Wealth Strategies

Japanese Market’s Upside Potential: Vaccination Progress, Rising Rates

.jpg)

This article argues that the Japanese market, which is lagging major peers amid a slow vaccine roll-out and the restrictions, has upside potential as health treatments gather pace.

Here is a guest commentary from Nikko Asset Management examining the potential upside in the Japanese market as the country seeks to exploit progress in its vaccine rollout - after a slow start - and rising interest rates.

The article is written by Junichi Takayama, investment director at Nikko Asset Management. The editors are pleased to share these views and invite readers’ reactions. Jump into the conversation! Email tom.burroughes@wealthbriefing.com and jackie.bennion@clearviewpublishing.com

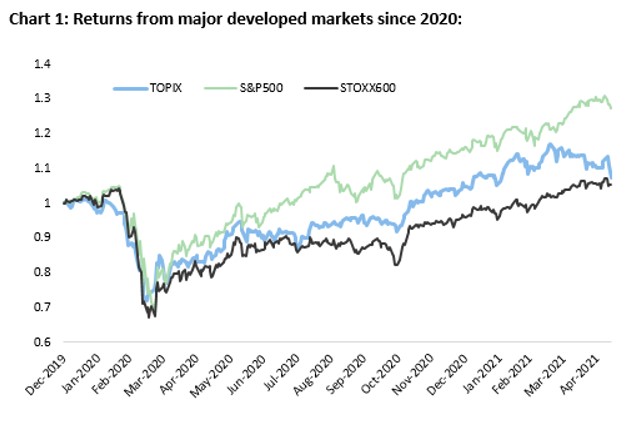

While the Japanese equity market managed to rebound strongly in 2020 after a sharp fall at the start of the pandemic, it has lagged its peers in 2021 amid the country’s struggle to contain COVID-19 and its slow rollout of vaccinations. However, the rollout of vaccines is gathering pace after a slow start. Japan’s dividend yields are also showing potential appeal amid a rising interest rate environment.

Despite initial post-COVID-19 recovery, a fourth

infection wave looms over Japan stocks

The Japanese equity was hit hard by the outbreak of the COVID-19

pandemic at the start of 2020 and dropped sharply in tandem with

its global peers. Japanese equities kept abreast with a

subsequent rebound by global markets enabled by aggressive

monetary and fiscal policies in large economies, notably the US.

By Q4 2020, the Japanese equity market had recovered to its

pre-pandemic level, thanks in part to its relatively low level of

coronavirus cases, which did not require the strict lockdown

measures that were taken in other parts of the world. A recovery

in external demand from the US and China, Japan’s two largest

trading partners, also boosted the recovery and the domestic

equity market performed strongly in 2020.

Source: Bloomberg, as at 13 May 2021

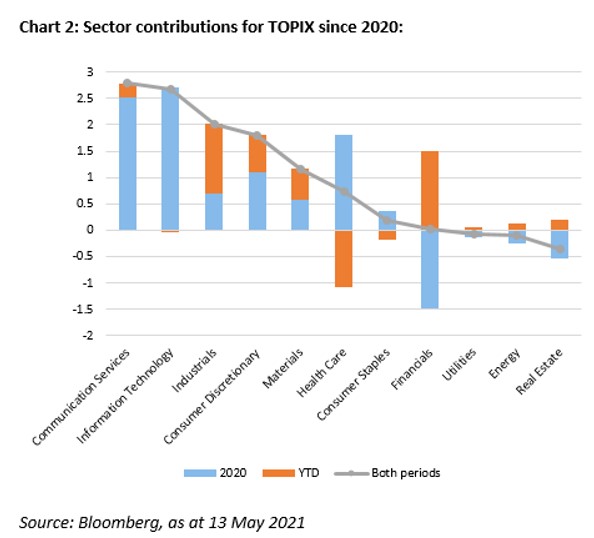

The specific factors that contributed to the rebound by Japan’s TOPIX index are summarised in Chart 2. We have split the time horizon into two parts. The blue bars indicate the sector return contribution in 2020 and the orange bars indicate the same contributions made so far year-to-date. The green line indicates the contributions for the entire period.

