Investment Strategies

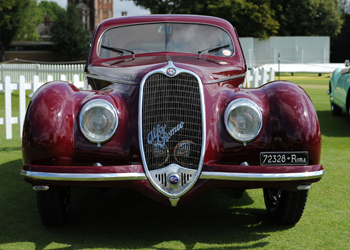

Classic Cars Set The Pace With Investment Returns In 2014

As investors nervously eye volatile equity markets, advocates of collectibles still make a case for holding more exotic assets to ride out any economic storms. With classic cars, marques such as Porsche and Ferrari clocked up gains of 15.84 per cent last year.

As investors nervously eye volatile equity markets, advocates of collectibles still make a case for holding more exotic assets to ride out any economic storms. With classic cars, marques such as Porsche and Ferrari clocked up gains of 15.84 per cent last year.

Historic Automobile Group International, a UK-based firm tracking the sector for classic cars, said its HAGI Top 50 Index of such vehicles rose 0.46 per cent in December from November, delivering a robust gain for the year although the pace slackened considerably from the 46.75 per cent rise in 2013.

By way of comparison, total returns on the MSCI World Index of developed countries’ equities (combining capital growth and reinvested dividends) were 4.9 per cent.

The best performer for the month and for 2014 was the HAGI P

Index (classic Porsche), which gained 6.67 per cent in December

ending the year up 32.06 per cent, HAGI said in a regular monitor

of prices fetched for such cars.

.

Another strong marque index was the HAGI Mercedes-Benz Classic

Index (MBCI), which rose 6.09 points (3.94 per cent) in December,

ending the year up 13.42 per cent.

The HAGI F Index (classic Ferrari) lost 1.41 points or 0.48 per cent in December but ended the year up 17.53 per cent. However it is still the strongest HAGI index over 5 years (+191.14 per cent). All other marques (HAGI Top ex P&F Index) lost 1.13 [per cent in December and closed the year 2014 up by 8.34 per cent.