Legal

Singapore's Tax, Regulatory Changes - Latest Developments

International law firm Baker McKenzie outlines important regulatory, legal and tax changes affecting wealth advisors and their clients in Singapore and the surrounding area.

International law firm Baker McKenzie lists a range of legal and tax developments affecting wealth planners in the Asia region and beyond. The commentary comes from Dawn Quek, principal, Baker McKenzie Wong & Leow, which is member firm of Baker McKenzie in Singapore; Enoch Wan, senior associate and Jaclyn Toh, associate, at the same organisation.

This publication is grateful for the chance to share these comments and invites responses from readers. This news service does not necessarily endorse all views of guest contributors. Email the editor at tom.burroughes@wealthbriefing.com

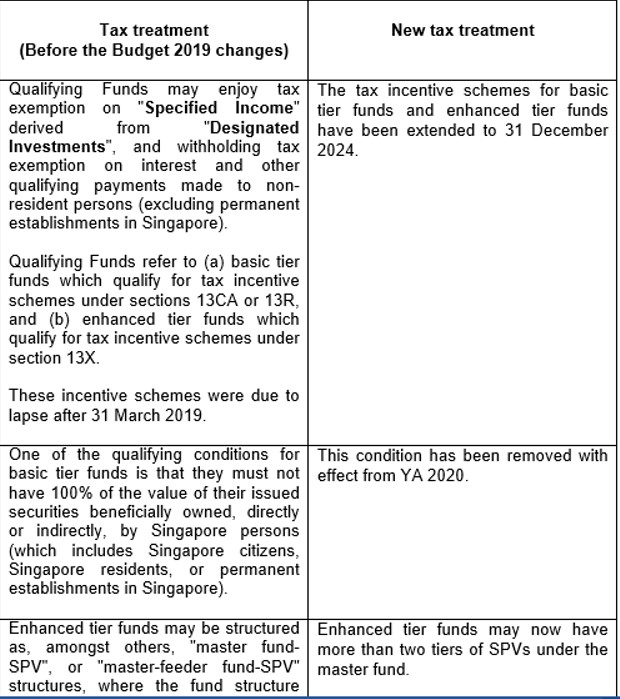

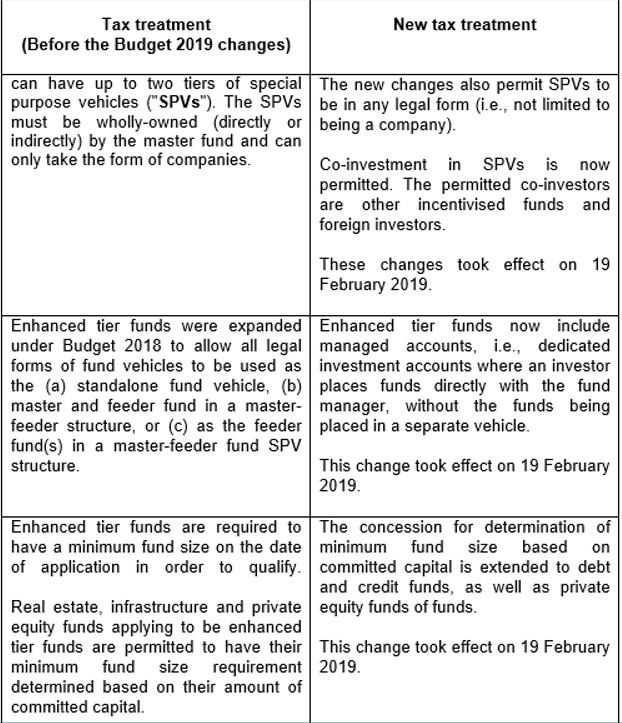

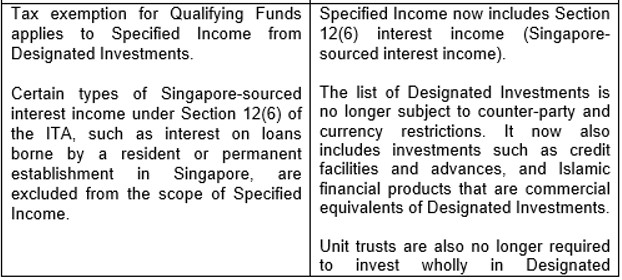

1. Enhanced tax incentives for funds managed by Singapore-based fund managers ("Qualifying Funds")

The Singapore government has continued its efforts in refining tax incentives to support and increase wealth and asset management in Singapore. A recent significant change would be the enhanced incentives for Qualifying Funds, which are commonly used by asset owning vehicles managed by Singapore family office. Under Budget 2019, the tax incentives for Qualifying Funds have been extended to 31 December 2024, and their scope expanded in terms of eligibility criteria and tax benefits. The key changes are as follows:

More details are expected to be released by the Monetary Authority of Singapore by May 2019.

The changes under Budget 2019 are a welcome liberalisation that will do much to further boost Singapore's status as an asset management hub, both for private wealth and for third party fund raising.

