Wealth Strategies

China’s Macro Prospects: Five Key Questions - Matthews Asia

An investment strategist at the US-based Asia-focused firm delves into factors which he thinks are important for China in the months ahead.

Andy Rothman, investment strategist at Matthews Asia discuses five topics to think about the policy and macro environment for the next few quarters. The editors are pleased to share these insights; the usual editorial disclaimers apply. To respond, email tom.burroughes@wealthbriefing.com and jackie.bennion@clearviewpublishing.com

Just published macro data for the second quarter revealed few surprises, as the Chinese economy continued to recover from COVID-19. I am now focused on what lies ahead, and in this issue of Sinology I discuss five topics that will help investors think about the policy and macro environment for the next several quarters.

I expect the US-China political relationship to remain uneasy, at least through next November’s Congressional mid-term elections. While this may weigh on investor sentiment, those political tensions should have little impact on the Chinese economy. Regulatory changes in China are being driven by concerns which are similar to those being addressed in Washington, London, Brussels other capitals around the world. Although they create short-term volatility, they are likely to be good for the long-term health of sectors as diverse as pharma, education and internet platforms. There is no evidence that the Chinese government has become less supportive of privately owned companies.

Manufacturing has completely recovered from the pandemic, but periodic, small COVID outbreaks have left many Chinese consumers wary of spending on services that require gathering in confined spaces. I expect the services sector to gradually recover as the share of Chinese consumers who have been vaccinated rises. The residential property market remains healthy, with limited leverage for buyers.

I expect some fine-tuning of monetary policy in the second half of the year, including a minor uptick in the pace of credit growth, but I believe the central bank when they say they “won’t flood the economy with stimulus.” De-risking the financial system should continue.

What is the direction of US-China relations?

The Biden administration has used less politically charged

rhetoric, compared with the previous administration, in talking

about China, but has continued to pursue an approach that can be

best described as containment, albeit without specifically

calling it containment. A senior White House official recently

declared that “the period that was broadly described as

engagement [with China] has come to an end” and, in the future,

“the dominant paradigm is going to be competition.”

The Biden administration has yet to even reverse some of the own goals scored by the previous administration, including shuttering two programmes - the Peace Corps in China and the US-China Fulbright programme - which promoted people-to-people exchanges and provided thousands of Americans with an opportunity to learn more about China.

The previous administration’s punitive tariffs on Chinese imports have also not been withdrawn, despite clear evidence that they have been costly for American consumers and have not put pressure on China’s exports, or on policy-makers in Beijing.

Economists at the Fed, Princeton and Columbia universities collaborated on a study which found that “the full incidence of the tariffs falls on domestic consumers with no impact so far on the prices received by foreign exporters.”

Economists at the Fed also concluded that “the tariffs have not boosted manufacturing employment or output” in the US.

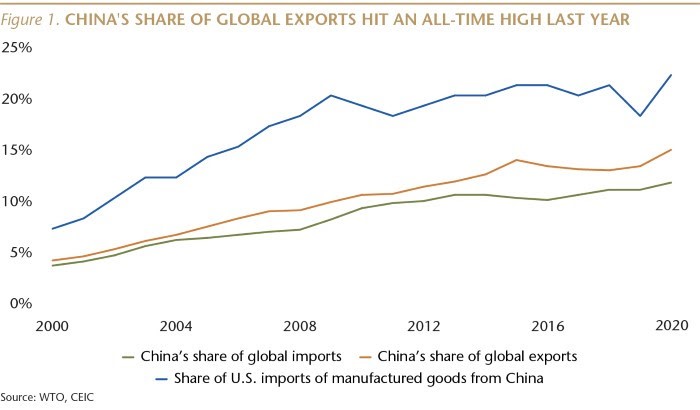

Despite the tariffs and political tensions, the share of manufactured goods imports coming into the US from China last year returned to the historical high of 22 per cent. In addition, China’s share of global exports hit an all-time high of almost 15 per cent last year.

Yet, the tariffs remain in place.

I expect the bilateral political relationship to remain uneasy, at least through next November’s Congressional mid-term elections. But, while these political tensions may weigh on investor sentiment, they are likely to continue to have little impact on the Chinese economy, which is fuelled primarily by domestic demand, not exports. Last year was the ninth consecutive year in which the services and consumption (tertiary) part of China’s GDP was larger than the manufacturing and construction (secondary) part, as rebalancing continued despite the pandemic. Chinese consumer spending, as well as investment in their home equities markets, should remain well insulated from tensions with Washington.

What is the direction of China’s regulatory

environment?

I believe there are three factors which have influenced recent

regulatory changes in China.

The first factor concerns the relationship between a few private companies and the Chinese government. Since allowing the re-establishment of privately owned firms in the 1980s, the government has made clear that while entrepreneurs are free to become rich and famous, they cannot use their wealth and fame to challenge the government on political and governance issues. Unsurprisingly, the government recently intervened after two well-known companies questioned or ignored the advice of regulators. This is one of the many reasons why we advocate for an active, rather than a passive, approach to investing in Chinese equities.

