WM Market Reports

Recent Developments Affecting the Wealth Management Industry - Japan

A range of regulatory, taxation and legal developments affecting wealth managers and clients in Japan. Here is an overview.

The following briefing note was issued by Baker McKenzie about recent developments affecting the wealth management sector in Japan. It is republished here with permission. This publication does not necessarily endorse everything produced by guest contributors. Email the editor at tom.burroughes@wealthbriefing.com

1. Implementation of CRS and information exchange in

Japan

Japan has passed legislation giving effect to Common Reporting

Standards ("CRS") in 2015, under which certain financial

institutions operating in Japan are obligated to report certain

financial account information regarding account holders to the

Japanese tax authorities. (1) The CRS system came into effect in

Japan on 1 January 2017, and the first reports were due to be

submitted by the financial institutions by 20 April 2018.

According to publicly released sources, Japan's National

Tax Agency ("NTA") had gathered information on approximately

550,000 foreign accounts held by Japanese residents, from 64

countries, predominately in Asia and Europe, by 31 October 2018.

(2)

Likewise, the NTA had provided information on about 90,000 accounts held in Japan to 58 countries and regions by the end of October 2018. Compared with a paltry 9,102 filings made in 2016 in compliance with Japan's overseas asset requirement, under which individuals holding assets with a value of JPY Y50 million or more ($446,000), including value in trusts, are required to report information regarding such assets with the tax return; this data may be a sign that there were many assets that Japanese residents had failed to properly declare. (3)

It remains to be seen precisely how Japanese tax authorities will use the data that they have collected under the CRS in audit practice. There is clearly an incentive, however, under the CRS rules for Japanese resident persons to comply with Japanese overseas asset reporting requirements (and for non-residents holding assets in Japan to comply with their local country's asset reporting requirements). Additionally, the NTA has publicly announced through its website that it is focusing on audits of high net worth individuals and, in particular, on international transactions undertaken by such individuals.

2. Japanese gift and inheritance tax

rules

In 2017, Japanese inheritance tax rules were amended such that,

where a foreign national who had lived in Japan for 10 years (in

the aggregate) out of the last 15 years, died outside Japan, the

foreign national's heirs would be subject to Japanese inheritance

tax on such foreign national's assets located both in Japan and

elsewhere. (A similar rule also applies for gift tax purposes.)

This rule resulted in a situation where the heirs of a foreign

national who had left Japan would potentially be subject to

Japanese inheritance tax on the foreign national's worldwide

assets for up to five years after such foreign national had

expatriated from Japan.

The fact that Japanese inheritance tax could "follow" a foreign national for up to five years after such a person had left Japan caused great concern among Japan's expatriate community, and threatened to derail the Japanese government's efforts at attracting successful foreign talent to live and work in the country.

In Japan's 2018 Tax Reform, the Japanese government abolished the above rule applying to foreign nationals (4), subject to certain anti-avoidance measures in the context of gift tax. This change applies for inheritance taxable events that occurred on or after 1 April 2018.

3. Japanese exit tax coming into effect in

2020

Under Japan's 2015 tax legislation, which was passed by Japan's

Diet and promulgated on 31 March 2015, a new "exit tax" came into

effect. Under the new tax regime, which applies to both

expatriating Japanese nationals and certain long-term foreign

residents, an individual subject to the exit tax must pay tax on

the deemed gain realised at applicable individual income tax

rates on the sale of assets. (5) The threshold for the exit tax

is: (a) individuals with financial assets with total aggregate

value of Y100 million or more; and (b) the individual has

maintained his place of residence or place of abode in Japan for

more than five years or more during the 10-year period

immediately prior to departure from Japan.

In order to determine whether the Y100 million threshold is met, the law considers the assets including certain securities, as defined under the Income Tax Law (including foreign stocks and bonds and stock option certificates), any interest held in a silent partnership (i.e. a Tokumei Kumiai or “TK”) contract; unsettled credit transactions or when-issued transactions; and unsettled derivatives.

With respect to foreign nationals, the five-year period does not include time spent in Japan under a visa status specified under Table 1 of the Immigration Control and Refugee Recognition Act (which includes work status visas, such as intra-company transferee visas or business investor/manager visas, under which expatriate employees are typically assigned to Japan. It will apply to non-Japanese persons present in Japan under a visa status specified under Table 2 of the Immigration Control and Refugee Recognition Act, including permanent residents, spouses of Japanese nationals, etc.

The persons subject to the above law include those who (a) own certain assets with a combined value of Y100 million at the time of the inheritance, and (b) have had a principal place of residence ("jusho") or temporary place of residence ("kyosho") in Japan for at least five out of the last 10 years, as of the date before the inheritance.

