Industry Surveys

Women Advance In Alternative Investment Sector, Big Divide Remains - Study

How far the dial has moved on gender diversity in fund management is at the heart of KPMG’s annual Women In Alternative Investments report. Who is hard at work advancing the role of women in the sector? Here are some findings.

A global study of how women are advancing within the alternative investment sector, covering areas such as private equity and hedge funds, shows that they are making progress but a wide gap between them and their male peers remains.

The consulting firm, KPMG, has reported on diversity in the sector since 2011, and this year spoke to a record number of male and female respondents from across the alternative investment space.

Tom Brown, the group’s global head of asset management, said the landscape is changing.

“Even in the highly male-dominated alternative investments industry, we’re starting to see progress on diversity,” he said, crediting investors more than fund managers for driving change, often through ESG offerings or finding more gender-specific investment vehicles.

Despite the optimism, results this year underscore how far apart men and women are in viewing their own industry’s progress. While the majority of women and men (84 and 76 per cent respectively) agree that gender diversity is a business imperative, 20 per cent more men than women feel satisfied that enough is being done to tackle the problem. Add to that, two-thirds of men believe that their company is already taking the issue seriously enough, while just half of women feel the same way.

Leading by example

So where are tangible improvements being made? In Europe,

governments are playing a significant role.

A stream of quotas and guidelines aimed at increasing gender equality on corporate boards, plus the UK’s gender pay gap reporting requirements, and progressive parental leave policies, especially in the Nordic countries, have “pushed these issues to the mainstream,” said Chrystelle Veeckmans, partner at KPMG in Luxembourg, and “causing many firms and companies to re-examine diversity policies and practices.”

Private equity and venture capital firms are also putting gender inclusion on a more formal footing. This year’s report singles out work done at US investment house TPG, which launched a board diversity initiative in 2017 to add at least one woman to every portfolio company board the firm controls or has significant influence over. Since the regime began, the group has added 20 women to board positions. The Carlyle Group is mentioned for hiring a chief diversity officer to recruit female talent at a senior level.

Powerful US pension funds such as California Public Employees Retirement System (CalPERS) also come in for praise for leveraging shareholder clout to get more women into board positions, as do asset managers BlackRock and State Street for using proxy voting to get better outcomes in the corporate boardrooms of their portfolio firms.

Better returns

It is becoming widely accepted now that diversity makes good

business sense, backed by growing research.

“Having a breadth of backgrounds - gender, ethnic and generational, among others - leads to a better understanding of markets and market participants and can lead to better investment decisions and returns. There should be little debate about this,” said John Hershey, director of alternative investments at Oregon State Treasury.

Another encouraging sign is a growth in product offerings such as exchange-traded funds and indices designed specifically for advancing gender workplace opportunities; and more investors, women in particular, making diversity their main portfolio focus, whether allocating funds or directly investing in female-founded companies.

In a similar vein, private equity and venture capital firms are using impact-investing funds to align at least some of their investment aims with the 17 Sustainable Development Goals - one of which is gender equality.

The study shows that many more alternative investment managers this year are requiring firms to account for and, in some cases, improve diversity efforts in the next 12 months. Last year, only 11 per cent of fund managers required firms to increase diversity efforts, this year that number is up to 42 per cent.

As for reporting the fruits of these efforts, 75 per cent of investors said that they plan to ask investment teams to report back on diversity, up from 60 per cent last year. More than a third said they would require disclosure of diversity statistics for all potential investments, up from just 16 per cent last year.

What does gender diversity look like?

In more practical steps, organisations, particularly in the US,

are sharing guidelines to help investors assess where fund

managers stand on diversity. The global Institutional Limited

Partners Association (ILPA) recently released a due diligence

questionnaire to help investors along these lines.

Queries might include whether an alternative investments firm has any formal mentoring for women or minorities, whether it supports organisations that promote advancing women or minorities in the sector, descriptions of recruiting processes, and whether any claims of sexual harassment or discrimination have been lodged against any employees. “What gets measured gets managed,” said Theresa Whitmarsh, an investor involved in the effort.

