Emerging Markets

Why Foreign Flows Have Returned To India Amid Tariff Uncertainty

With the turmoil caused by US tariffs and other forces, the author of this article says it is not surprising that one country that has managed to weather the storm is India.

The following commentary comes from Abhinav Mehra, one of the investment advisors of Chikara Indian Subcontinent Fund. Given recent economic turbulence amid US tariff policy and other factors, India repays attention. We have carried several articles from Chikara (see here and here) about the country’s investment case – and risks. The editors are pleased to share these insights. Remember that these articles are meant to stimulate debate. Please respond with comments. The usual editorial disclaimers apply to views of outside contributors. Email tom.burroughes@wealthbriefing.com and amanda.cheesley@clearviewpublishing.com

President Trump’s tariffs have hit a lot of equity markets globally since April. Over in India, though, sentiment has improved. Kotak data shows that foreign investors have broken a prolonged period of selling to become net buyers of the country over the last two months.

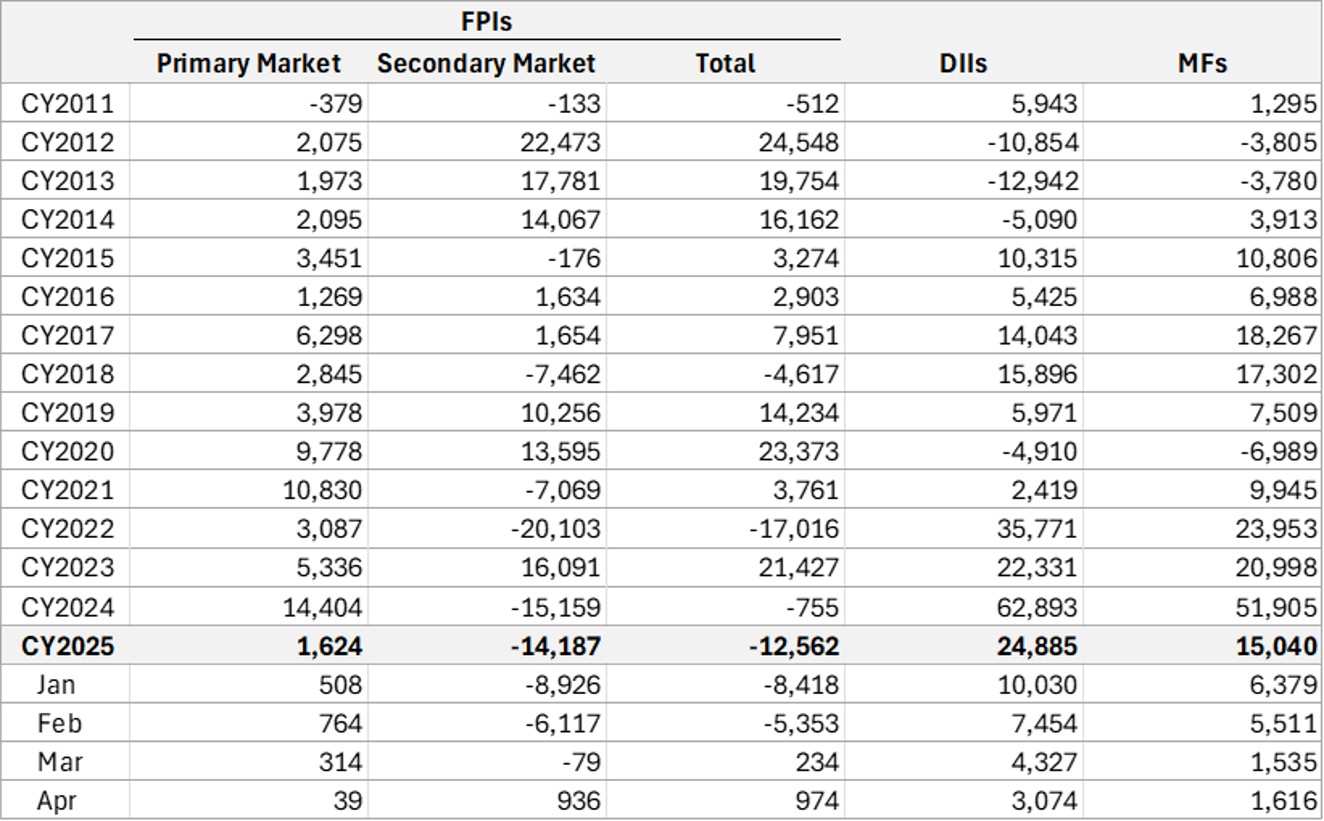

Net investments by foreign portfolio investments (FPIs), domestic institutional investors (DIIs), and mutual funds (MFs)

Source: Bloomberg, Kotak Institutional Equities

These flows have already helped to reverse the losses suffered at the beginning of the year by companies listed on India’s benchmark Nifty 50 index.

And with low oil prices, supply chain shifts, and continuing consumer strength now providing major additional tailwinds to the Indian economy, this may support ongoing international investor interest.

India enters the spotlight

The fundamental reason for the sudden sentiment shift towards

India is the nation’s domestic market. Specifically, its size and

how important a role it plays in India’s economy.

At 65 per cent, India’s household consumption as a percentage of GDP is higher than many other major global economies. The same figure, for example, sits at 63 per cent in the UK, 53 per cent in Germany, and 40 per cent in China.

India’s economy is relatively less reliant on exports than many of its emerging market peers. This reduces its exposure to the negative impacts of Trump’s import levies, so we now see this strong base investment case being compounded by several additional factors.

First, the Indian economy is receiving a welcome tailwind from oil prices.

Although the country is the world’s third-largest consumer of crude oil, it depends on imports to meet over 85 per cent of its requirements. The fact that it continues to trade below $60 a barrel, stands to reduce its overall import bill significantly.

Second, India is increasingly seen as a powerful manufacturing proxy for China, supported by its large workforce and competitive labour costs.

Apple, which is the most notable example, is reportedly manufacturing 14 per cent of its iPhones in India. Apple has also announced plans to increase that to 40 per cent within 18 months. We expect many other manufacturers to follow the tech giant’s lead as the US-China trade war rages.

Finally, a key long-term driver of India’s domestic growth is the affluence of India’s middle-class, which is increasing right now at a time when the rest of the world is feeling the pinch.

This increasingly wealthy group is benefitting both from the sweeping income tax cuts introduced by India’s government in April and India’s central bank cutting rates for the first time in years.

Indian households may also be benefiting from elevated gold prices, given that an estimated 15 per cent of their wealth is allocated to the precious metal. To put this into perspective, recent HSBC Global research found that Indian households now possess more gold than the reserves of the world’s top 10 central banks combined.

These dynamics are working together to create a “wealth effect” to the benefit of the Indian economy. Lower taxes, lower borrowing costs, and higher gold prices make middle class families feel more financially secure, so they are willing to increase their consumption.

Crunch time

[There is] a strong domestic market, a boost from low oil prices

and manufacturing and an increasingly affluent middle class.

Given these factors, it is understandable that foreign investment interest in India has increased. However, in our view, international flows will really start to gather momentum over the coming months.

The current crop of quarterly figures will be the first to really demonstrate how sweeping US tariffs are impacting stocks globally. We are anticipating strong numbers to be released by Indian equities, particularly those facing consumers, that would contrast the slew of earnings downgrades anticipated for other global equities.