It should be noted that the Japanese exit tax and inheritance tax work in tandem at the time of the death of a person subject to both. Specifically, where certain residents of Japan have certain assets at the time of their passing worth Y100 million or more (i.e., they are subject to the exit tax), and a non-resident receives through inheritance all or some of such assets, the assets will be deemed to have been transferred as of the inheritance date, and the decedent will be assessed income tax on any built in gain in such assets. Thus, the estate of the decedent would be subject to exit tax on the expatriation, and the recipient subject to inheritance tax on the same assets.

The law was promulgated with respect to non-Japanese nationals to apply prospectively; thus, the five-year count for foreign nationals began in July 2015, such that the five-year period will not come into effect until (at the earliest) July 2020, for foreign nationals resident in Japan on a permanent resident or similar visa status. As a practical matter, the prospect of being taxed on capital gains on securities and similar assets has caused a number of long-term residents to expatriate Japan prior to the effective date of the exit tax. Likewise, another strategy to avoid the effect of the tax is for an expatriate currently in Japan on a "permanent resident" or spousal visa to relinquish that visa status and switch to a work visa.

In any event, the upcoming effective date of the law applying to non-Japanese nationals should be considered with respect to any Japan expatriation planning in future, and should be considered prior to a move to Japan by either a Japanese national or non-national.

4. Inheritance and gift tax rates - unchanged from 2018

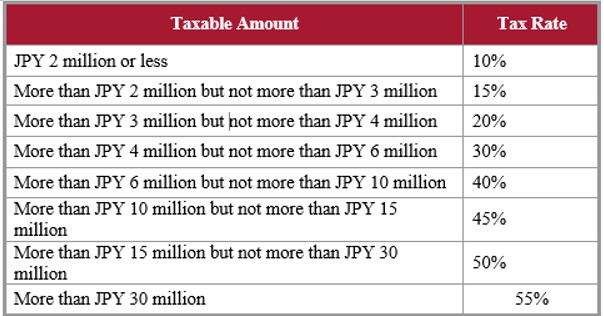

A. Japanese Gift Tax

Japanese gift tax rates, imposed at progressive rates ranging up

to 55 per cent, remained the same in 2019 as in 2018. Gift tax is

assessed on the total value of gifts received annually. For this

purpose, gifts from all donors are aggregated subject to an

annual exemption of Y1.1 million. (6) Rates can be summarized as

follows.

Note that special gift tax rates apply to gifts made from lineal ascendants including parents and grandparents to their lineal descendants, and including children or grandchildren who are 20 years old or older as of 1 January of the year in which the gift is made.

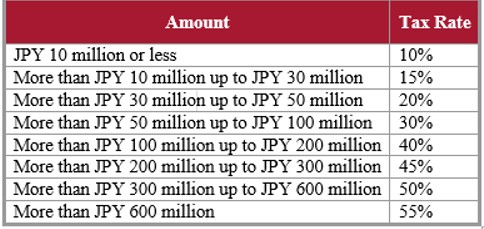

B. Japanese inheritance tax

As with gift tax, the taxpayer of inheritance taxes is the

individual who acquired property by inheritance or by bequest.

Inheritance tax rates and available deductions in effect in 2019 are as shown in the following table:

As briefly discussed in section 2, the analysis to determine

whether heirs will be subject to inheritance tax on domestic

assets, foreign assets, or both, can be complex, and will depend

in the case of a non-national on the length of time that person

has resided in Japan.

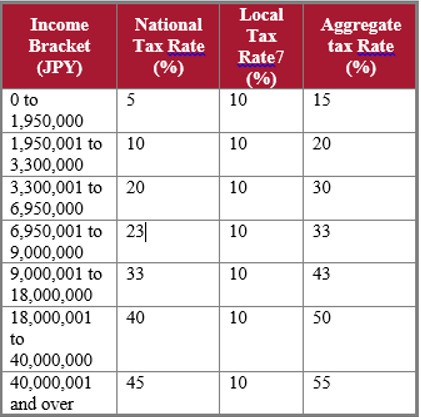

5. Individual income tax rates - unchanged from

2018

Japanese individual income tax rates are summarized below. Note

that a 2.1 per cent surtax is levied on the national income tax

to 2037, thus the maximum marginal rate is 55.945 per cent. The

following tax rates are applicable to the aggregate income of the

taxpayer. (7)

6. Other changes

A. MLI has come Into effect with respect to

Japanese treaties

Japan signed the MLI in April 2017, and the document was ratified

by Japan's Diet on 18 May 2018. The MLI has already come into

effect with respect to a number of Japan's bilateral tax treaties

(including the UK, New Zealand, Australia, Sweden and others).

