Alt Investments

Private Markets Outlook Remains Strong, But Investors Must Be Choosy – BlackRock

The world's largest asset manager casts its eye over likely major trends in the alternative investments space, such as in private equity, credit, infrastructure and real estate. These have all featured more heavily on wealth managers' menus in recent years.

The case for private market investment continues to grow but public listed equities remain a major part of portfolios as business cycles and company journeys oscillate, according to an overview of alternative asset markets by BlackRock.

Technology, healthcare and the new ways in which people are consuming will drive the growth of privately held businesses and the returns they generate, the report said.

Often companies will move back and forth between listed/private markets at different stages during their lives. The private markets benefit from a greater pool of potential investments, but participants need to be able to address both public and private, or risk losing an investment relationship with a strong corporate, BlackRock, overseeing $9.46 trillion in assets at end-September 2021, said.

Wealth managers that cannot offer both private and public market access will be in a difficult position, the report said.

“A blurring of the lines is leading to increased opportunity sets but also challenges for investors who cannot navigate across both public and private markets, or across private markets' verticals,” it said.

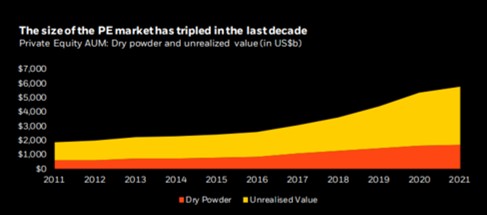

The risk premia paid on private equity and credit remains, explaining why wealth managers, family offices and high net worth individuals continue to put more money into such asset classes. The size of the private equity market has tripled in the last decade, from about $2 trillion in 2010 to more than $6 trillion in 2021. The number of active private equity investors has also tripled.

Source: BlackRock

That said, BlackRock expects private equity valuations, for example, to remain strong, putting more pressure on investors and advisors to be choosy. More than a decade of very low official interest rates has squeezed yields on listed equities, making less liquid, private investments more attractive by comparison.

Private market investments – such as private equity and credit –

have exploded 30-fold from 2000 to $30.5 trillion today. US-based

firm ALTSMARK, which

provides a solution for managing, reporting and risk analysis on

private market investments,

has argued that wealth managers who lack the ability to

offer clients access to the space could go out of

business.

Drivers and tailwinds

The report, entitled 2022 Private Markets Outlook: Resilience

and Adaptation, said that the coming 12 months should see a

wider rise in real assets as markets rebound from the disruptions

of COVID-19 and associated State restrictions.

Among its predictions, the report said that private credit assets under management are expected to expand 11 per cent per year to $1.46 trillion by 2025

“For real assets, we see the cyclical rebound, technological change and the response to climate change as three dominant drivers of the outlook. At the same time, the market is driven by a decoupled rebound due to variations in reopening strategies and a longer-term push towards re-shored supply chains; a differentiated market upswing across sectors, reflecting the booming conditions in logistics, telecom and renewable power, and a lagging recovery in air transport and hospitality; and finally a competitive deployment stage, due to abundant capital moving into real assets, partly reflecting a shift from other asset classes for relatively higher and more resilient yields.

“For infrastructure markets, the outlook is marked by the 3Ds of decarbonisation, digitalisation and decentralisation. The push to decarbonise the global economy requires a massive energy transition from fossil fuels to renewables, not just with the mainstays of solar and wind, but increasingly with carbon capture, battery storage and blue and green hydrogen. The digital world continues to transform our daily lives, with online work, shopping, schooling and entertainment markedly accelerated by the pandemic, as robotics and automation deliver genuine productivity gains.

“Moreover, infrastructure services are decentralising on several fronts, as location becomes less important for virtual work and shopping, and as holdings diversify for resilience and operational efficiency.

"For real estate markets, the 3Ds of infrastructure are similarly applicable, while we see several additional drivers at work. In particular, the wide and sustained divergence in performance between the winners (sheds and beds) and losers (hotels and retail) are likely to be sustained for now, providing considerable scope for alpha from sector selection. At the same time, distressed and dislocated real estate segments are starting to show signs of deep value, although these opportunities need on-the-ground, off-market sourcing capabilities to unlock. Looking further ahead, long-run demographic drivers remain all-important, with local differences in population and ageing trends making compelling cases for childcare centers in Australia, multifamily housing in the US and senior living in Japan,” it concluded.