The second factor is the Chinese government’s concern for data security and privacy, along with a desire to promote competition, protect consumer and small business interests, and tackle economic inequality issues. These considerations are very similar to the discussions taking place in Washington, London, Brussels and other capitals around the world regarding the best ways to regulate the tech industry, protect consumers and reduce inequality.

These regulatory changes in China, which have to date covered sectors as diverse as pharmaceuticals, online gaming, education, internet platforms and real estate, are likely to be good for the long-term health of these industries and China’s economy. But, because the Chinese government has the ability to act quickly, and often does not clearly articulate its policy objectives, these changes can create short-term volatility in market sentiment.

The third factor is concern by the Chinese government about the rising tensions in the political relationship with the US, and the direction of President Biden’s China policy. This may be leading the Chinese government to take steps to reduce the degree of interconnectivity between the two economies, including Chinese company participation in US capital markets.

It is possible that the Chinese government is anticipating that in the coming years American regulators may force Chinese companies to delist from US markets, and Beijing may want to block more companies from joining a club where they are no longer welcome. It is also possible that Beijing may encourage Chinese companies already listed in the US to switch to exchanges in Hong Kong, Shanghai or Shenzhen.

It is not clear how far the Chinese government wants to move in this direction, and recent rhetoric may largely be a signal to the Biden administration rather than an indication of a major change in Chinese regulatory policy.

Given the liberalisation of the Chinese capital markets, we are confident that despite the recent regulatory actions, which could prompt or accelerate the decision for Chinese companies listed on US exchanges to seek secondary listings on exchanges in Hong Kong or mainland China, investors such as Matthews Asia will still be able to access the opportunities presented by these businesses on behalf of the strategies we manage for our clients.

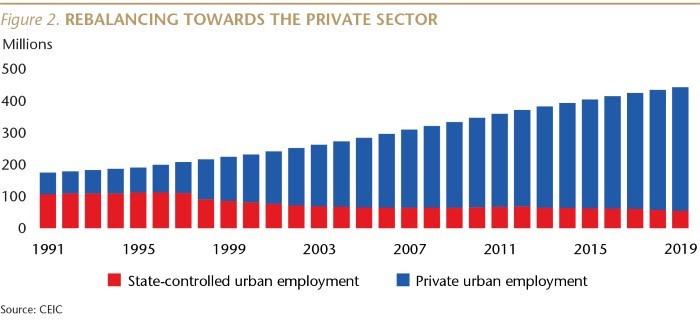

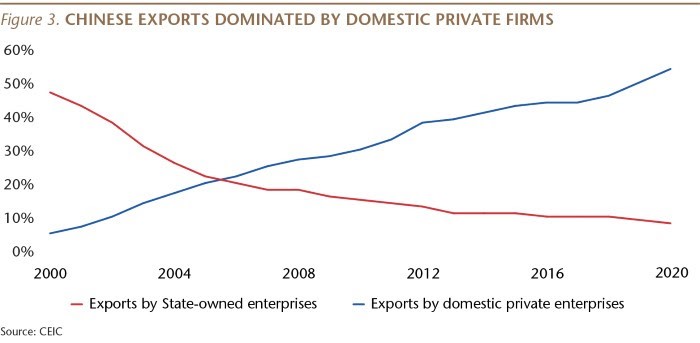

I would also like to emphasise that, in my view, there is no evidence that the Chinese government has become less supportive of privately owned companies. It is clear that private firms are the engine of China’s growth and job creation. Almost 90 per cent of urban employment is in private companies, and private firms also account for the majority of China’s exports.

Privately owned companies are China’s most innovative firms, and the government’s economic growth plans are based on innovation. We also note that the two largest, publicly listed Chinese companies, by market cap, are privately owned. Privately owned firms also account for about 80 per cent of companies listed on China’s science and technology board, its version of NASDAQ.

In the financial sector, I believe the government is encouraging limited competition. In January, a senior Chinese financial sector regulator stated that “the private economy is an indispensable driving force of our country.” He added that “financial regulatory authorities have always supported the development of the private economy.”

The regulator noted that “internet platform companies such as Ant

Group ... have played an innovative role in developing financial

technology, and improving the efficiency and inclusiveness of

financial services.”

Has China's consumer sector recovered fully from

COVID?

Manufacturing has completely recovered from COVID. For

example, over the first half of this year, the two-year compound

annual growth rate (CAGR) of industrial value-added was 7 per

cent, faster than the 6 per cent year-over-year (YoY) pace during

the first half of 2019, before the pandemic.

However, consumption of goods and services is the largest part of China’s economy, and that has yet to fully recover. In the first half of the year, the two-year CAGR of household consumption was 5.4 per cent compared with 7.5 per cent year-on-year in 1H19.

Spending on some consumer goods has rebounded nicely. Sales of food, alcohol and tobacco actually rose faster in the first half than during the same period in pre-COVID 2019.