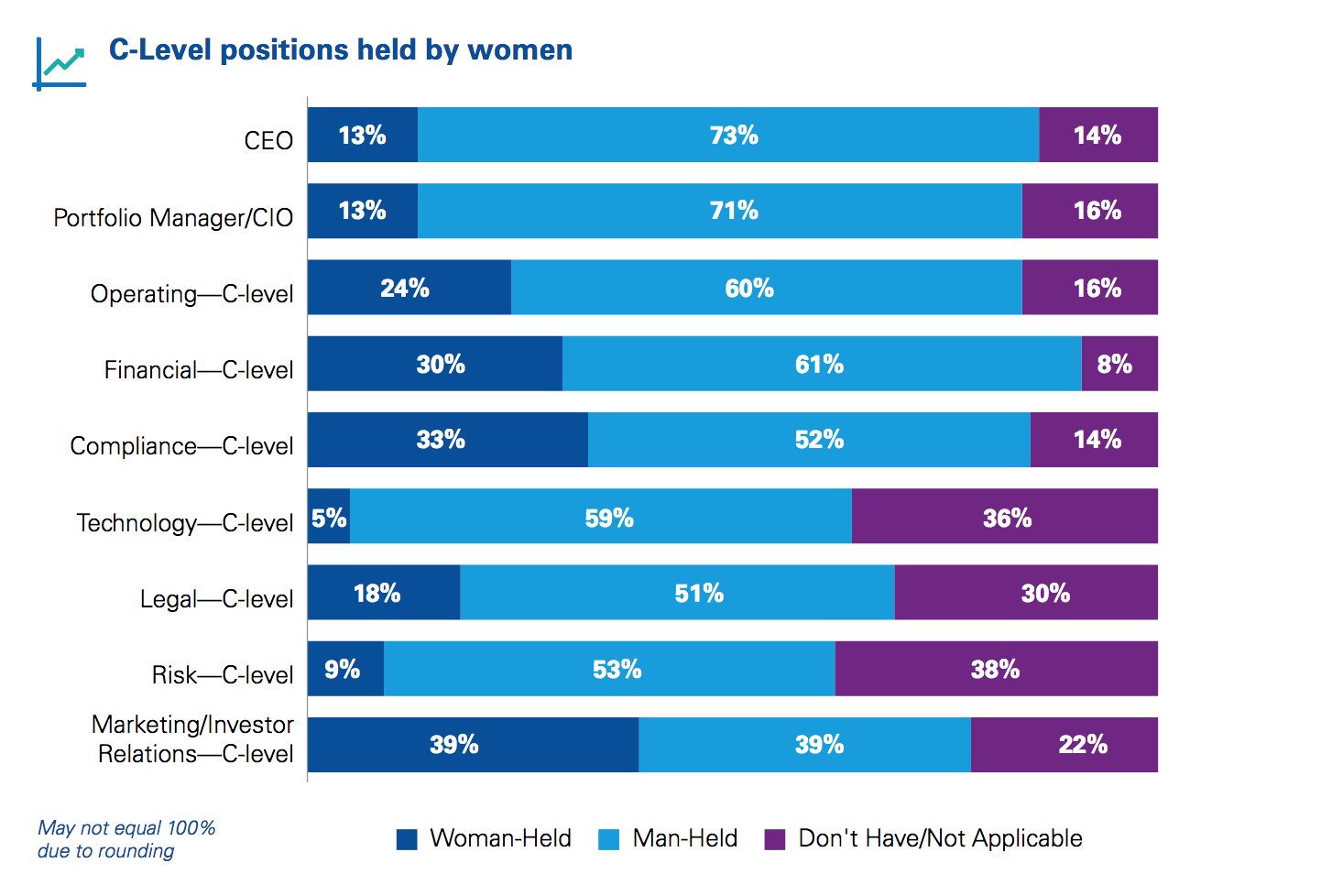

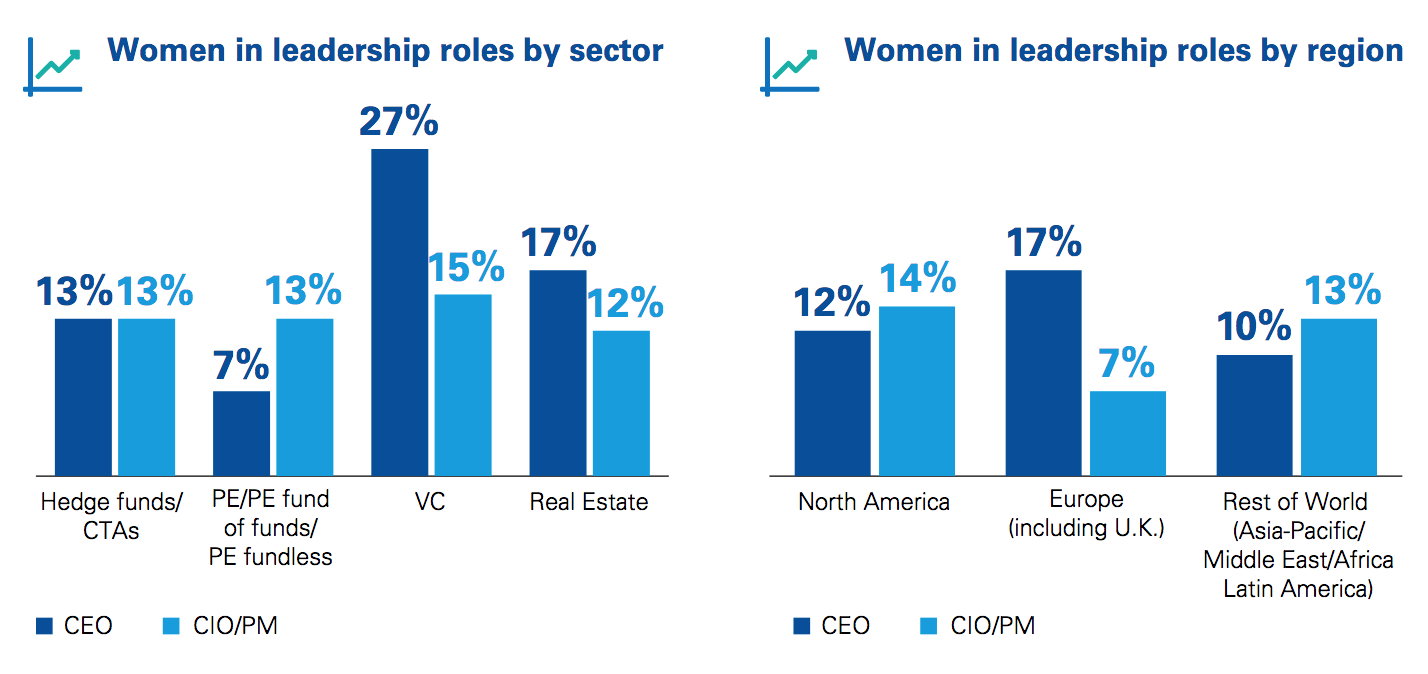

The overall picture shows that women still face an uphill battle to make it to the top of their firms. Only 38 per cent of firms represented have women on their investment committee and only 34 per cent of new promotions include diverse employees.

“We are a very long way from achieving anything that looks like equality,” said Sarah Hayes, real estate partner at KPMG in the UK. “The fact that over half of male respondents think enough is already being done is a concerning and questionable starting point,” she said.

Hayes argues that diversity is no longer limited to measuring gender or ethnicity but much more about diversity of thought, which is “potentially even more challenging to define, address and measure. But as investors increasingly put the sector under the microscope, few will be able to hide from the facts for long.”