Some of the provisions to which Japan has "opted in" that are

particularly notable are Articles 12 and 13, involving PE, and

Article 7, which incorporates the PPT. Where the PPT

applies, taxpayers should be certain to consider whether this

could potentially affect eligibility of the taxpayer to the

treaty.

Articles 12 and 13 of the MLI expand the scope of a PE to more broadly encompass activities undertaken by a commissionaire (a "toiya"), and prevent taxpayers from relying on multiple specific activity exemptions in order to avoid a PE. It remains unclear at this time how the Japanese tax authorities will apply these provisions practically, and whether the tax authorities will broaden the scope of structures that they challenge on audit. Until this time, Japan has tended to rely on TP provisions to challenge transactions, but the Japanese tax authorities could treat this as an opportunity to expand the scope of structures that they challenge from a PE perspective on audit in future.

B. Changes to Japanese Earnings Stripping

Rules

Japan first introduced earnings stripping rules in 2012, with

effect from company's fiscal years starting on or after 1 April

2013. Under the rules, net interest payments by a Japanese

company to an offshore related person (8) in excess of 50 per

cent of the Japanese company’s adjusted taxable income is

disallowed for tax purposes. (9)

Under the 2019 Tax Reform, the headline threshold beyond which interest payments would be non-deductible to the Japanese company would be reduced from 50 per cent to 20 per cent. (10)

Furthermore, the scope of interest subject to the rule would also be increased. Under current law, a company is exempted from the scope of the earnings stripping rule if interest paid to an offshore related party that is not otherwise subject to Japanese corporate income tax in the hands of the recipient (11), does not exceed 50 per cent of total adjusted taxable income of the Japanese company. Under the proposed revision to the rule, interest payments to any party (including an unrelated party) that is not otherwise subject to Japanese corporate income tax in the hands of the recipient, in excess of 20 per cent of the adjusted taxable income of the Japanese company, will be non-deductible to the Japanese company.

The calculation of "adjusted taxable income" for purposes of the earnings stripping has also been changed. For persons with companies in Japan that are highly leveraged, the above rules should be given careful consideration.

C. Changes to Japanese cryptocurrency rules in

future?

Japan's Financial Services Agency (the FSA) submitted a bill to

the Diet seeking changes to existing laws governing

cryptocurrencies.

Proposed changes include characterizing cryptocurrencies as "Crypto Assets" rather than "virtual currencies" in light of the fact that most crypto-assets are not used as currencies, and restrictions on advertisements for "speculative investments" in the cryptocurrency space, etc.

While the changes proposed by the FSA are not directly related to tax, it is hoped that new tax regulations will also be implemented with respect to cryptocurrency in future. For example, currently individuals are taxed at regular individual tax rates on gains in the sale of crypto-assets; if more favourable rates were implemented this might encourage further development in the area generally, and placement of Japan as a digital asset "hub" in Asia.

Footnotes

1. The Act on Special Provisions of the Income Tax Act, the

Corporation Tax Act and the Local Tax Act Incidental to

Enforcement of Tax Treaties (the "Act on Special

Provisions").

2. See Mainichi Japan, "Japan tax agency begins info

exchange on foreigner-held accounts with home countries", 7

November 2018.

3. See Nikkei Online, "Japan lands trove of offshore asset data

to fight tax evasion; Half a million overseas accounts identified

through reporting program". 1 November 2018.

4. Although the heirs of a foreign national who had resided in

Japan long-term are no longert o be subject to inheritance tax

with respect to non-Japan situs assets after the non-resident

leaves Japan under the 2018 tax proposal, the rules does not

eliminate gift or inheritance tax in those circumstances with

respect to Japan-situs assets.

5. The specific rate at which tax will be owed depends on the tax

category of the income realized; Japan's individual income tax is

made up of several income categories, with varying rates. For

example, capital gain arising on the transfer of listed or

non-listed stocks is generally subject to tax at a flat 15.315

per cent.

6. Article 21-5, Inheritance Tax Law, Article 70-2, Special Tax

Measures Law.

7, The Local Tax Rate is the sum of prefectural and municipal

taxes.

8, Specifically, "net interest payments" refers to interest

payments to related persons less interest income relating to

interest payments received from related persons.

9, For purposes of the rules, an "interest payment to a related

person" does not include interest payments under a repo

transaction, or interest payments that are subject to Japanese

tax in the hands of the recipient.

10, Note that there is no proposal to change the currently

applicable carryforward rule with regard to disallowed interest

amounts (i.e., interest amounts incurred in the previous seven

years and disallowed in such previous years under the dividend

stripping rules are deductible in the current fiscal year).

11, Related parties are defined for this purpose as parties

with a 50% or more capital relationship.