We highlight three key observations from Chart 2.

1. The Japanese equity market’s strong performance in 2020 was driven by IT and communication services (which includes software and other IT service companies), while financials were a drag due to expectations that interest rates would remain low.

2. Sectors such as financials, real estate, utilities and energy followed identical patterns. These sectors were hit hard by the pandemic in 2020 but have been rebounding since the beginning of 2021. This is due to a shift in the market which led to sector rotation, with investors picking up some stocks that had been oversold.

3. Technology names have been quiet so far in 2021. Despite a strong start to Q1, recent weakness in the market has wiped out all the gains.

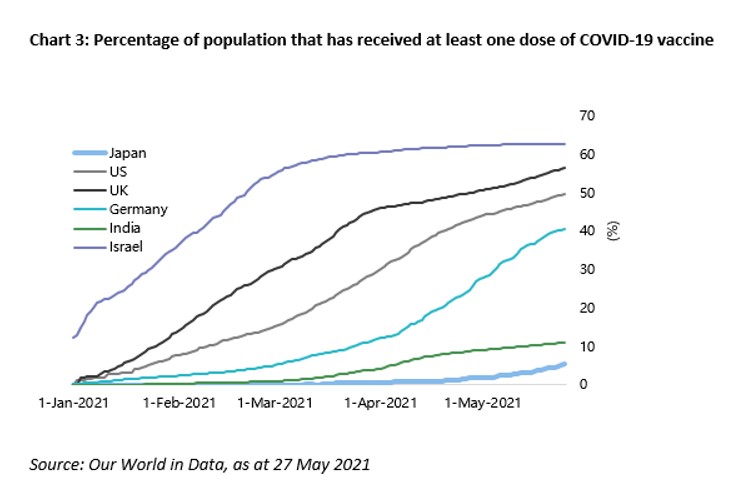

We think that the Japanese market’s recent underperformance relative to its global peers is due to a fresh wave of COVID-19 infections in the country and Japan’s slow vaccine rollout.

Japan’s vaccination effort has been slow but it has

started to step on the gas

Many of Japan’s major population centres are under a state of

emergency with the government is trying to contain a fourth wave

of a coronavirus outbreak. The state of emergency was effective

through 31 May, but has recently been extended into June as new

coronavirus variants have become more dominant. The weakness of

the Japanese market has coincided with the latest wave of

COVID-19 infections, but we believe that vaccinations will play a

key role in revitalising the market.

We can identify two main reasons for Japan’s slow rollout. First, it has so far been unable to develop its own vaccine and is therefore reliant on imports; in other words, it essentially needs to wait until vaccine-producing countries have finished inoculating their own populations. Japan is home to some pharmaceutical companies with the potential ability to develop COVID-19 vaccines. However, the government, unlike its peers in countries such as the US, failed to swiftly provide Japanese pharmaceutical companies with the incentives for speedy vaccine development.

Second, Japan has a particularly onerous approval process for pharmaceuticals - due to numerous drug disasters in the past - which considerably slows the development and import of vaccines.

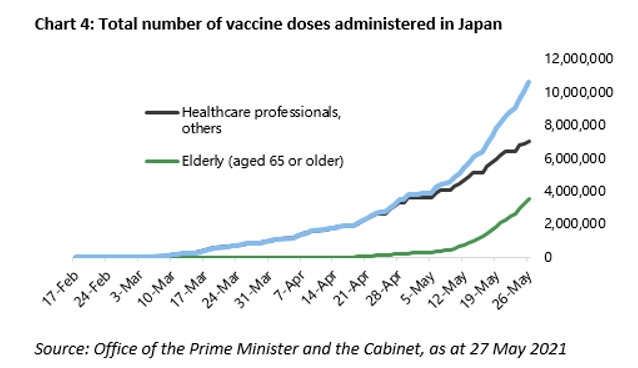

Japan, however, is starting to step on the gas. Following a sluggish start, vaccination in Japan is finally gaining momentum (Chart 4). State-run mass vaccination centres were opened in Tokyo and Osaka, Japan’s two largest cities, on 24 May, with the government recruiting the country’s military to operate the venues. Local governments in other areas are also planning to set up their own mass vaccination sites, with baseball stadiums considered as potential venues. Stringent regulations are also being softened so that Japan can deal with a shortage of eligible medical staff allowed to administer shots. Furthermore, Japan, where only the Pfizer coronavirus vaccine had been approved, gave the green light to the Moderna and AstraZeneca vaccines on 21 May.

