Technology

Making Digital Pay: Wealth Firms New Tech Investment Approach

The authors of this article ask to what extent will higher spending by firms produce revenue growth? The answer is that, they say, increased investment has not yet translated into improved value creation.

The air is thick with commentary about how wealth managers have accelerated their use of digital technology, making the kind of changes in months that might have taken years in a pre-COVID-19 era. The rapid pace of digital adoption in the present environment might have become a bit of a cliché, but the core of this theme is true enough.

Making smart technology decisions remains challenging, however. Firms are conscious of tight margins; they don’t want to make costly mistakes. In this article, Peter Keuls, partner, and Thomas Griffin, at global wealth management for Aon, have their say on the subject. We are pleased to share these views; the team at Aon have been pushing thought leadership in wealth management on a number of fronts. As ever, the editors of this news service don’t necessarily endorse all views of guest contributors. To enter the conversation, email tom.burroughes@wealthbriefing.com and jackie.bennion@clearviewpublishing.com

We are becoming accustomed to hearing the phrase “digital transformation” used ever more frequently in the US wealth management industry, as a combination of escalating investor expectations and profitability pressures compel firms to commit a higher proportion of their budgets to technology spend.

But to what extent will higher spend by firms lead to revenue growth? Using proprietary Aon analysis and our client experience research insights, we find that, so far, increased investment has not translated into improved value creation.

As they look ahead to 2021, wealth management firms must optimize the mix of transformational and “Business as Usual” (BAU) initiatives, and consider their impact on clients and advisors, if they are to improve revenues.

Tech costs have been rising in recent years

A rising expectation of digital delivery is one factor driving

the significant increase in tech investment by firms in recent

years.

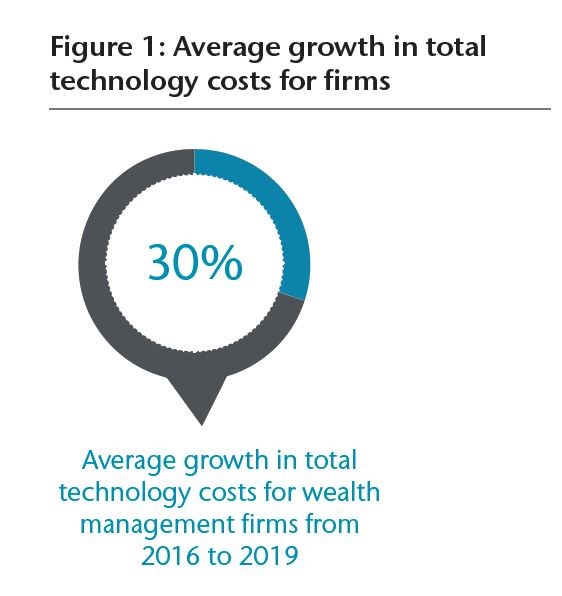

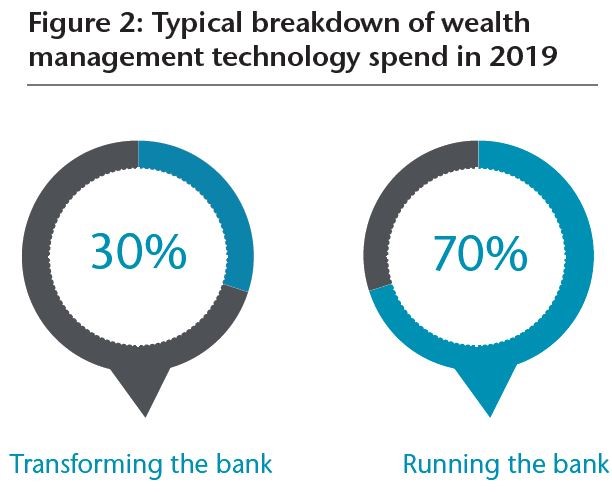

Our own analysis shows that total tech expenditure in 2019 was up by 30 per cent for the average US wealth management firm, compared to 2016. The mix of spend between transformational projects and BAU initiatives remains decisively in the BAU corner, with 70 per cent of budgets going toward “running-the-bank”. Platform enhancements, information security and data privacy remain top-of-mind for business leaders, but only comprise the minority portion of budgets.

The challenge is that although tech costs per advisor have increased by 30 per cent for the average wealth management firm since 2016, firms have struggled to realize value from these investments.

It’s proving challenging to determine a responsible level

of investment

The pandemic and ensuing economic uncertainty has dialed up the

pressure on budgets, making it imperative that leaders carefully

prioritise 2021 initiatives. At the same time, businesses can’t

afford to lose their appetite for innovation or fall further

behind wealthtech firms and more agile competitors.

Rather than cut back in the coming budget cycle, more focus is needed on which functions additional investment could be sourced from. In the short-term, this could mean diverting unused T&E budget for 2020/2021 as business travel and events remain on hold. In the longer term, savings could come from reducing real estate costs, and even a wholesale change to location strategy, now that virtual working is increasingly seen as a win-win for firms and employees alike.

Priority projects must support growth through the client

experience

To improve the chances that their digital investments will pay

off in the future, firms must have a line of sight into evolving

investor expectations.

Much is made of Millennial investors demanding changes to the digital experience, but similar sentiments are now prevalent among older generations too. Client feedback challenges some long-held internal assumptions on what the priorities need to be. Indeed, without this insight it is difficult to identify the initiatives that will improve engagement and wallet share.

A 2019 (1) study conducted by Aon for Appway, the technology firm, showed that High-Net Worth clients scored US wealth management firms just 6.6 out of 10 for the user friendliness and innovation of their online tools. They seek improvements across multiple areas, from reassurance on data security to wanting a truly end-to-end digital experience without having to speak to their advisor. Failing to address their frustrations harms the relationship, belies claims of client-centricity and fuels switching.

Not enough focus has been given by firms to advisor

productivity

A final critical piece of the puzzle is understanding the impact

of planned tech initiatives on advisor productivity. The risks of

getting this wrong can be significant: Millions of dollars might

be spent developing tools to enhance advisor productivity that

are subsequently not adopted by the salesforce.

Here, best practice on the tools that have made a difference to the most successful advisors can help. Our 2020 research conducted on behalf of Money Management Institute showed that a digital mindset is not just a “nice to have” for advisors, it’s a revenue generator. But firms need to do a better job of educating advisors on new capabilities as they are introduced. Critically, they should also seek feedback from advisors prior to making innovation decisions.

Conclusion: New sources of data in

decision-making

To improve effectiveness, wealth management firms must broaden

the inputs of tech spend decisions. Financial benchmarking

analysis can identify cost savings from “run the bank” tech

initiatives and repurpose these budgets to invest in new platform

capabilities. Tech development should be tested against client

priorities to ensure evolving needs are met, while benchmarking

the client experience will identify gaps that could be addressed

to improve share of wallet.

Ironically, given the narrative of technology and talent coming into conflict, the effectiveness of tech spend will fundamentally be determined by advisors. The successful roll-out of platforms relies on the adoption of new tools that have been developed. This requires a firm-level commitment to invest in people and help advisors realize value from technology, as only an agile workforce will be able to quickly leverage new capabilities to respond to changing client needs.

Without a doubt 2020 will be remembered for many things. But it could still be a turning-point for better data-driven decision-making.

1, Appway and Aon, Innovate to Succeed: The Client Call to

Action for Wealth Management, 2019