But, spending on services has struggled to rebound. The two-year CAGR of household spending on education, cultural, entertainment, medical and transport services all remain well below their pre-pandemic rates.

The problem is not lack of income. Per capita disposable income rose 15.4 per cent in the first half compared with the same period in pre-pandemic 2019, with a two-year CAGR of 7.4 per cent.

The problem, in my view, is that periodic, small COVID outbreaks have resulted in aggressive, localised lockdowns, which have left many Chinese consumers wary of spending on services that require gathering in confined spaces.

To be sure, COVID remains largely under control in China. As of 14 July, there were only 506 people in Chinese hospitals with COVID, compared with over 15,000 in the US. Since the start of the year, only two people in China have died as a result of COVID, compared with almost 260,000 in the US.

But during months when there has been an increase in COVID cases, retail sales have been weaker. I expect spending on services to gradually recover as the share of Chinese consumers who have been vaccinated rises. (China had administered 100 vaccine doses per 100 people as of 13 July, up from only 26 doses as of 13 May. During that period, the US went from 80 doses per 100 people to 100, and the UK went from 82 to 119 doses.*) The Chinese government aims to fully vaccinate all of the eligible population by the end of the year.

Inflation is unlikely to be an obstacle to improved consumer spending. The Consumer Price Index (CPI) rose by only 1.1 per cent YoY in 2Q21, while core CPI rose 0.8 per cent.

*For vaccines that require multiple doses, each individual dose is counted. As the same person may receive more than one dose, the number of doses per 100 people can be higher than 100. (Source: Our World In Data)

How has the property market weathered COVID?

New home sales rose 19.5 per cent in the first half compared with

pre-pandemic 1H19, on a square meter basis. Sharp increases in

home prices have been limited to a small number of cities, and

overall, prices have risen in line with income.

Over the 10 years through 2019, prior to the pandemic, new home prices rose at an average annual pace of 7.7 per cent, while nominal urban income rose at an average rate of 9.5 per cent. The pandemic interrupted this balance last year, with new home prices up 7.5 per cent YoY in 2020, compared with a 3.5 per cent YoY increase in nominal urban income, but that was a temporary aberration. In the first half of this year, new home prices rose 9.7 per cent YoY, while nominal urban income rose 11.4 per cent.

China’s housing market is not generating the kind of financial system risks that developed in the US during the decade prior to the Global Financial Crisis, in part because China’s regulators have learned from our mistakes. In fact, because homebuyers are required to use a lot of cash and because banks have not been permitted to make irresponsible loans, mortgages may be among the safest of bank assets in China.

Chinese homebuyers who use a mortgage must put down at least 20 per cent cash for a primary residence (and much more for an investment property), in sharp contrast to the 2 per cent median cash down payment in the US in 2006.

It is also worth noting that Chinese banks have not been permitted to engage in the “financial engineering” that caused the US crisis. For example, nearly one-quarter of all mortgages originated in the first half of 2005 in the US were interest-only loans. Those do not exist in China.

There is very little mortgage securitisation in China, and most banks hold mortgages through maturity, so they have a clear incentive to avoid lending to risky borrowers.

And the government has been continually fine-tuning its policies to limit property market speculation and promote the construction of lower-cost housing. Recent regulations have also limited bank exposure to the property sector.

China does face a serious property problem - but it is a social and political problem. In larger cities, many residents are priced out of the market and may never be able to afford to own a home. This problem - shared by cities such as San Francisco, New York and London - is a long-term challenge, and it’s one with consequences that are very different from a housing bubble.

What will monetary policy look like in the second

half?

Following a modest stimulus in response to COVID, the central

bank has been normalising the pace of credit growth since last

autumn. I expect some fine-tuning in the second half of the year,

including a minor uptick in the pace of credit growth, but I

believe the central bank when it says they “won’t flood the

economy with stimulus.”

The fine-tuning may have begun in June, when the new flow of Total Social Finance (TSF, the broadest measure of credit in China) rebounded to a level above that during June of last year. The central bank’s early July announcement that it will cut the required reserve ratio (RRR) for financial institutions is another signal of plans for easing plans for modest easing.

At the same time, I expect the central bank to continue with its efforts to reduce risks in the financial system. June was the 37th consecutive month in which shadow (off-balance-sheet) loans outstanding declined YoY.

Concluding comments

The macro picture looks healthy for the coming quarters,

including an expectation of a fuller recovery in consumer

spending on services. There are two key risks. The first is the

risk that the central bank fails to provide enough credit and

liquidity to support the final legs of recovery from COVID, but I

think this is a modest risk, especially given last month’s uptick

in new credit flow.

The second risk is with the political and regulatory environment. Foreign investor sentiment may suffer under the weight of rising political tensions between Washington and Beijing, but this is unlikely to disrupt spending by Chinese consumers, or their investments in their home equities markets. More regulatory changes are expected, especially in sectors which are data-rich, and these have the potential to create near-term volatility if not communicated clearly. In the long run, these regulatory changes are likely to create a supportive environment for quality companies.