The removal of the restriction against 100 per cent beneficial ownership of basic tier funds by Singapore persons makes the incentives under Sections 13CA and 13R much more flexible by allowing fundraising from local investors. This broadens the range of potential investors and allows for changes in the composition of the investors which was not previously possible. Also, it may encourage the creation of Singapore fund vehicles. The relaxation of the prohibition for Section 13R incentive against funds with previous businesses in Singapore also indicates an intention on the Government's part to make establishment of funds easier and more commercially practical.

The enhancements to the incentive under Section 13X of the ITA make it an even more attractive option for fund managers and wealth managers. The expansion to allow co-investment in SPVs, multiple tiers of SPVs and SPVs in all legal forms offer opportunities for more flexible structuring, which can better suit the commercial needs of both institutional investors and high net worth individuals.

The inclusion of Singapore-sourced interest, and other income that falls under Section 12(6) of the ITA, in the list of "Specified Income" is a significant change that opens up a wide range of structuring options, and will do much to attract more financing to flow into Singapore.

In summary, the changes should further boost the attractiveness of the existing fund incentive regime in Singapore. Taken together with the fact that these fund incentives will apply to the Variable Capital Companies regime, Singapore will be at the forefront of the competition in the asset and wealth management sectors, both regionally and globally.

2. Fund tax incentive schemes available

to Singapore Variable Capital Companies

The VCC Bill was passed by Parliament on 1 October 2018. The VCC

Bill provides for the incorporation and operation of a new

corporate structure, a VCC, to cater to the needs of investment

funds. The VCC will complement the existing suite of corporate

structures (companies, trusts, and limited partnerships)

available to fund managers in Singapore. The introduction of VCCs

will encourage fund managers to co-locate fund domiciliation with

existing fund management activities in Singapore, building on

Singapore’s strength as a full-service international fund

management centre.

Tax Framework for VCCs

To complement the VCC regulatory framework, a tax framework for

VCCs has been introduced. The introduction of this new tax

framework for VCCs is welcome. Given that the intention is to

encourage investment funds to be set up in Singapore, the

extension of the tax exemption schemes under Sections 13R and 13X

of the ITA respectively to VCCs is critical to support this drive

to enhance Singapore's attractiveness as a jurisdiction for

investment funds.

This tax framework for VCCs aligns the tax treatment for VCCs with that of other vehicles that are currently commonly used for investment funds in Singapore. This makes the VCC a genuinely viable fund vehicle from both a corporate and tax perspective, and will do much to attract fund managers to set up in Singapore.

The details of the tax framework for VCCs are as follows:

(a) A VCC will be treated as a company and a single entity for tax purposes;

A VCC can be set up as a standalone VCC (with no sub-funds), or as an umbrella VCC (with sub-funds). In both cases, the VCC will be treated as a single entity for income tax purposes. An umbrella VCC, and its sub-funds, only needs to submit one set of corporate income tax return to the Inland Revenue Authority of Singapore ("IRAS").

VCCs that are Singapore tax residents will be eligible to access Singapore’s tax treaties. This applies to both standalone VCCs and umbrella VCCs. The tax residency of VCCs will be determined based on facts and circumstances, as determined by IRAS.

(b) Tax exemptions under Section 13R and 13X of the ITA will be extended to VCCs;

Currently, fund vehicles that wish to avail themselves of the sections 13R and 13X schemes will need to submit tax incentive applications for MAS’ approval. In the case of an umbrella VCC, the VCC, which is the legal entity, can apply for the tax incentives on behalf of its sub-funds. Accordingly, the tax incentive conditions under both schemes and the corresponding economic commitments are to be applied on the umbrella VCC (as opposed to its individual sub-funds).

For additions of sub-funds to an umbrella VCC, there is no need to inform or seek MAS’ approval, as long as the umbrella VCC (and its sub-funds) continues to invest within the scope of what the umbrella VCC fund is mandated to do via its offering document and approved under either the section 13R or 13X scheme. This is consistent with the current practice, where there is no need to inform or seek MAS’ approval for additions of sub-trusts for fund vehicles structured as trusts.

(c) Expansion of application of concessionary tax rate under the Financial Sector Incentive - Fund Management scheme;

The 10 per cent concessionary tax rate under the FSI-FM scheme will be expanded to include fee income received from managing / advising VCCs incentivized under sections 13R or 13X of the ITA ("Incentivised VCCs"). MAS will take into consideration both quantitative and qualitative factors when evaluating the applications for the FSI-FM award.

(d) The GST remission for funds will be extended to Incentivised VCCs.

GST is chargeable on fund management, custodian and other services supplied by GST-registered suppliers to funds belonging in Singapore.

A GST remission was introduced from 22 January 2009, to simplify the rules and administrative processes for prescribed funds managed by prescribed fund managers in Singapore to claim input tax based on GST principles. Under the GST remission, funds that meet all the qualifying conditions will be able to recover GST incurred on expenses based on a fixed recovery rate, without having to register for GST. The fixed recovery rate is determined annually based on the proportion of taxable supplies made by the industry.

