Surveys

Singapore Scores Top As APAC Prime Residential Hotspot

As the firm's report notes, the geopolitical landscape and shifts in policy environments are encouraging affluent people to find more welcoming homes overseas.

Singapore’s credentials as a prime residential home for HNW individuals and families has been underscored by global property consultancy Knight Frank in its Quality Life-ing report, issued this week. Australia ranks in second place.

Across metrics of economy, human capital, quality of life, environment, and infrastructure and mobility, the Asian city-state – a major wealth management hub – outranks jurisdictions in Asia-Pacific such as Australia, Taiwan, Hong Kong, South Korea and New Zealand.

"Among all the markets assessed, Singapore is the single standout city to achieve a top five ranking in each indicator, highlighting its strengths and accomplishments as a young and small nation," it said.

Analysing 15 markets in total across the region, Knight Frank said Singapore’s work in areas such as attracting family offices, its stable legal and political framework, robust economy and skilled workforce, fed into its status.

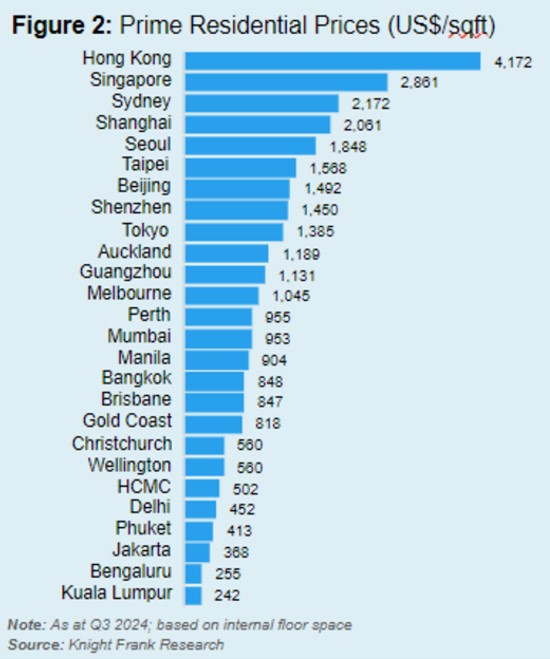

That said, success brings costs: in the third quarter of 2024, prime residential prices in Singapore surged 6.9 per cent on a year before, making it the second costliest APAC market, at US$2,861 per square feet, 31 per cent cheaper than Hong Kong (US$4,172) and ahead of Sydney ($2,172). Singapore’s projected gross domestic growth rate is slated to be between 1 and 3 per cent this year.

The following chart shows the overall price rankings.

The report said that the number of Singapore-based family offices has shot up from 400 in the pandemic year of 2020 to 1,650 in August. Rival centres, such as Hong Kong and Dubai, are competing to attract these entities. (On a more cautionary note, Singapore regulators have tightened regulations on the family office sector to weed out FOs that aren’t sufficiently committed to investing in the local economy.)

Turning to Australia, Knight Frank said the nation is the second most desirable location for investments and relocations, as it came in top five for four out of the five indicators in the study.

“The region's sustained economic growth and rising affluence are expected to drive stable price growth and returns, particularly as 19 megacities are projected to emerge by 2030, intensifying housing demand,” the report said. “Additionally, the middle-class population in Asia-Pacific is anticipated to reach 1.7 billion by 2030, prompting a significant rise in demand for affordable housing, especially in emerging markets like Vietnam and Indonesia.”

“Furthermore, there is a noticeable shift towards branded residences in the prime market especially in markets such as Australia, India, and Thailand, appealing to both local and international investors who value luxury living combined with high-end services on top of secure investments,” it added.