Offshore

Offshore IPOs Rose In 2015; Hong Kong Tops Listing Venues

One way of measuring the vigour of offshore centres is the number of initial public offerings handled by these places. Recent data suggests this area is strong.

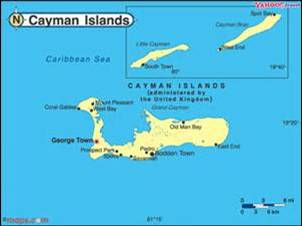

Initial public offerings handled via offshore centres rose to 202 last year from 181 in 2014, with the Cayman Islands seizing the bulk of this business, according to Appleby, the law firm.

The offshore firm examined completed and planned IPOs by companies incorporated in Bermuda, the British Virgin Islands, Cayman Islands, Hong Kong, Guernsey, Isle of Man, Jersey, Mauritius and Seychelles.

The IPO figure is the highest in five years, Cameron Adderley, global practice group head of the corporate department at Appleby, said. “Seventy-eight offshore companies completed their debuts across a wide range of stock exchanges, with a combined worth of almost $11 billion and an average size of $140 million,” Adderley said.

The amount of business transacted via such centres is indicative of their overall health, despite all the talk that the offshore world is under pressure.

With 151 local companies completing IPOs or announcing plans to go public on global markets, Cayman was the leader for offshore-incorporated IPOs in 2015. Cayman was followed by BVI with 11, Guernsey with 10 and Jersey with eight. Next came Bermuda, Hong Kong and Mauritius, each with seven, and Seychelles, with one, Appleby said in a note.

The top five sectors for IPO activity were manufacturing (53), financial and insurance activities (43), professional, scientific and technical activities (20), construction (19) and information and communication (16), according to Appleby.

For offshore companies looking to list, the Hong Kong Stock Exchange proved by far the most popular exchange, attracting 132 companies, included the top four IPOs by value, the report said.

Guernsey

In separate data, the Guernsey-based Channel Islands

Securities Exchange revealed that more than 400 securities were

listed last year, a rise of 8 per cent compared with new listings

in 2014, and taking total listings to 2,173. Investment funds,

real estate investment trusts and convertible bonds were among

the 423 securities which listed on the CISE last year.

During the period, the market capitalisation of the CISE increased by £61.6 billion (21 per cent), the exchange said in a statement.

Last year, China Cinda Finance (2014) II Limited became the first issuer with an ultimate parent company domiciled in China to be listed on the CISE, it added.