The GST remission will be extended to VCCs. To qualify for GST remission in the current financial year, the VCC must satisfy the conditions for income tax concession as a section 13R or 13X fund as at the last day of its preceding financial year. The VCC must also be managed or advised by a prescribed fund manager in Singapore. Under the remission, sub-funds of qualifying umbrella VCCs will be entitled to make input tax claims on GST incurred on their purchases at the fixed input tax recovery rate.

The GST remission, which was due to expire on 31 March 2019, has

been extended to 31 December 2024, per the Budget 2019

announcement.

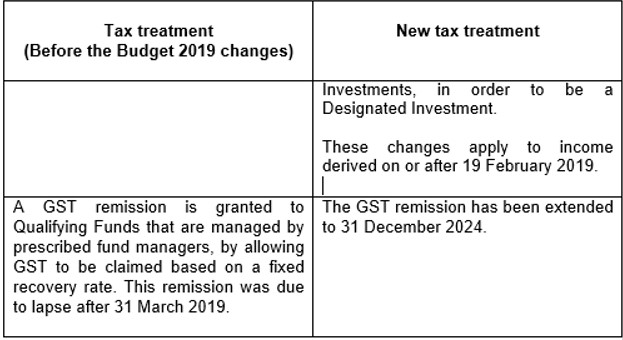

3. Increase in Additional Buyer's Stamp

Duties ("ABSD")

The Singapore Government raised ABSD rates and tightened

loan-to-value ("LTV") limits on residential property purchases

with effect from 6 July 2018. The increased duty imposed on

buyers would likely help in curbing excessive demand.

Generally, ABSD rates will increase by 10% for all entities and by 5 per cent for all individuals other than Singapore Citizens and Singapore Permanent Residents purchasing their first residential property. ABSD rates for developers purchasing residential properties for housing development will increase by 15 per cent.

In addition, LTV limits have been tightened by five percentage points for all housing loans granted by financial institutions. These revised LTV limits do not apply to loans granted by the Housing and Development Board.

The ABSD rate depends on the profile of the buyer. For acquisitions made jointly by two or more parties of different profiles, the applicable rate will be based on the profile with the highest ABSD rate. A summary of the changes to the ABSD rates can be found in the table below:

4. Singapore and US sign Tax Information Exchange Agreement ("TIEA") and the reciprocal Foreign Account Tax Compliance Act Model 1 Intergovernmental Agreement ("FATCA IGA")

On 13 November 2018, Singapore and the US signed a TIEA.

The TIEA allows the competent authorities of Singapore and the US to request for and exchange information that is “foreseeably relevant” to the administration and enforcement of domestic tax laws. It also sets out the scope of information that can be exchanged, procedure to follow, as well as the limitations on the exchange of information.

The scope of the TIEA casts a wide net over information that may be exchanged under the TIEA. Persons in possession or control of information should be mindful of the scope of the TIEA. Equally, the limitations of the TIEA and avenues to reject requests for the exchange of information are relevant and such persons should be aware of their rights and obligations when a request is made by a competent authority to exchange information.

Singapore also signed the FATCA IGA with the US on 13 November 2018. While the FATCA IGA has been signed, it has not been ratified and does not yet have the force of law in Singapore and in the US.

5. The standard for assessing Exchange of Information ("EOI") requests, and the application of discretion under the statutory framework of the EOI regime

In the case of AXY & Ors v Comptroller of Income Tax [2018] SGCA 23, the Court of Appeal clarified that the standard for assessing an EOI request remains that of "foreseeable relevance", and the amendments made to the EOI regimed by the Income Tax (Amendment) Act 2013 did not change the standard; it merely altered the identity of the authority that was to make this determination from the court to the Comptroller of Income Tax.

The Comptroller is afforded a wide discretion in dealing with EOI requests and is generally not expected to go behind the assertions made by a foreign tax authority in an EOI request.

6. Phasing out of

Not-Ordinarily-Resident ("NOR") scheme

The NOR scheme was introduced in Budget 2002 to attract talented

individuals to relocate to Singapore to complement Singapore's

talent pool. It extends favourable tax treatment to qualifying

individuals for a period of five consecutive years, subject to

certain conditions being met.

During Budget 2019, it was announced that the NOR scheme will be phased out. The last such NOR status will be granted for YA 2020 (i.e., for income earned in 2019) and expire in YA 2024. For those individuals already accorded the NOR status, they will continue to benefit from the NOR tax concessions until the expiry of their NOR status, subject to meeting all prescribed conditions.

Over the years, Singapore has been successful in attracting global talent to complement our local talent in order to drive Singapore's economy forward, creating the vibrant and competitive business landscape of today. The phasing out of the NOR scheme suggests that it has achieved its purpose. It is also an acknowledgement that today's Singapore has a lot more to offer (e.g. highly rated education system, an efficient transport system) in its efforts to attract and retain highly-skilled individuals.