Strategy

US Elections, Relations With China: Managers Comment

As polling data points to Biden winning by a wide margin in November, briefing notes are beginning to fill up with what that all means for investors. But the next president, whoever that is, is unlikely to change course on China. Views from economists and fund managers below.

Republicans might dispute that “we’ve been here before” on speculation that Biden is in for a comfortable win in November. Regardless, as the Democratic candidate gains momentum, US markets are beginning to contemplate the policy implications of a Biden presidency and, if he does win, expect executive orders not beholden to Congress to be his most likely path for policy change. Before that contemplation, what do the polls show?

“Whether we use macro modeling or polls, both point to a comfortable Biden win," Schroders economist Piya Sachdeva said in a US election briefing this week. The firm's data showed that Biden is ahead in almost all battleground states, with Ohio, Indiana, and Iowa being the exceptions.

“When we collate the implied Electoral College votes, in the form of leaning states, it suggests that Biden would win 62 per cent of the vote. If we were to allow for more uncertainty, by including ’toss-up’” states (those polling less than 5 per cent between candidates), the polls point to Biden winning 57 per cent of the vote. Either way, it is "still a fairly comfortable Biden majority,” she said.

In the event, investors should expect a partial rollback of Trump’s tax cuts, along with tightening regulatory pressures, Schroders’ head of small/mid cap equities Bob Kaynor, said.

“On the positive side for the economy, any infrastructure bill, which seems to be gaining bipartisan support, is likely to stimulate growth and be inflationary. At this point in the cycle, both would be welcome, especially if accompanied by carefully managed interest rate rises,” Kaynor said.

Recovery, tax

A main focus for economists has been monitoring jobs data as an

indication of how painful the route out of the economic crisis

becomes and its bearing on the election.

With initial unemployment claims rising in July for the first time since March, Schroders chief economist Keith Wade said the figures show a US recovery losing momentum and now "lagging behind Europe."

On whether markets would prefer a Democrat or Republican win, Schroders’ global strategist Sean Markowicz said perceptions of a Biden win being bad for markets does not hold up to history.

“If there is a Democratic sweep, US share prices are likely to price in an increase in corporate tax rates," he said, which would bolster the appeal of non-US equities, especially if coupled with reduced trade frictions. But if Republicans keep the Senate, tax reforms are "unlikely". Preserving the tax status and defrosting international relations is the "best-case scenario for global markets," he said.

Warning that investors are perhaps becoming “disturbingly oblivious to major risk build-ups,” George Lagarias, chief economist at Mazars, said these risks include a second viral wave hitting the US and other large economies; and liberal economies across Europe and the Americas having trouble agreeing on the size and manner of fiscal support. Both are compounding the risk of job losses and business closures, he said. Responding to whether investors should pro-actively reduce risk, he said this was not necessary "as aggressive monetary policy has often proved more potent than short-term risks."

US stimulus

BMO GAM chief economist Steve Bell said that the firm expects the

next US fiscal package to be around 5 per cent of GDP for the

whole year, and "a massive stimulus" when added to the other

federal support measures. "Whereas Europe has tended to subsidize

people to remain employed, the US has allowed unemployment to

skyrocket and given very generous benefits ($600 a week) that are

more than average wages in most states," he points out. With that

wage support pulled on July 31, politicians in Washington have

yet to agree on a replacement but Bell expects them to drop to

$300 a week in the next tranche.

Based on evidence that the virus may be passing its peak in the US -- a view shared by other economists, in spite of media reports to the contrary -- David Page, head of macro research at AXA IM, said the firm has reduced its forecast for Q3 GDP to +19.3 per cent from +28.6 per cent based on additional restrictions being imposed by some states. “In the main we assume this shortfall will largely be made good in Q4.” The firm has revised its 2020 outlook fractionally down to -4.7 per cent from -4.5 per cent for 2020; and forecasts a rebound of 4.8 per cent growth in 2021, above the current consensus of 3.9 per cent.

