Alt Investments

Vroom-Vroom! Classic Cars Made Investors More Money Than Gold In 2011

The price of gold rose about 10 per cent last year, albeit

retreating from a record high above $1,900 per ounce and up from

around $285 a

decade ago. This surge has attracted many investors, but for some

hard assets

such as classic cars, the price ascent last year told an enticing

story, particularly for petrolheads with a few hundred thousand

to throw around.

UK-based

Historic Automobile Group International says

that some segments of the classic car market have advanced by

more than 20 per

cent. Not surprisingly, this seriously impresses your glamorous

correspondent.

Dietrich Hatlapa, 48, HAGI founder and unashamed classic car

nut, says: “We’ve discovered that classic cars move independently

of any other

investment area, and that’s a very attractive attribute for

collectors and

investors alike in this day and age.”

The numbers do a lot of the talking.

The HAGI Top Index, measuring the performance of 50 key

collectible classic cars, advanced by 13.89 per cent in 2011.

However, another

HAGI index calculation reveals a segment of the top market that

rose by 21.65

per cent growth in 2011. This is the return offered by the HAGI

Top with

Ferrari and Porsche removed. (In 2011 the HAGI F Ferrari Index

advanced 10.58

per cent, while the HAGI P Porsche Index returned a more modest

4.53 per cent,

after strong growth in previous years.)

And for car enthusiasts who want more details, here are some

specifics. And remember, unlike a bar of gold, you can drive

these things and

impress your friends and annoy everyone else:

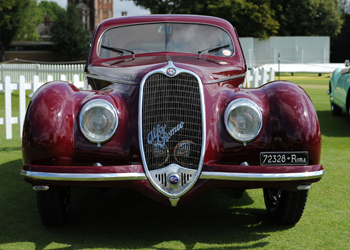

Bentley R-type Continental Fastback by HJ.Mulliner, 1952-55

(208 produced): fine examples trading at £400,000 at the start of

2011 were

commanding £500,000-plus by year end;

-- BMW 507, 1956-59 (252 produced): £500,000 buys fine

example at start 2011; now £750,000 for best cars;

-- Mercedes-Benz 300SL Roadster, 1956-63 (1858 produced):

cars trading at £350,000-375,000 at start 2011 now selling at

£475,000-500,000-plus;

-- Aston Martin DB5 saloon, 1963-65 (1063 produced): prices

have advanced from £325,000 to £400,000-plus for fine examples;

-- Jaguar XJ220,

1992-94 (281 produced): was £140,000; now £180,000-plus for best.

In 2011 Hatlapa published a ground-breaking 350-page book,

Better Than Gold: Investing in Historic Cars. It is certainly a

pleasure to

make money from things you love.