We believe that the Japanese equity market will be in a good

position to benefit once a significant amount of vaccines are

rolled out, permitting the re-opening of the economy.

Conservative guidance by companies

May was the peak of Japan’s latest full year earnings season, and

a striking feature was the divergence in the earnings of

manufacturers and non-manufacturers. Manufacturers, including

autos and machinery, were negatively impacted by the pandemic due

to operational disruptions and deflated demand early in 2020.

However, the sector recovered strongly in the second half of the

fiscal year (which ran through March 2021). Driven by growing

demand in the US and China, manufacturers posted a 35 per cent

increase in earnings for the fiscal year through March 2021. It

is also worth noting that semiconductor-related names have

announced strong results thanks to accelerated use of technology

and an increase in end demand.

Non-manufacturers, on the other hand, struggled in the wake of the states of emergency declared in 2020 and 2021. As people were urged to stay at home, the obvious losers included the transport sector, such as railways and airlines, and restaurant chains.

Companies are collectively forecasting net income growth of 28 per cent for the current fiscal year which started in April. But we think there is potentially more upside to this number because corporations are likely being conservative with their guidance.

Chart 5 shows the dividend forecasts of TOPIX-listed companies at the beginning of each fiscal year since 2010. The far-right column shows the composition of the most recent dividend forecasts in relation to the previous year. We can see that, at around 40 per cent, the share of the companies planning to hike dividends would make it the largest such increase in the last 10 years.

Another interesting feature is the yellow bar indicating that a relatively high number of companies have not yet disclosed their dividend forecast (although not as many as last year). This is understandable given the uncertainties surrounding the economy, but these companies have the potential to come out with dividend hikes as well.

The conservative forecasts should not come as a surprise when the state of emergency, the current economic situation, and the slow vaccine rollout are taken into account. Once vaccinations progress and the economy re-opens, we think that the conservative earnings guidance and the dividend forecasts could be revised up towards the end of the year, and that will be positive for market sentiment.

The relevance of dividends amid the prospect of higher

interest rates

Japan’s current dividend yield level and the potential upside in

dividends warrant attention. Chart 6 shows the dividend yields of

Japan (TOPIX) and US (S&P 500). Both US and Japanese yields

have been gradually declining over the past 12 months amid a

rally by the markets. But as many Japanese companies are expected

to hike dividends this fiscal year, Japan’s yield is higher.

Chart 7 shows the relative ratio between the two markets (Japan

dividend yield divided by US dividend yield); we can see that

from this perspective Japan is currently more attractive.

Chart 8 shows the two markets’ equity duration - that is, the number of years it takes theoretically for invested capital to be recouped (i.e., inverse of dividend yield). Japan’s is 47 years while that of the US is 69 years. A shorter duration can be construed as less sensitivity to interest rates as the proportion of cash flows that make up a stock’s value will likely be received sooner. The Japanese equity market could therefore fare better when interest rates rise.

Furthermore, from a broader perspective the Japanese equity

market has shown a tendency to perform better than its US

counterpart when US yields are rising (Chart 9). This

characteristic offers investors the option to diversify away from

the US market, with its heavy exposure to the tech sector, when

interest rates rise.

Summary

While the Japanese equity market is lagging its peers due to

virus-related economic restrictions and a slow start to

vaccinations, the market will have significant upside potential

once the rollout of vaccinations gathers speed. And while recent

corporate earnings expectations have been understandably

conservative, a re-opening of the economy could trigger upward

revisions in earnings and dividends, with the latter to become

more attractive in a rising interest rate environment. Such an

environment will also be conducive to a shift from growth to

value, which could also benefit from secular, structural changes

unfolding in Japan.