With so much resting on the performance of US technology stocks, Christopher Smart from Barings steered investors toward last week’s Congressional grilling of BigTech where politicians were keen on introducing new laws to address worries from data privacy to election interference. The firm's chief strategist argued that besides fresh anti-trust scrutiny, the big 5 of Google (Alphabet), Facebook, Microsoft, Amazon and Apple, also face a trickier future doing business in countries that haven’t enshrined personal liberties. Despite technology firms performing heroics during the height of the lockdown and delivering blowout second quarter earnings, the question for investors enjoying this success is "whether these rules will tame the golden geese or kill them,” Smart said.

The approaching US election is also stoking worries of foreign interference, either through hacking into voting systems or introducing fake information that casts doubt on its legitimacy. “All this leaves one of the most dynamic sectors of the global economy increasingly shaped by politics and regulation," Smart said.

US China trade picture

Regardless of the election outcome, managers broadly agree that

growing rivalry between the US and China is not going away should

there be a new administration.

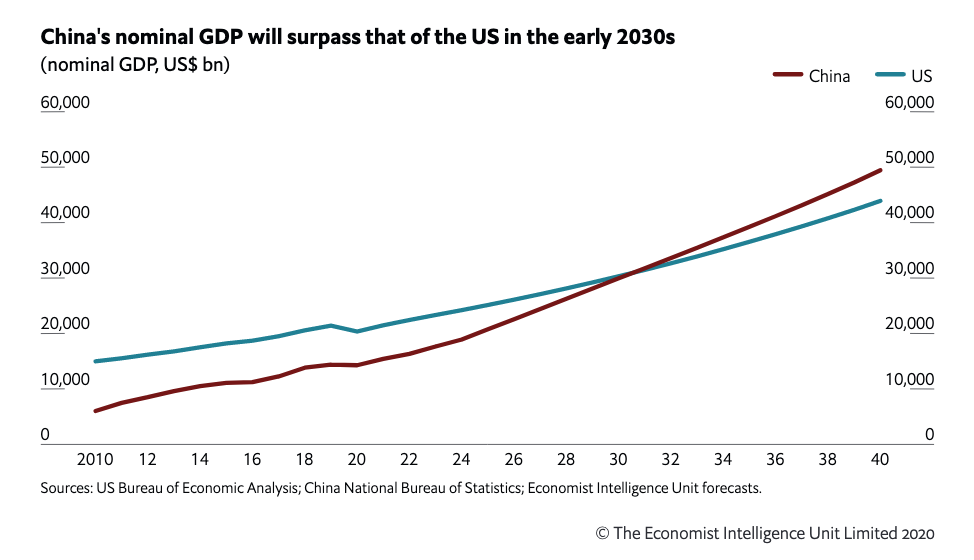

If Biden wins, “he will come to power with US-China relations in a dismal state," the Economist Intelligence Unit (EIU) said in a report this week on the state of affairs. It called phase-one of the trade deal signed in January 2020 “effectively a dead letter” and reported bilateral trade volumes at their lowest in years.

The deal has also done little to calm tensions in other trading areas, such as high-tech supply chains, investment, financial services, security, and human rights, the report found.

In a running list of policy actions, the report highlighted further US export controls put on Huawei; further curbs on investment into China; and sanctions on Chinese officials suspected of human rights abuses in Hong Kong and against mainland China's Uighur population.

"The US has also taken a firmer policy stance against China’s territorial ambitions in the South China Sea, potentially setting the two countries up for an accidental confrontation in the region," it said.

That the two nations have moved from partners to competitors came through in another statement on Wednesday from Mike Pompeo. The Secretary of State said the US would ban Chinese apps that “threaten our privacy, proliferate viruses, and spread propaganda and disinformation” in what is developing into a tech cold war. India has already taken similar action against Chinese app makers, including the popular TikTok video service.

Covering policy direction, the EIU noted that the Biden recovery plan contained "numerous pledges to combat Chinese trade practices, including state subsidies, surplus production and dumping, currency manipulation, weak IP protection and forced technology transfers," in a reminder that the tone might change but curbing Chinese dominance remains a priority for the US.