Emerging Markets

Reasons To Be Cheerful About China's Equities

This news service speaks to a London-based specialist investing in China, who argues that the Asian giant's economic and business woes are turning around and that the market looks very compelling at present valuations.

Reports that Beijing is at last considering easing its zero-Covid policy have already prompted a gain in mainland equity markets. After months of being hammered by domestic and global headwinds, might China’s equity market be due for significant gains?

Xiaolin Chen, head of international at KraneShares and a specialist in Chinese investments, thinks the case for owning the country’s stock market – at least within certain constraints – looks increasingly compelling. In valuation terms and when likely reforms are considered, the market has a lot to offer, she told this news service in a recent call. (KraneShares operates a suite of exchange-traded funds.)

“China has gone through a very intense period to shift to a new direction. Over 2021 and first quarter of 2022, the government put a framework in place to accommodate the growth in China, especially in the internet sector by introducing a series of regulations. The introduction phase was completed and there was no announcement of new major regulation since March 2022 as it moved on to the implementation stage,” she said.

“Now, however, the situation is getting clearer, with policy on Covid moving in a more liberal direction," she said. "The 20 measures of the updated Covid policy introduced on 11 November made a key first step of China’s reopening. To name a few, over 1,300 student visas were issued for India. China’s National Health Commission announced a continued push to vaccinate the elderly,” Chen continued.

Chen differs from the kind of view given by Tiger Global Management, the firm overseeing $125 billion in AuM. The US firm reportedly paused its investments in China after President Xi consolidated his power.

The Chinese economy has been hit by Beijing’s zero-Covid policy and last year’s clampdown on sectors including technology and areas such as for-profit/after-hours schooling. The real estate sector is a worry – given its share of GDP – because of heavy debt exposures, as shown by the default of property developer Evergrande, for example. Beijing’s oft-stated desire to re-take Taiwan, its security crackdown on Hong Kong, alleged mass theft of intellectual property and encroachments into the South China Sea have also put it at odds with the West. President Joe Biden’s administration has also restricted exports of silicon chip tech to China. Another worry is that in the longer term, China faces a declining population problem as the consequences of the now-defunct “One Child” policy are being realised.

The MSCI China Index, as of 2 December, was down 32.5 per cent (in dollars).

The prospect of looser Covid regulations has cheered investors.

“Overall, relaxation of China on Covid control policy spurs hope for border reopening, particularly in the Greater Bay Area because this part of the region does most international business and has a large enough economy on its own that is already the economic size of Italy,” Ronald Chan, founder and chief investment officer of Chartwell Capital, the Hong Kong based investment firm, said.

“Hong Kong and Macau will see instant benefits when this happens.

Currently, the Hang Seng Index trades at its historical low P/E

ratio of 7x. If you look at the past 15 years, the average is

roughly 11x. Sector wise, tourism-related and domestic

consumption will benefit the most. Total revenue from

tourism-related sectors may see over 30 to 40 per cent growth if

the border between Hong Kong, Macau, and other cities within the

Greater Bay Area opens up. And, if more provinces in China open

up to Hong Kong and Macau, I think the expectation can be much

higher,” he said.

Signs of optimism?

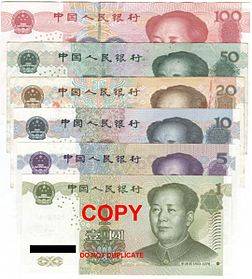

China's stocks and the renminbi rose amid reports that Beijing is

moving to a more targeted zero-Covid policy while reducing virus

testing and quarantines. The country, ruled by the Communist

Party, has been confronted by widespread anti-lockdown protests.

Yesterday, Hong Kong’s Hang Seng rose 4.5 per cent. The Shanghai Composite Index gained 1.8 per cent. The renminbi rose more than 1 per cent against the dollar yesterday.

Change in evidence

KraneShares’ Chen said there is more hard evidence that Beijing

is delivering positive change.

“The long-awaited clarity on the next step of Covid policy in China finally has translated from the so-called rumour to concrete announcements. The 20 measures of the updated policy introduced on the 11 of November (a well-known Single’s day sales event in China) was perceived as the best “promotion” investors have long been waiting for to capitalise for China’s economy. It is hugely welcomed by the market as a strong signal to reassure a beginning of reopening in China,” Chen said.

“In addition to Covid policy updates, there have been several other positive developments in China. Real estate, which accounts over 60 per cent of the Chinese households' financial assets, has gone through a series of consolidation in recent months,” she said. The recent announcement by PBoC [People’s Bank of China] and CBIRC [China Banking and Insurance Regulatory Commission], which detailed concrete steps in helping the developers, buyers that potentially mitigated default risks, has been perceived to put a floor for the market,” she said.

US President Joe Biden and President Xi recently met, helping to calm some concerns.

“The fact that the two have met, had a discussion for three hours and addressed many topics that are at the front and centre for each country is a significant step forward and removed the alleged new Cold War threat. The fact, that there will be follow-ups post the meeting at senior levels reassured us there will be concrete actions [rather] than just words,” Chen added.