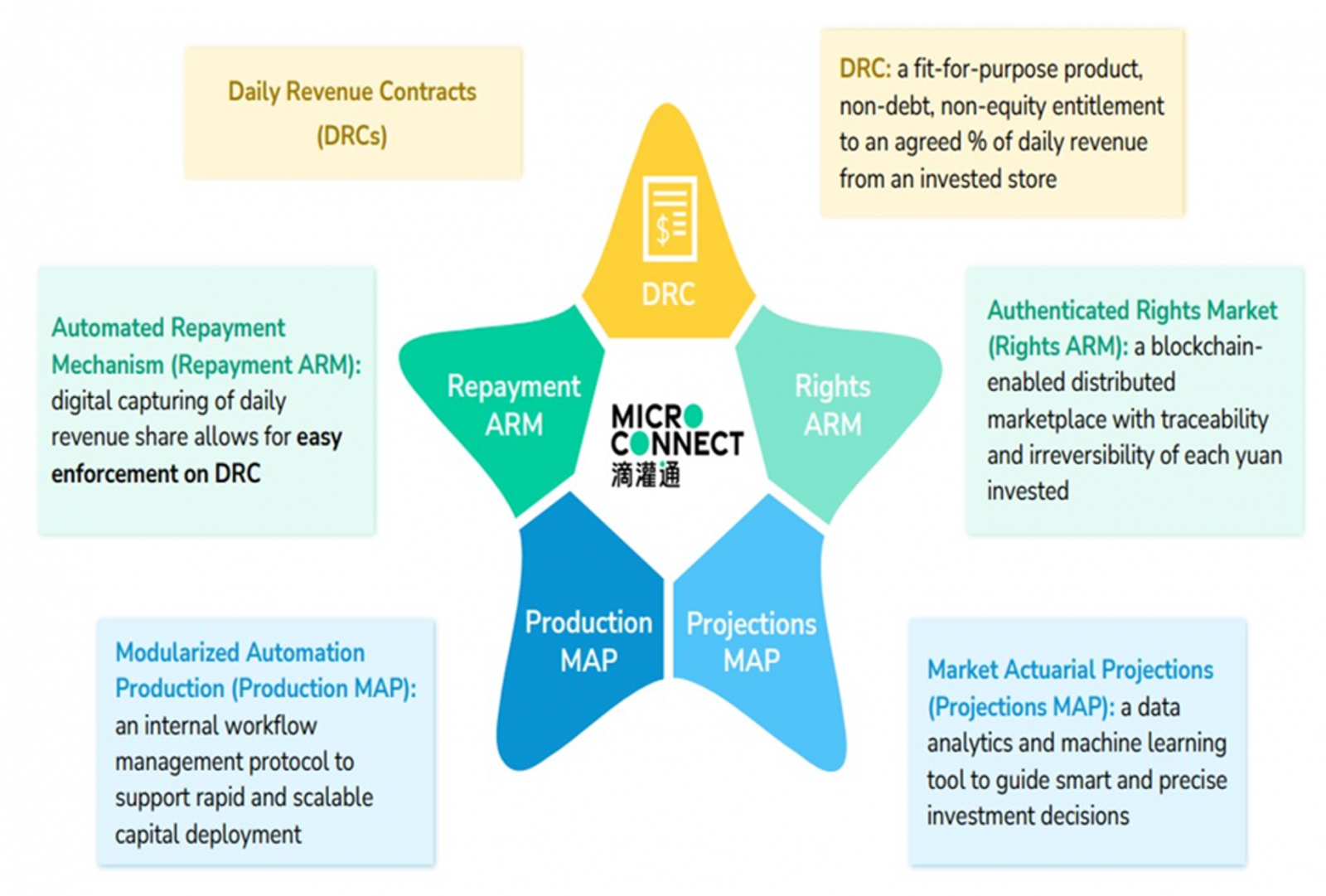

The “Micro Star” brings together five elements: Automated Repayment Mechanism (digital capturing of daily revenue share); Daily Revenue Contracts; Market Actuarial Projections; and Modularized Automation Production. These elements blend to create a scalable financial model, the firm said.

The “star”

Source: Micro Connect White Paper

Stepping stones

The firm is moving in three main steps. In its first iteration,

it is strengthening its Daily Revenue Contract (DRC) deployment

capability; in its second stage, it is adding blockchain

technology to this “Micro Star” model, to make the system more

transparent and bring in more investors, and third, it is

constructing an exchange platform. This platform will allow

global investors to access DRC investments and aid firms’

capital-raisings more easily. Micro Connect will act as a market

operator, generating trading income in addition to investment

returns and management fees. The trading platform is expected to

go live later this year.